BNB drops by ONLY 0.35%: Sign of decoupling?

- Clearance in Dubai and a likely return to India helped improve BNB’s sentiment

- Bullish traders in derivatives market increased sharply in the last 24 hours.

BNB, the native token of the Binance ecosystem, was one of the better-performing major cryptocurrency in the last 24 hours, according to CoinMarketCap.

While most blue chip coins and altcoins continued to bleed, BNB walked away with comparatively less damage, trading just 0.35% lower than yesterday.

A deeper examination of the 24-hour trajectory showed the fourth-largest digital asset rising to $554 at 4:30 AM UTC on the 18th of April. However, it retraced soon after and was trading at $541 at press time.

Positive developments in the Binance ecosystem may have offered a cushion to prevent BNB from sliding lower.

BNB helped by these developments

The world’s largest crypto trading platform, Binance, announced that it received a license from Dubai’s crypto regulators to extend its services to retail investors in the city.

While Binance was already serving institutional investors, but the latest clearance gave it access to a broader spectrum of traders in the economic hub.

Good news kept coming from Asia, as a recent report by Indian publication Economic Times hinted at Binance’s return to the Indian market, after getting banned earlier in January.

Apart from the aforementioned regulatory wins, Binance also announced the successful completion of BSC Feynman hardfork, enabling native staking and governance on the BSC Chain.

The cumulative effect of these news likely helped in boosting BNB’s prospects.

Read Binance Coin’s [BNB] Price Prediction 2024-25

Derivatives traders go bullish on BNB

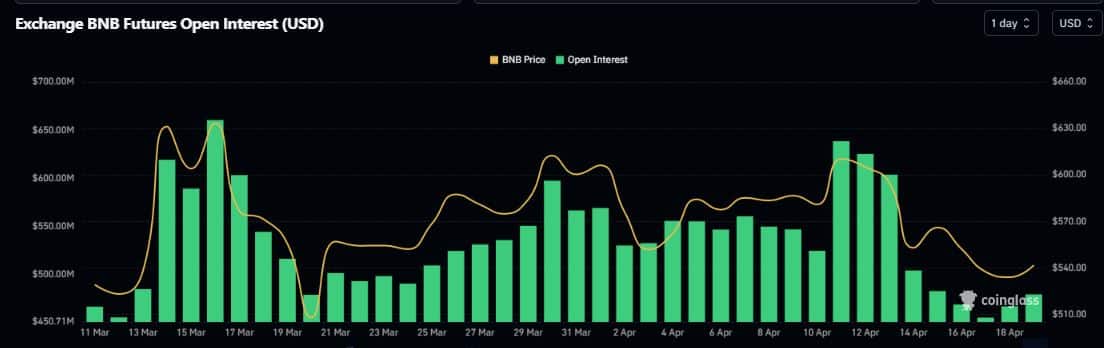

Meanwhile, derivatives traders ramped up their bets on BNB. According to AMBCrypto’s analysis of Coinglass’ data, the Open Interest (OI) in BNB futures rose nearly 10% in the last 24 hours to $525 million.

Moreover, the number of traders betting on BNB’s price increase exceeded those who were bearish on the coin, as evidenced by the Longs/Shorts Ratio.