BNB’s 52% volume drop: Analysts predict unexpected bullish twist

- BNB’s underwhelming price action forced traders to skip the coin.

- While sentiment remained gloomy, other metrics indicated a recovery.

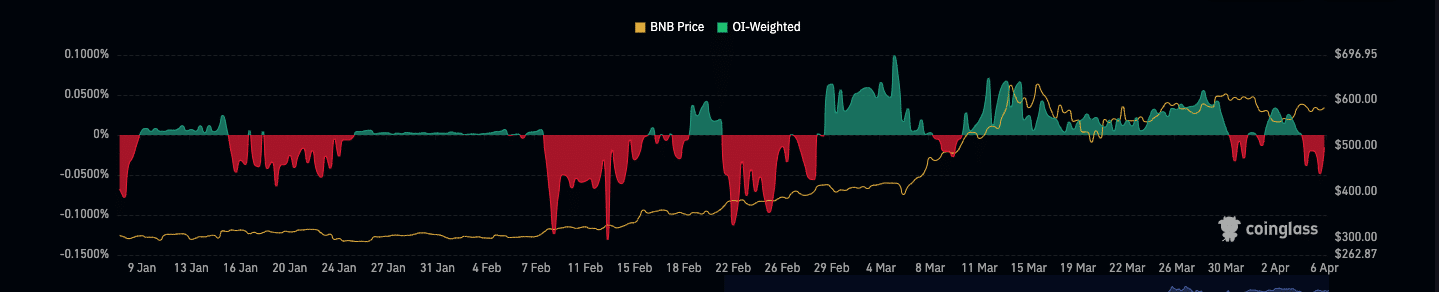

According to data from Coinglass, Binance Coin’s [BNB] volume in the derivatives market dropped by 52.97% in the last 24 hours. At press time, the volume was $671.80 million.

The decrease in volume was a sign that traders did not expect a positive impact from BNB’s price on their position. Hence, most refrained from adding liquidity to their accounts.

The coin wants to defy expectations

At press time, BNB’s price was $581.47, representing a 4.50% decrease in the last seven days. However, the coin was not the only one affected by a decline – many altcoins also faced the same fate.

But there was something different about BNB that might have forced traders to overlook the coin. One of them is the Funding Rate.

As of this writing, the Funding Rate was -0.0129%. Typically, positive funding means that the perp price is trading at a discount compared to the spot value.

However, BNB’s negative reading implied that the perp price was at a discount compared to the index value. From a trading perspective, the negative funding while the price stalls is potentially bullish.

This is because shorts are aggressive but have nothing to show as reward. Therefore, the price of the coin might key into the underlying support and rebound.

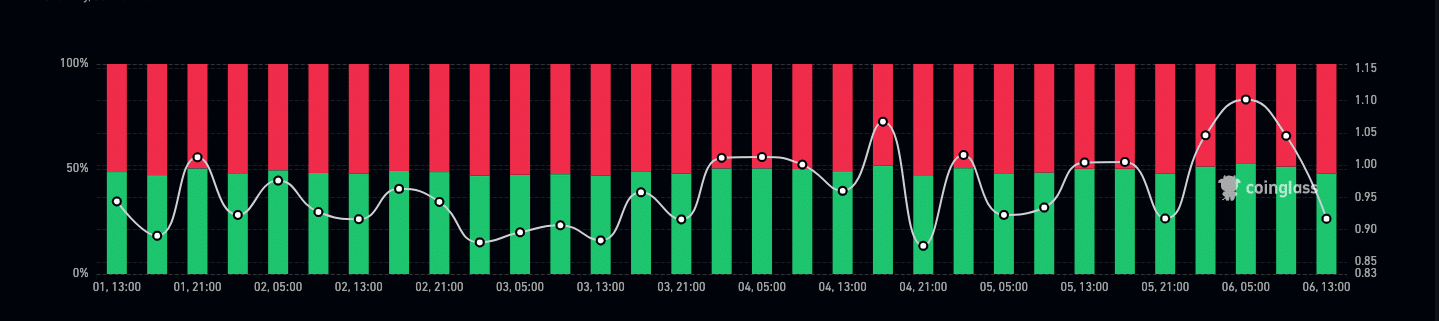

Should this be the case, BNB’s price might surpass $595 in the short term. Despite the bullish bias, AMBCrypto noticed that the Long/Short ratio was 0.92.

