BNB can hit an all-time high, but THESE conditions need to be met!

- The formation of an ascending triangle and a hike in funding rates could be key

- A breach of the press time resistance, outlined by the triangle’s upper edge, is important before BNB can hit new ATH

Binance Coin (BNB) has been a fairly consistent cryptocurrency, with the altcoin recording hikes of 6.46% and 2.83% on the monthly and daily charts, respectively. Taken together, these hikes mean that there is a strong presence of bullish investors in BNB’s market.

However, according to AMBCrypto, these steady gains may just be the beginning. In fact, further analysis seemed to reveal that there may be room for another hike, potentially pushing the altcoin beyond its highest recorded value of $721.80.

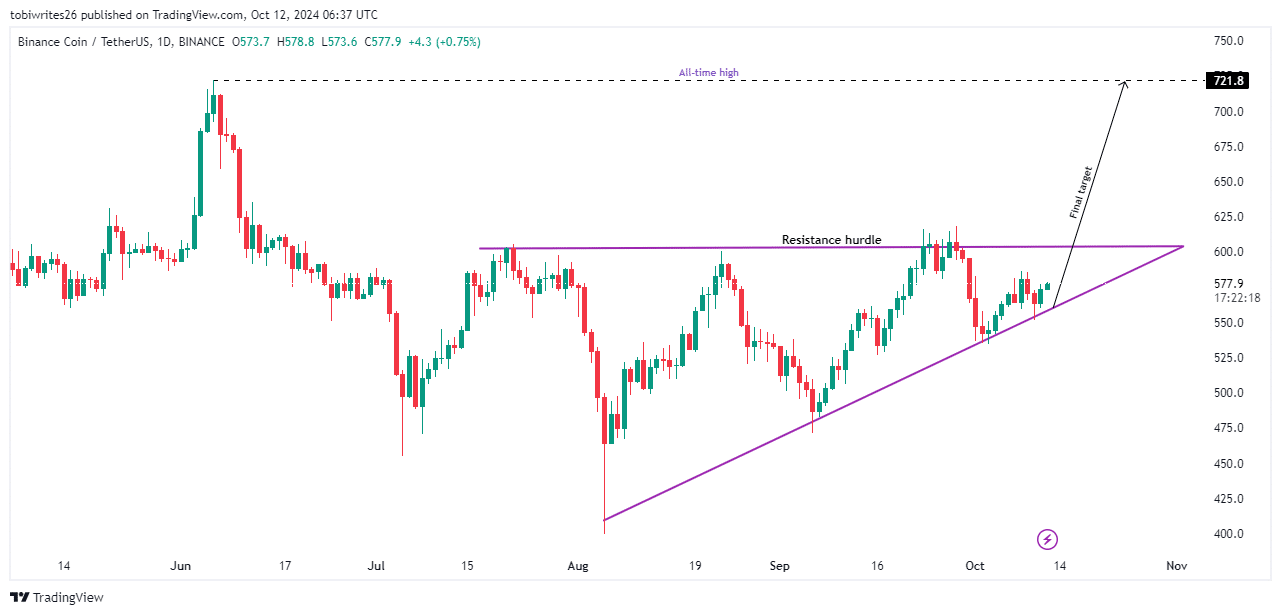

BNB’s outlook on the chart

At the time of writing, BNB’s chart revealed a bullish trend as it moved within an ascending triangle. It seemed to be moving between a horizontal resistance line and a diagonal support level.

Now, BNB has rebounded from the triangle’s support line and appears set for a breakout. If it successfully breaches the resistance, the coin could reach and potentially exceed its all-time high, setting a new price record.

Conversely, if selling pressure at this resistance outweighs its buying momentum, BNB might remain trapped within the ascending triangle. If this happens, the crypto will revert to the support level for an extended period.

Hence, the critical question is whether there is sufficient bullish momentum to sustain a move that could break through the triangle’s boundaries.

