Can Binance Coin’s [BNB] increased adoption help it beat the bears?

![Can Binance Coin's [BNB] increased adoption help it beat the bears?n help it beat the bears in the coming days?](https://ambcrypto.com/wp-content/uploads/2023/02/BNB.png.webp)

- FCF Pay announced that it will accept BNB for virtual prepaid debit cards.

- Metrics remain bullish, but market indicators gave reasons for concern.

Binance Coin [BNB] posted its weekly metrics on 4 February, mentioning a few of the chain’s notable statistics. As per the latest data, BNB’s weekly transactions exceeded 17 million, while the daily average transaction remained at 2.87 million. Furthermore, its weekly and daily average users stood at 2.78 million and 829k, respectively.

BNB Chain Key Metrics at a glance ?

?Millions of Weekly Active Users

?Millions of Daily Transactions

?Low gas fees, like REALLY low pic.twitter.com/veH0a7p514— BNB Chain (@BNBCHAIN) February 4, 2023

Read Binance Coin’s [BNB] Price Prediction 2023-24

Not only this, but another interesting development reflected upon the increased adoption of BNB. FCF Pay, a blockchain payment system, announced that it will accept BNB for virtual prepaid debit cards.

#BNB now accepted for virtual prepaid debit cards! ??

? $5000 limit

♻️ Refillable

? No ID required? #BNBChain investors, check out the #FCF Project White Paper and Roadmap: https://t.co/tnKcdssqrD#BSC #Binance $BNB #BSCGems #bscgem #BscChain pic.twitter.com/2V6GNvK6kY

— FCF PAY – Blockchain Payment System (@fcfpay) February 3, 2023

Bulls dominated the week

BNB’s price action remained bullish last week as it registered gains. According to CoinMarketCap, BNB’s price increased by 6% in the last seven days, and at the time of writing, it was trading at $329.58 with a market capitalization of over $52 billion.

BNB’s MVRV Ratio went up in the last few days, which might have played a role in increasing its value. Moreover, LunarCrush’s data revealed that BNB’s market dominance also increased by nearly 3% in the past week.

Demand from the futures market also remained high as BNB’s Binance funding rate spiked. However, BNB’s velocity went down during the last few days of the week. BNB’s social volume also followed the velocity and registered a decline, suggesting that the crypto’s popularity declined.

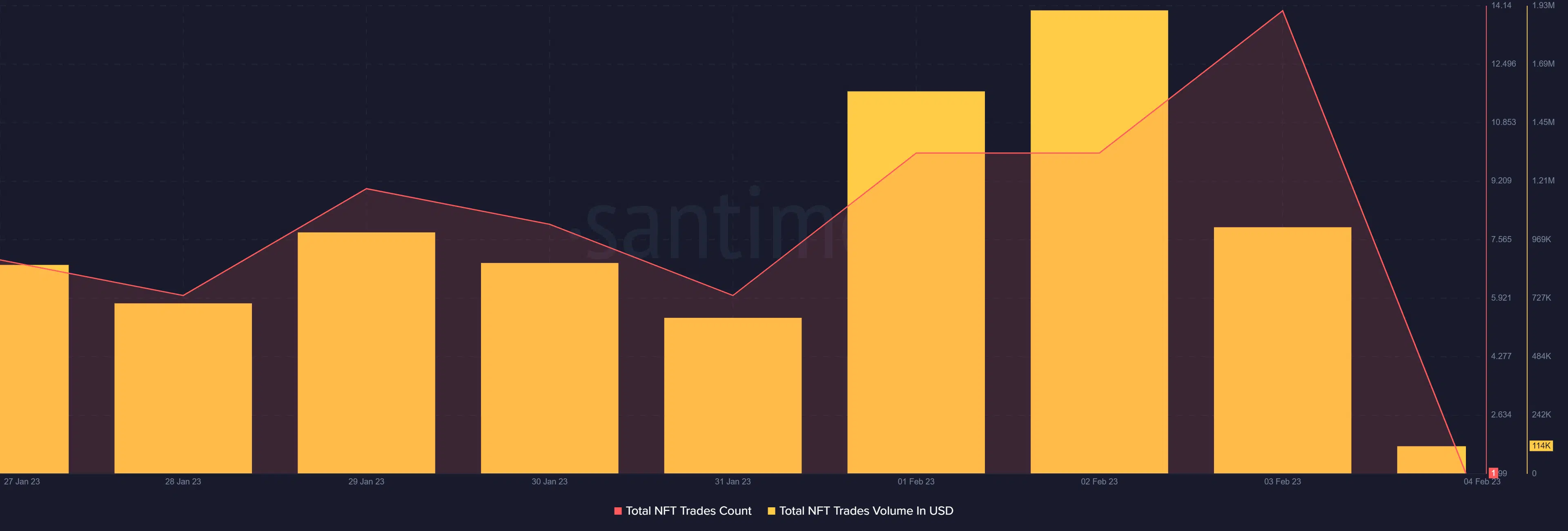

Interestingly, Binance Coin’s NFT ecosystem witnessed growth, which was evident from Santiment’s chart. BNB’s total NFT trade counts and total NFT trade volume in USD increased last week.

Realistic or not, here’s BNB market cap in BTC’s terms

BNB favors the bears

Though the last week remained in buyers’ favor, things might change soon as BNB’s daily chart suggested that the bears had arrived. For instance, BNB’s Money Flow Index (MFI) was in the overbought zone, which might increase selling pressure and result in a price decline. The Chaikin Money Flow (CMF) registered a slight decline from the neutral mark, which was also bearish.

Additionally, Binance Coin’s Relative Strength Index (RSI) was supporting the bears as it was hovering right near the overbought zone. Nonetheless, the Exponential Moving Average (EMA) Ribbon gave a slight hope for a continued uptrend as the 20-day EMA was resting above the 55-day EMA.