BNB eyes breakout: Will bullish sentiment help the altcoin?

- BNB faced key resistance at $617, with bullish sentiment suggesting a potential breakout.

- Rising Open Interest and steady social dominance signaled growing confidence, but volatility looms.

Binance [BNB] is gaining significant attention as bullish sentiment continues to strengthen across the market. At press time, BNB was trading at $609.51, showing a 1.94% rise over the last 24 hours.

Both crowd and smart money indicators are signaling optimism; can BNB break key resistance levels and extend its current rally?

Can BNB clear key resistance levels?

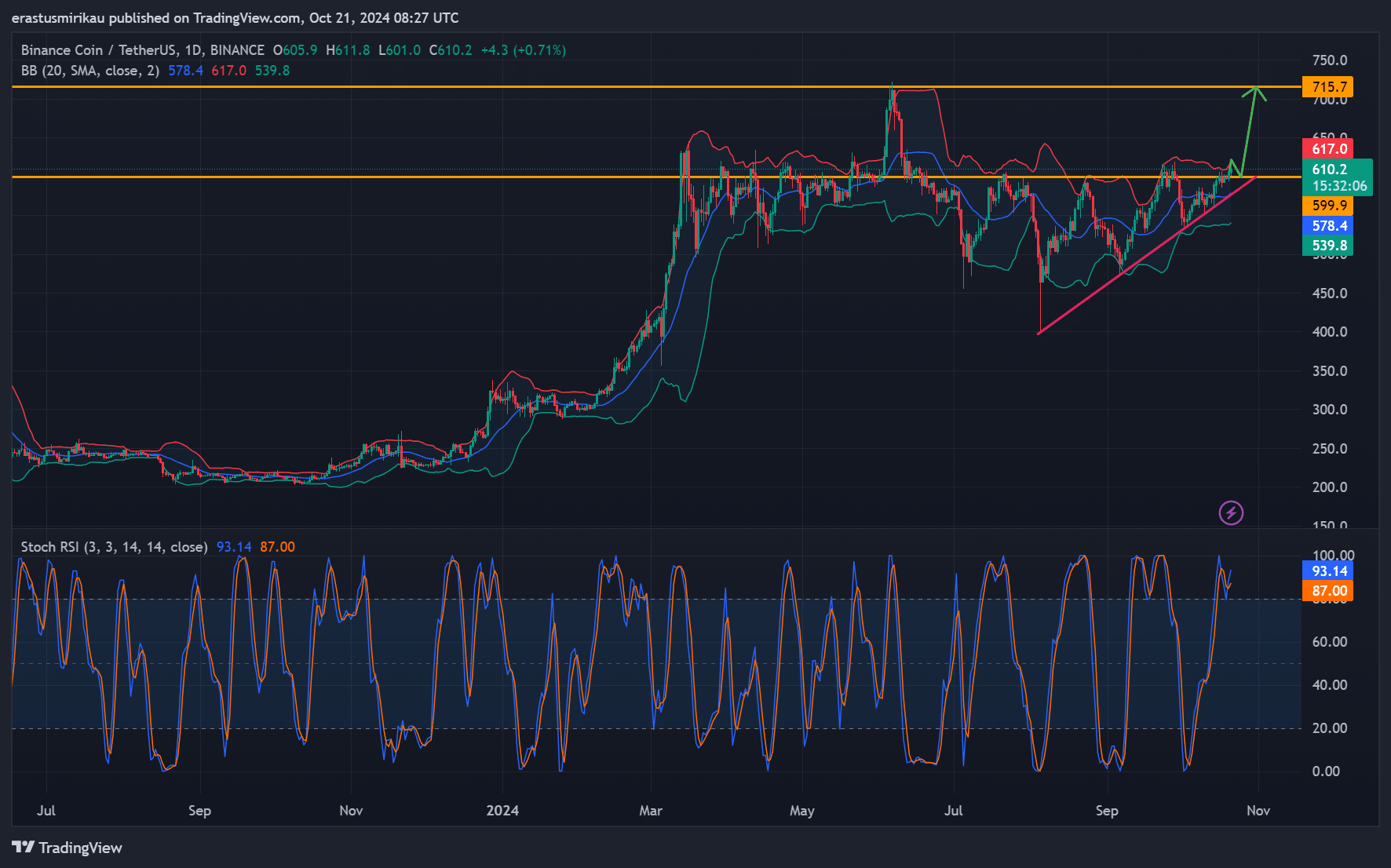

BNB’s price action shows encouraging signs of strength. Trading above $600 at press time, the token faced a crucial resistance zone at $617.

