BNB, Solana and Ethereum – How these L1s did in 2023?

- Competition in the L1 sector inflated with the growth of Ethereum, BNB and Solana.

- Ethereum dominated in terms of revenue and TVL.

As the cryptocurrency market rebounded from the crypto winter of 2022, competition among various Layer 1 (L1) protocols intensified.

Ethereum emerged as the clear revenue leader, surpassing other cryptocurrencies by a significant margin. This was primarily due to its robust ecosystem, attracting developers and users alike.

Tron, BNB, and Polygon secured the second, third, and fourth positions respectively in terms of revenue.

These platforms witnessed high levels of daily active addresses, indicating strong user engagement and adoption.

While Ethereum dominated in terms of revenue, Solana stood out in the transaction volume metric. Solana’s highly scalable and low-cost network architecture facilitated a surge in transaction activity.

This performance helped Solana secure the fifth position in revenue collection, highlighting its growing popularity and utility within the crypto ecosystem.

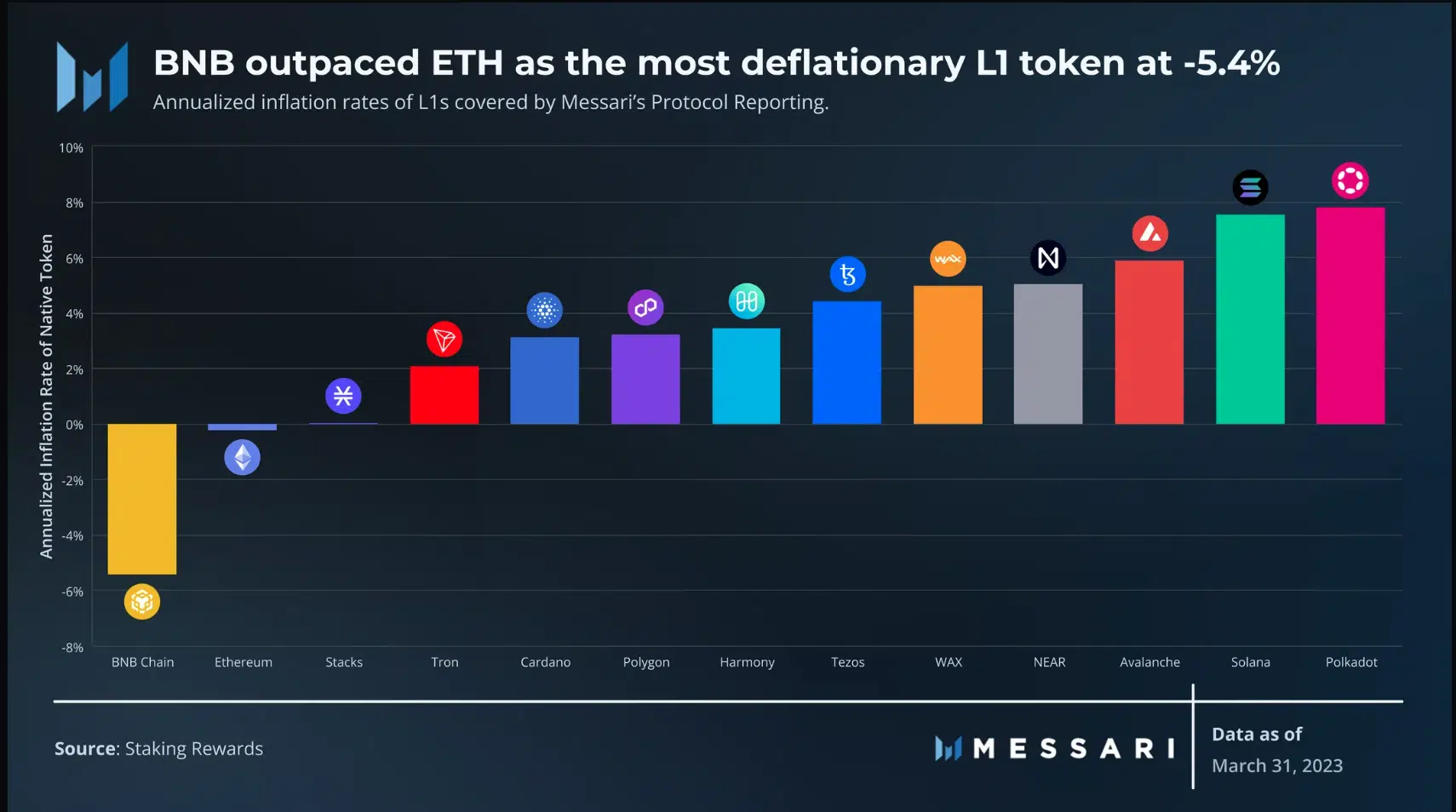

In Q1 2023, both BNB and ETH showcased deflationary characteristics. BNB and ETH burned a portion of their transaction fees, reducing the overall token supply over time.

Moreover, Binance’s regular token buybacks and burns contributed significantly to BNB’s deflationary pressure. This tokenomics design aimed to create scarcity and incentivize long-term holding, aligning the interests of investors and network participants.

