BNB Chain’s 2022 Q4 report- What BNB holders should know to make a profit

- The active addresses and transactions count of BNB increased in the last quarter.

- TVL and NFT ecosystems witnessed a decline.

Messari recently published Binance Coin’s [BNB] 2022 Q4 report, which highlighted the blockchain’s performance during the last three months of the previous year.

As per the report, BNB Chain registered growth in quite a few areas. This helped BNB begin the new year on a good note.

State of @BNBCHAIN Q4 2022 is LIVE.

Link to the FREE BNB Chain quarterly report from @JamesTrautman_ in the tweet below ⬇️ pic.twitter.com/FDETmjR7TR

— Messari (@MessariCrypto) February 5, 2023

Read Binance Coin’s [BNB] Price Prediction 2023-24

How has BNB been?

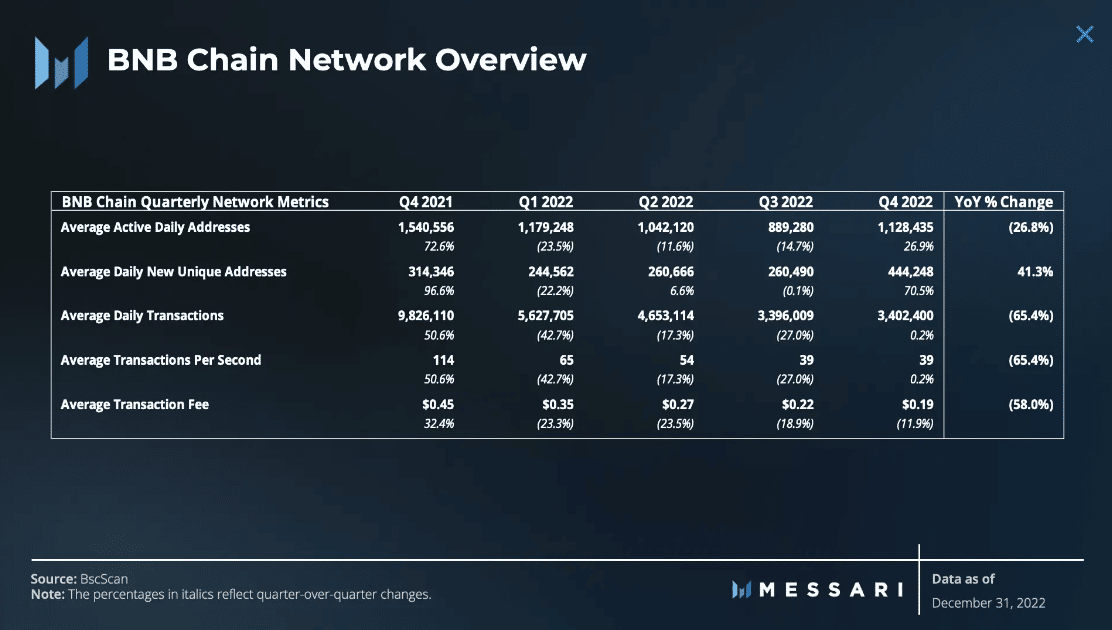

Messari’s report mentioned that BNB’s average daily active addresses increased considerably in the last quarter. The figure registered an increase of 30%, which reflected its popularity in the crypto space.

Furthermore, the average daily new unique addresses increased dramatically from 889k to over 1 million, indicating an influx of new network users.

Average transactions also witnessed a slight uptick despite the bearish market condition of that quarter. BNB Chain’s average daily transactions undermined the downward trend, finishing the quarter slightly up by 0.2%.

However, not everything was positive for BNB, as several of the other areas registered a decline. The most notable was a decline in BNB Chain’s revenue. According to the report, quarterly revenue decreased from $66.8 million to $59.98 million in Q4 2022.

Furthermore, BNB’s network value followed the quarterly revenue and registered a decline of -13.4%.

The same trend was true for the network’s Total Value Locked (TVL) as the value denominated in BNB and USD declined by 12% and 24%, respectively. Talking about TVL dominance, PancakeSwap managed to lead, followed by Venus and Alpaca Finance.

