Bitcoin: Whale accumulation is a sureshot sign of…

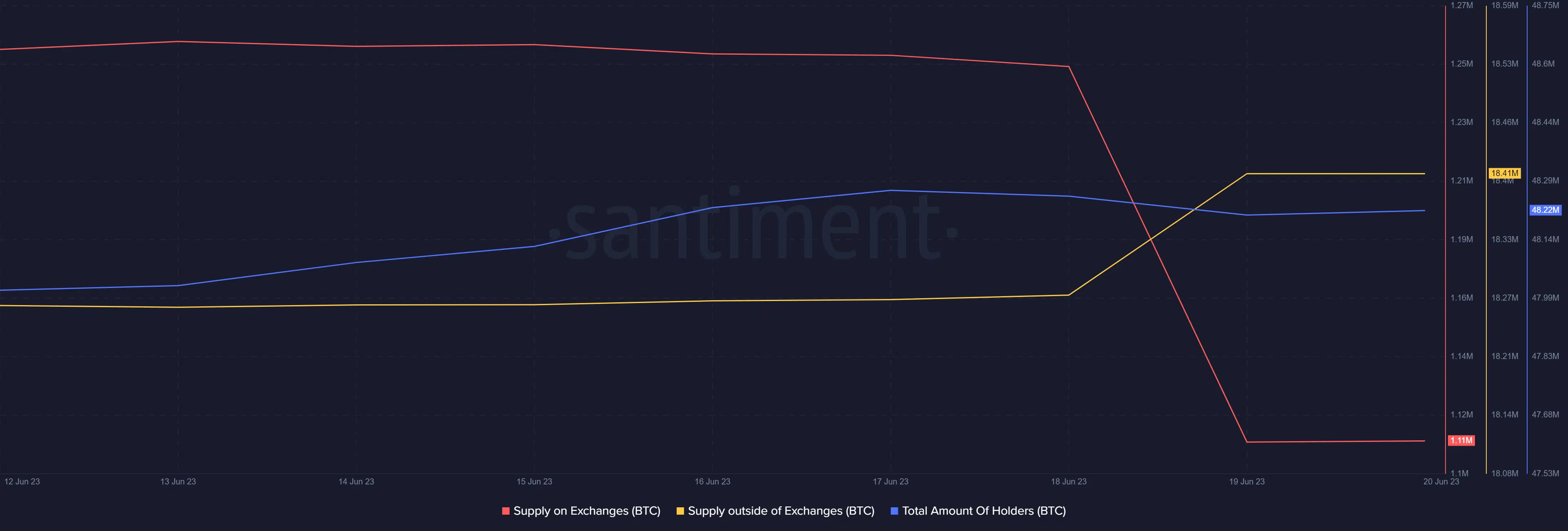

- BTC’s supply on exchanges declined while its supply outside of exchanges rose.

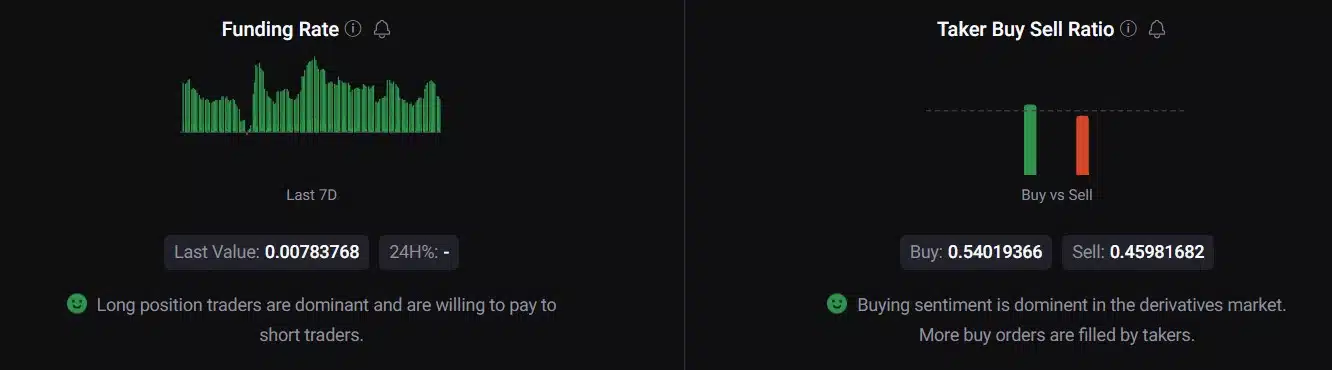

- Derivatives market metrics also looked bullish for BTC.

Bitcoin [BTC] has been in the accumulation phase for multiple weeks now, as its price stagnated under the $28,000 mark. Generally, high accumulation happens when the market doesn’t perform well, which is then followed by a trend reversal. The same seemed to be true this time as well, as BTC’s charts have turned green.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Bitcoin accumulation shows effects

Santiment’s 20 June tweet revealed that BTC whales have been quite active of late. Notably, wallets holding 1,000 – 10,000 BTC have accumulated a combined $3.5 billion since the first week of April.

? #Bitcoin's whales have been busy while the crowd watched prices dwindle these past two months. Now back above $27k once again, it's far from coincidence that wallets holding 1K to 10K $BTC have accumulated a combined $3.5B since the first week of April. https://t.co/LUEaQLeXTy pic.twitter.com/z8U5tCa9OQ

— Santiment (@santimentfeed) June 20, 2023

Due to the increased buying power of the whales, the market may experience short-term price increases. This was evident in the price charts already, as according to CoinMarketCap, BTC’s price rose by 2% and 1% in the last seven days and past 24 hours, respectively.

At press time, the king coin was trading at $26,766.55, with a market capitalization of over $519 billion.

A look at BTC’s supply

The accumulation trend continued into press time, as evident from Santiment’s chart. Bitcoin’s supply on exchanges declined sharply, while its supply outside of exchanges increased. This is a typical bullish signal.

Moreover, the total number of BTC holders also rose last week. Besides that, as per a Santiment report, the number of unique tokens has also taken off to about a 7-week high, which looked encouraging for the coin’s future.

Will this uptrend translate into a bull rally?

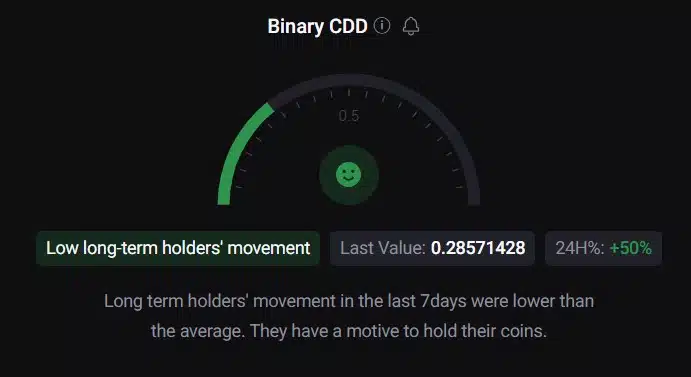

Bitcoin’s press time price action and accumulation trend gave hope for better days ahead. A look at BTC’s on-chain metrics shed light on how the coming days might look.

Read Bitcoin’s [BTC] Price Prediction 2023-24

BTC’s exchange reserve was declining, suggesting that the coin was not under selling pressure. The king of crypto’s binary CDD was green, meaning that long-term holders’ movements in the last seven days were lower than the average.

BTC’s funding rate also remained high, which suggested that the price trend might continue for longer. Lastly, Bitcoin’s taker buy/sell ratio was green, revealing that buying pressure was dominant in the derivatives market.