DeFi Sector and Ethereum’s Dominance

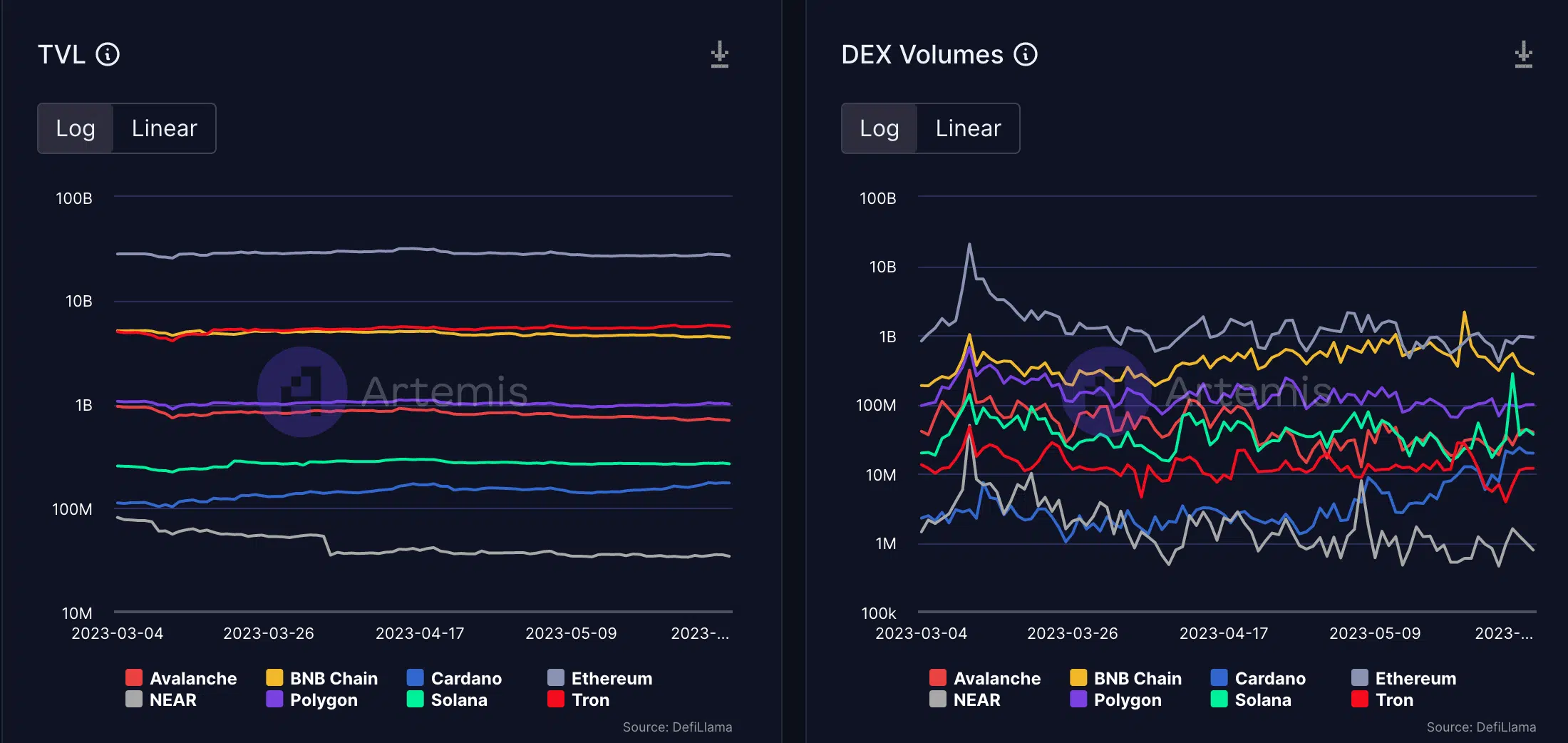

Ethereum continued to dominate the Total Value Locked (TVL) metric in the DeFi sector. Tron, BNB, and Polygon followed Ethereum, showcasing the rising prominence of these platforms in the DeFi landscape.

The high TVL could be attributed to the large volumes seen on decentralized exchanges (DEX) within these networks, reflecting the growing demand for DeFi services.

Despite higher gas fees, Ethereum remained the primary hub for NFT activity according to Messari’s data. Blur established itself as the dominant Ethereum marketplace in terms of volume during Q1 2023, capitalizing on its token launch and airdrop in mid-February.

Polygon witnessed substantial growth in average daily volume, experiencing a significant 101% increase, showcasing its rising popularity in the NFT sector.

Realistic or not, here’s ETH’s market cap in BTC terms

Coins penetrate deeper into the market

ETH, SOL and BNB demonstrated growth in market capitalization in the first quarter of 2023. Ethereum’s established position and continued adoption led to its market cap expansion.

Solana’s performance in transactions and its growing ecosystem attracted investor attention, resulting in market cap growth. BNB’s deflationary tokenomics and its position as the native token of Binance contributed to its market cap rise.

However, Polygon’s MATIC did not witness a comparable increase in its market capitalization during this period.