Values above 1 of the Long/Short ratio suggest positive investors’ expectations. As such, the reading as of this writing, indicated that traders were convinced that Binance Coin would struggle to climb higher.

Warning signs appear

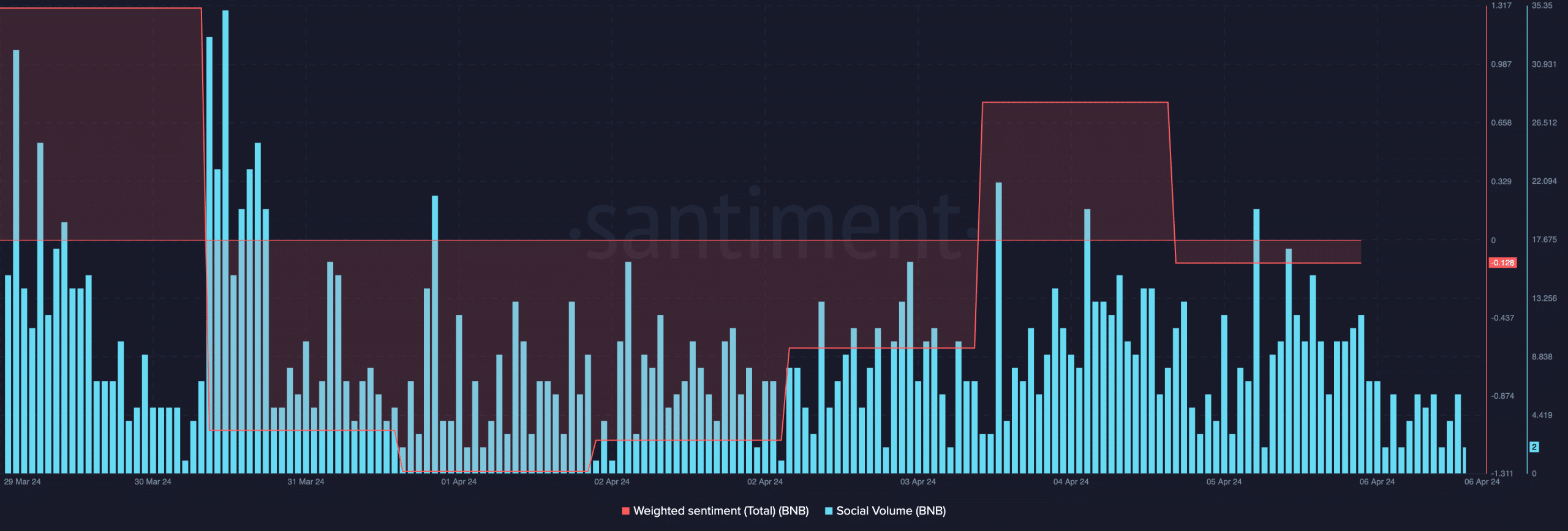

However, traders in the derivatives arm were not the only ones cautious about BNB. AMBCrypto checked the Weighted Sentiment provided by Santiment.

According to data from the analysis tool, the sentiment had dropped to the negative region. Positive values of the metric suggest that market participants are unfazed by fear or doubt.

However, the negative reading implied that the broader market was skeptical about an upward trajectory. Hence, the perception favored a possible market downturn.

If the sentiment continues to languish in the red zone, BNB might face a sharp decline. On the other hand, a higher volume could change the mood of investors.

Furthermore, the social volume around the coin fell. This indicates that the hype around BNB was not enough to drive a price pump.

Is your portfolio green? Check out the BNB Profit Calculator

At the same time, the decrease could serve as an opportunity for participants to scoop at lower prices.

Going forward, BNB might need its spot and derivative volume to improve if the price were to experience a snowball effect. If this does not happen, the coin might eventually trade sideways in the short term.