This level has proven to be a tough barrier in the past but clearing it could set the stage for a push toward the next major target of $715.7. Therefore, breaking this resistance is critical for further upward momentum.

Additionally, the chart’s stochastic RSI was at an overbought level, confirming the strong buying pressure behind BNB’s recent rise.

However, an overbought RSI often precedes a short-term pullback, suggesting that BNB may experience a brief correction before resuming its rally.

Traders should watch the $599 support level in case this retracement materializes.

BNB: Is more interest building?

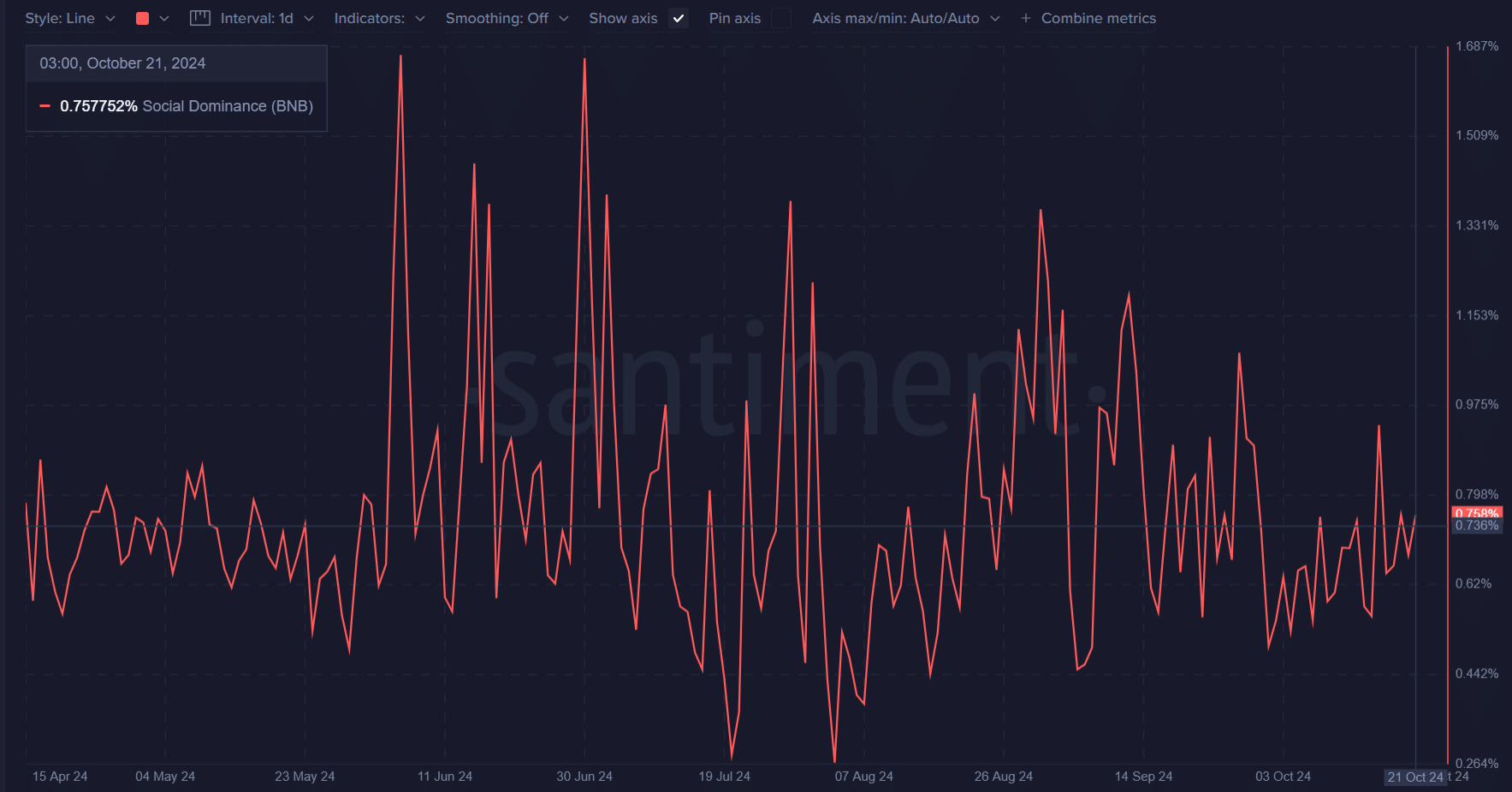

While the coin’s social dominance has fluctuated over the past few months, it sat at 0.757% at press time, reflecting steady attention from the market.

This consistency in social activity is significant, as increased social dominance typically correlates with growing investor interest.

If this trend continues, it could drive more market participants toward BNB, further supporting its price. However, it’s important to note that social dominance alone isn’t enough to guarantee sustained price growth.