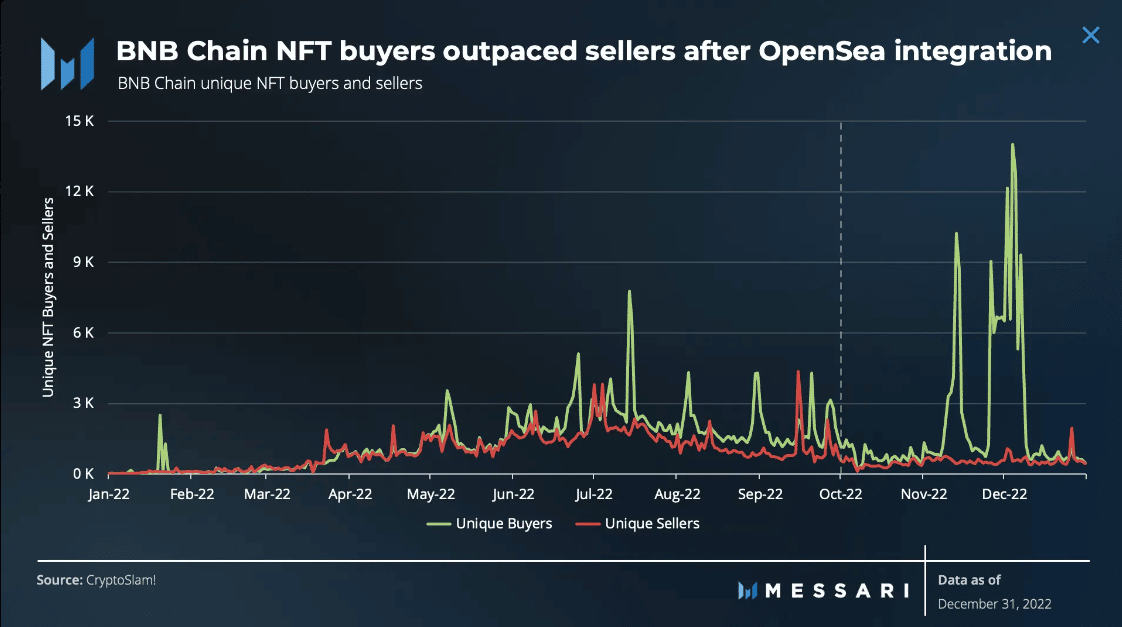

BNB’s NFT space was also affected by the bearish market conditions of the last quarter.

It should be noted here that BNB Chain’s secondary NFT sales dropped by more than 67%, which looked concerning for the network.

However, the chain’s integration with OpenSea helped change the situation. After BNB Chain’s NFTs were listed on OpenSea, the number of unique buyers skyrocketed.

Is your portfolio green? Check the BNB Profit Calculator

2023 brought better news

The new year began with a change in the market’s overall sentiment as most of the cryptos gained bullish momentum. Therefore, a few of the metrics turned in favor of BNB.

