BNB is ideal for long-term investment, thanks to quarterly burn highlights

Binance just announced that it has completed its 21st quarterly BNB burn. For those that did not know, the crypto company has a quarterly auto-burn that takes a significant amount of BNB out of supply. While this makes BNB a deflationary cryptocurrency, is it the right fit for long-term trades?

Here’s AMBCrypto’s price prediction for BNB

The answer depends on how much BNB is taken out of supply, and the pace at which the supply reduces. BNB’s circulating supply was just over 161.3 million at press time, which puts it in the low-cap category.

According to the official announcement, Binance burned 2.06 million BNB which is roughly 0.013% of the current circulating supply.

#Binance Completes 21st Quarterly #BNB Burn!

? 2.06m #BNB has been burned ? pic.twitter.com/VHvt1E4FzB

— Binance (@binance) October 13, 2022

Burn baby burn!

If Binance maintains a burn rate of more than two million BNB for the next 10 years, it will eliminate more than a third of its current supply.

Such an outcome would be heavily accretive to BNB bulls. This provides a strong incentive or value proposition for investors to hold BNB for the long term.

BNB delivered an impressive performance in the last few years. Its $260 price tag, at press time, was still relatively high despite the sizable drawback from its $691 all-time high.

However, one could argue that it was still trading at a discount compared to its potential long-term value if the quarterly burn continues.

BNB’s price action has been bearish so far this month. It is down by roughly 13% from its October highs and its current performance is in tandem with the bearish market conditions.

Should you wait for a steeper discount?

BNB’s price action may sink lower if the market continues on the current trajectory. Unfortunately, the unpredictable nature of the market means a bullish bounce might be around the corner.

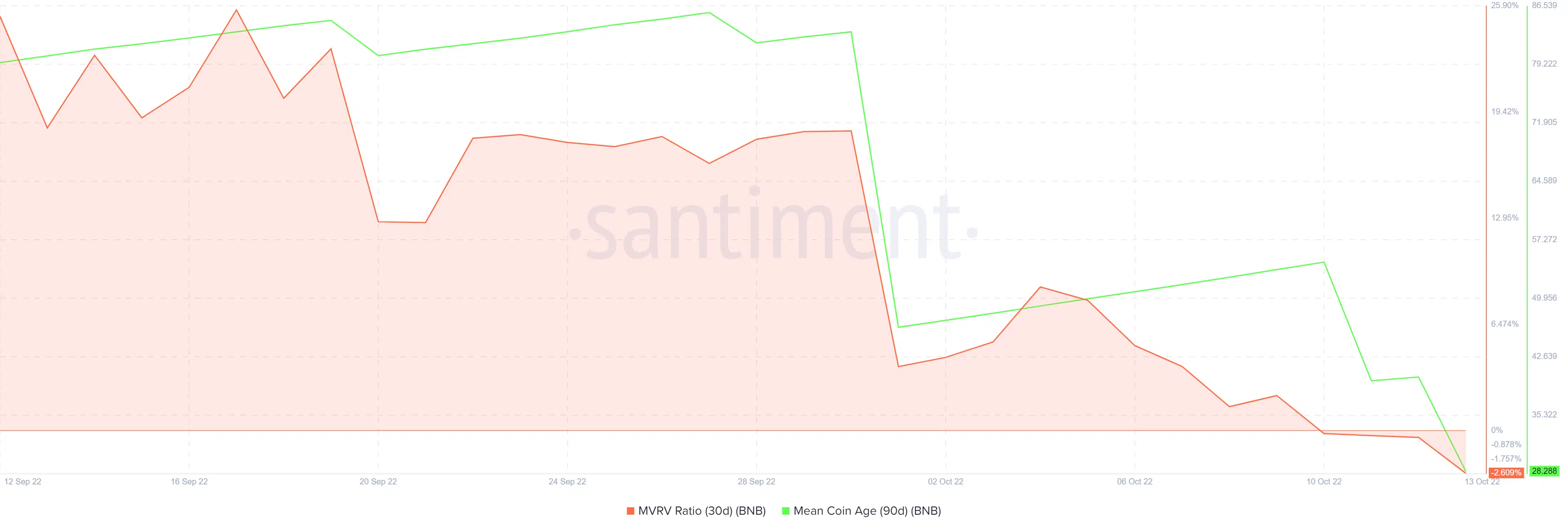

As far as short-term demand is concerned, both the 30-day MVRV ratio and the 90-day mean coin age are down in the last four weeks.

The downward trajectory indicates that investors have been trimming their balances during the last four weeks. In other words, BNB’s price action has been characterized by low buying pressure, allowing the bears to dominate.

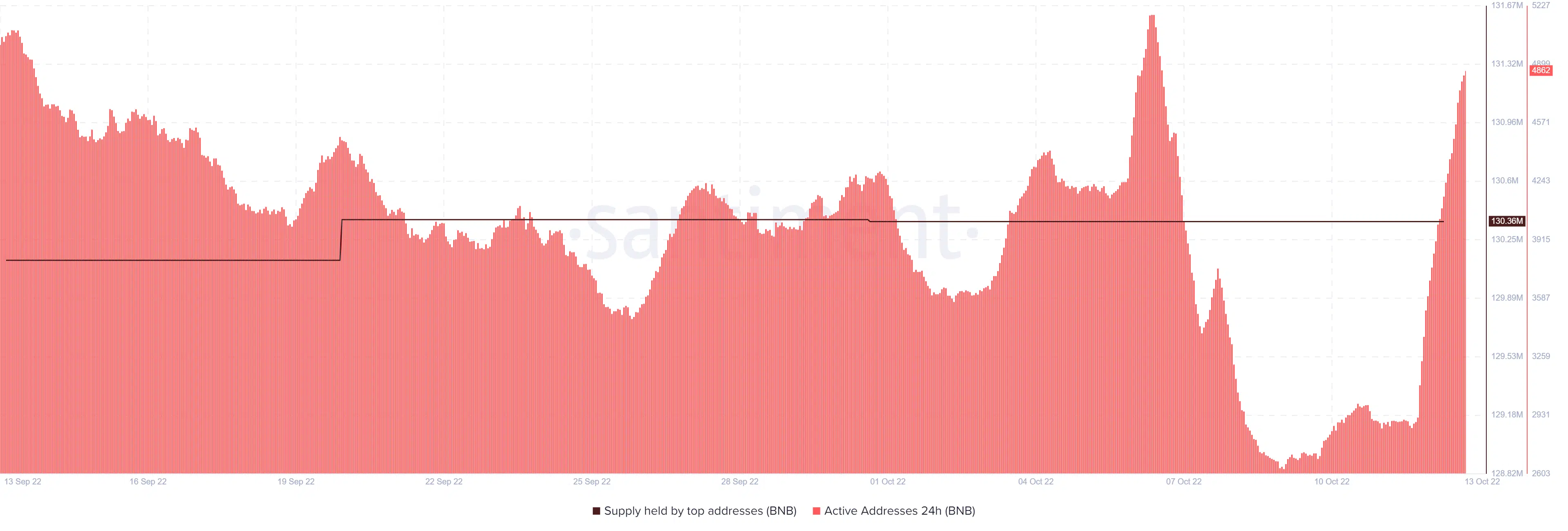

There have been some positive observations despite this. For example, the supply held by top addresses increased by a sizable margin between 19 and 20 September. This means whales have been dollar-cost-averaging even as prices fell.

Active addresses registered a sharp spike in the last 24 hours, as the price retested September lows.

BNB might still drop lower but the current observations suggest that the short-term support might provide bullish relief. As for its long-term price action, the burn underscores BNB’s potential long-term value.