A sign of confidence?

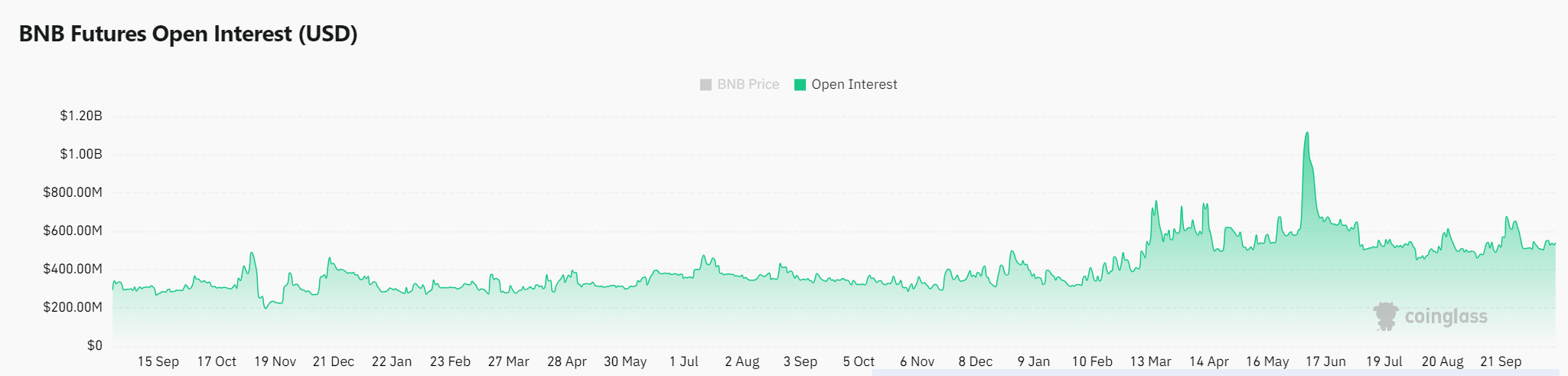

Open interest in the Futures market has surged 5.94%, totaling $562.01 million at press time.

This rise in Open interest reflected growing trader interest and suggested that more bets are being placed on Binance Coin’s future price movements.

An uptick in Open Interest often leads to increased volatility, which could provide further trading opportunities for Binance Coin in the near term.

However, higher Open Interest also means greater exposure to market risks, as large traders may unwind their positions, causing sharp price swings. Traders should stay vigilant as Open Interest increases.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

Will BNB sustain its bullish momentum?

Binance Coin’s rising price, bullish sentiment, and increasing open interest all point to potential upside. However, overcoming key resistance at $617 remains essential.

While Binance Coin seems well-positioned for further gains, short-term corrections could still occur. If BNB breaks through this resistance, a rally toward $715 appears likely, setting the stage for more bullish action.