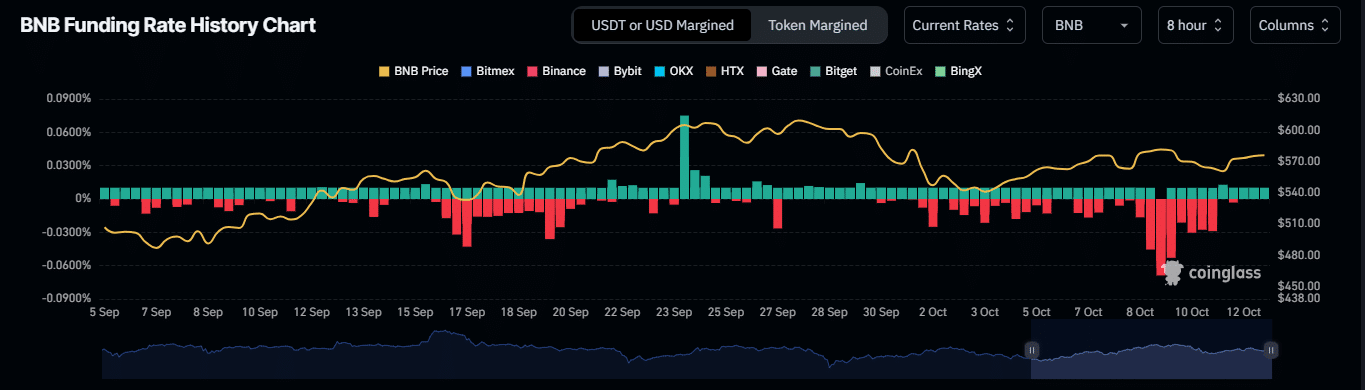

Rising trading activity among traders

There has been a significant hike in interest among traders who want to purchase BNB. Especially as they anticipate the asset to move into higher price zones.

At press time, the funding rate for BNB had climbed to 0.0041% over the past 24 hours. A positive rate, such as this, means that holders of long positions are paying those with short positions, suggesting that Futures prices are trading above the spot price.

This funding rate is important as it helps ensure that the price of perpetual Futures contracts aligns with the underlying asset’s spot price through payments exchanged between longs and shorts.

Open Interest, which measures the total number of outstanding derivative contracts that have not been settled, also underlined bullish sentiment for BNB. The growing Open Interest pointed to increasing trader engagement. It also seemed to position the asset for a potential rally.

If this trend persists, BNB is likely to breach the resistance level of the ascending triangle. Furthermore, this rally could intensify owing to growing development activities related to the asset.

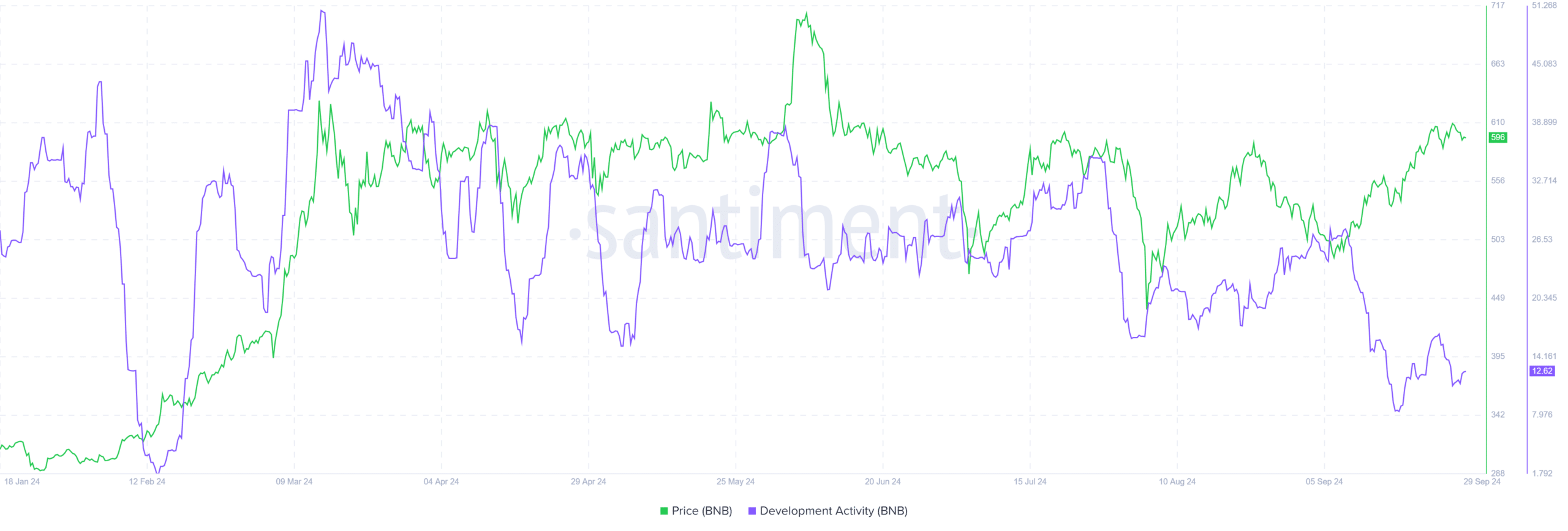

Development activity puts BNB in a good spot

There has been a notable hike in development activities within the BNB ecosystem, indicating a major effort to improve its functionalities and offerings.

Historically, there has been a correlation between the intensity of development activities and an asset’s price action.