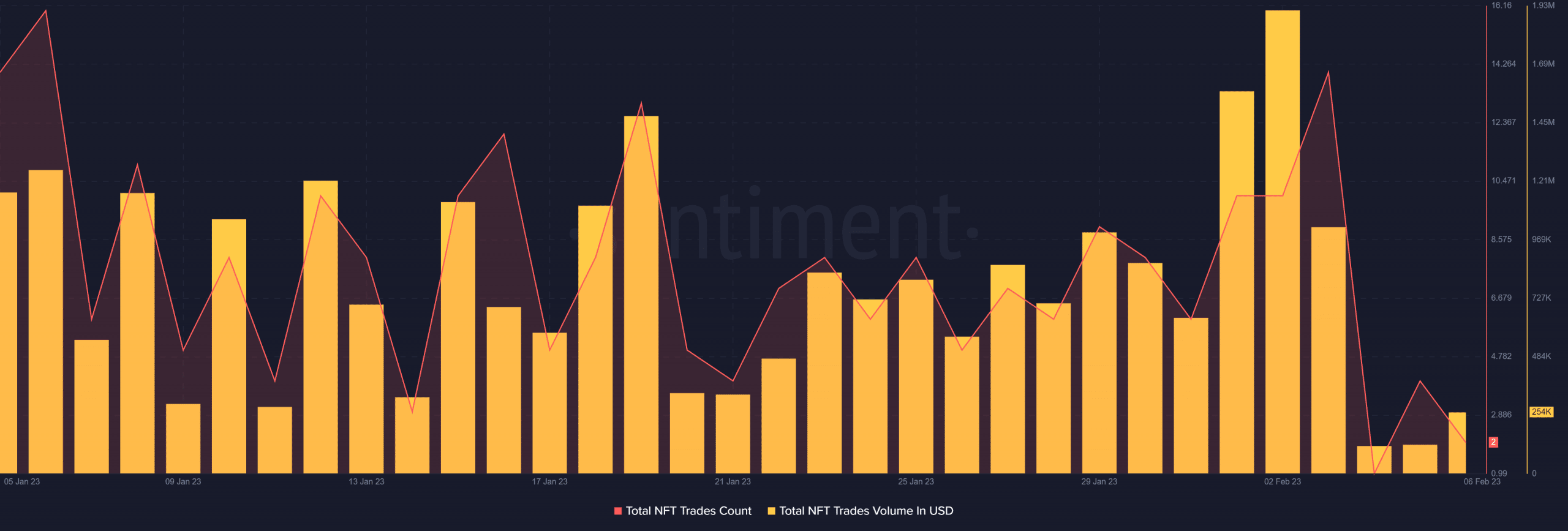

For instance, while BNB’s NFT ecosystem witnessed a decline in Q4 2022, the new year changed the scenario. As per Santiment, the total number of NFT trade counts and total NFT trade volume in USD registered an increase in the last 30 days.

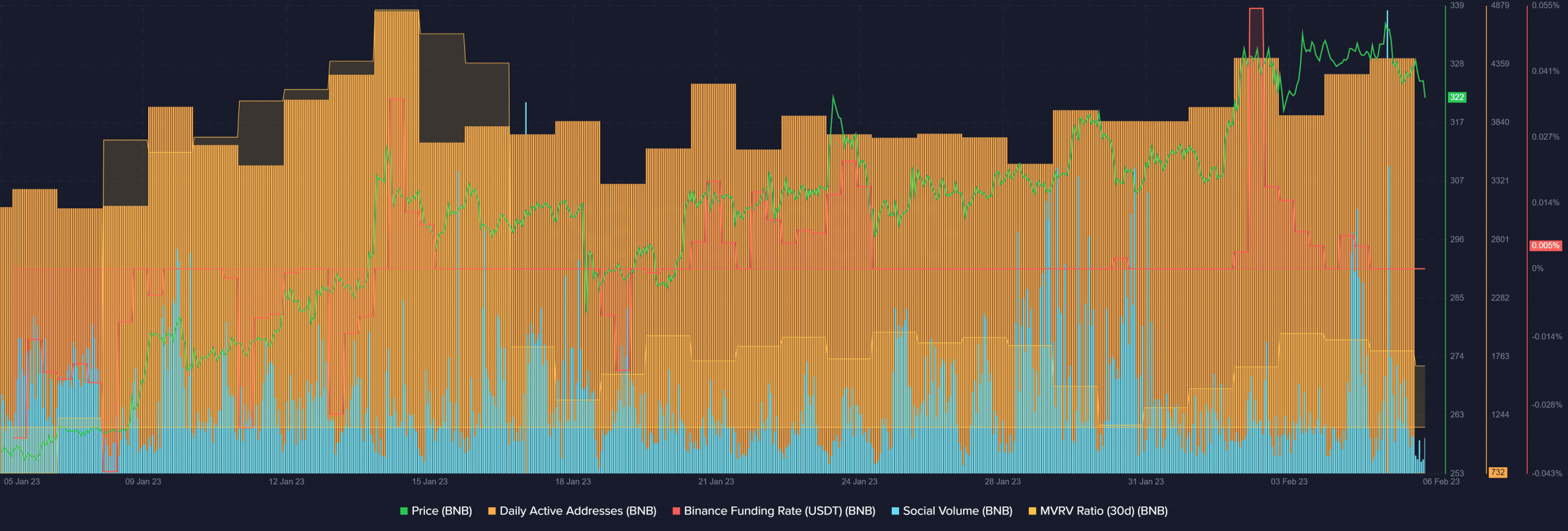

Not only this, but BNB’s daily active addresses also increased last month, which complemented BNB Q4 2022’s performance.

The blockchain’s popularity rose as its social volume went up. Moreover, BNB’s demand in the futures market increased, as suggested by its Binance funding rate.

Nonetheless, despite a considerable price pump, BNB’s MVRV Ratio took a hit, which was a little surprising.