BNB’s bullish bets rise: To $600 and beyond?

- Aggressive sellers might force BNB’s price down.

- Many long positions have been wiped out, and more might not escape it.

Binance Coin [BNB] options volume has increased by 68.38% ahead of this weekend’s end-of-the-month and Q1 expiration. The volume includes the contracts on OKX, Binance, Deribit, and Bybit.

According to Coinglass, the options Open Interest also jumped. The data AMBCrypto compiled implied that BNB had attracted more traders to its side.

A further assessment of the derivatives market revealed that most of the outstanding contracts were buy options.

Trading options give participants the right to buy (call) or sell (put) an asset within a specific period. If there are more puts, then most traders are bearish.

But in the coin’s case, more calls implied that traders are betting on BNB to end March on a good note.

It’s not yet a win for bulls

BNB’s price, at press time, was $584.82, indicating that the value had risen by 52.26% in the last 30 days. But the price had previously hit $600.

Therefore, the value as of this writing, implied that the last few weeks have not been smooth for the Binance exchange coin.

Can BNB revisit $600 or higher before the month ends? This is one question traders might be asking themselves. Like the traders with open contracts, AMBCrypto was also interested in the possibility.

When we checked Hyblock’s Stat Analyzer, we also noticed that there have been more bids than asks. This suggests that traders were willing to pay a high price per BNB.

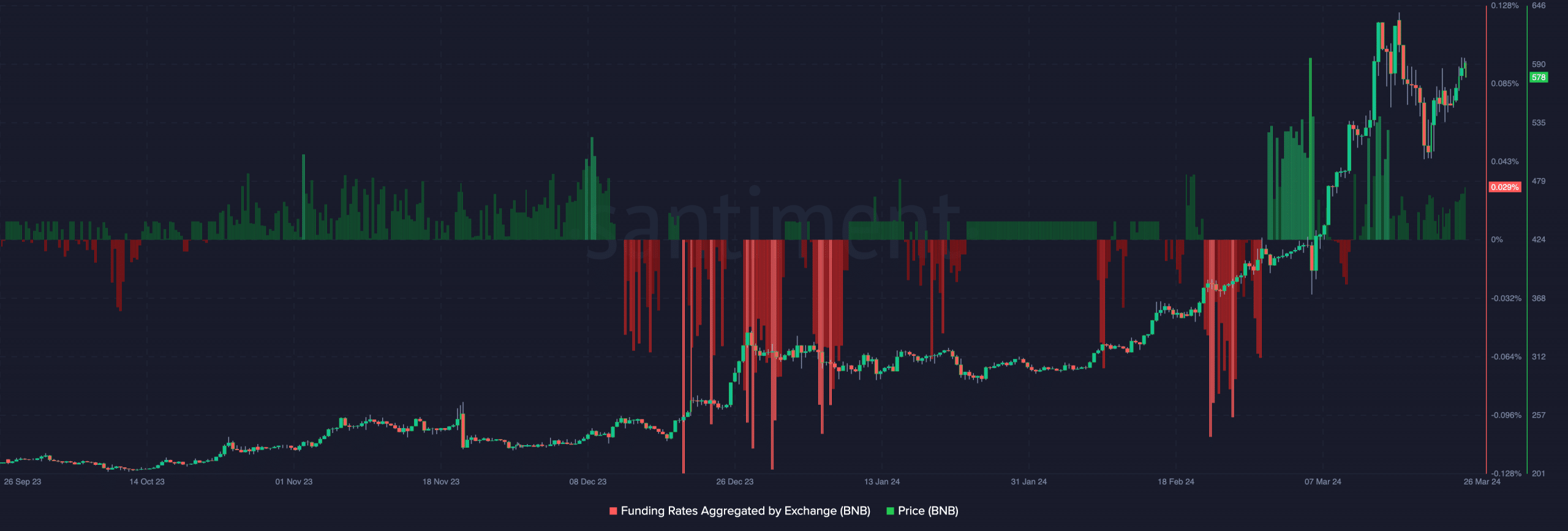

However, the possible outcome of this bullish bias might be incomplete without looking at other perspectives. From an on-chain point of view, the Funding Rate jumped as BNB’s price kept moving lower.

Longs suffer and others may be next

The positive funding as the price dropped might not be great despite the increase in Open Interest.

For context, this means that buyers were fading the coin’s move and sellers were the aggressive ones in the spot market.

If this metric maintains this position till month’s end, then BNB might find it challenging to hit cross $600.

However, if funding becomes negative as prices move higher, then traders who have placed big bets might gain.

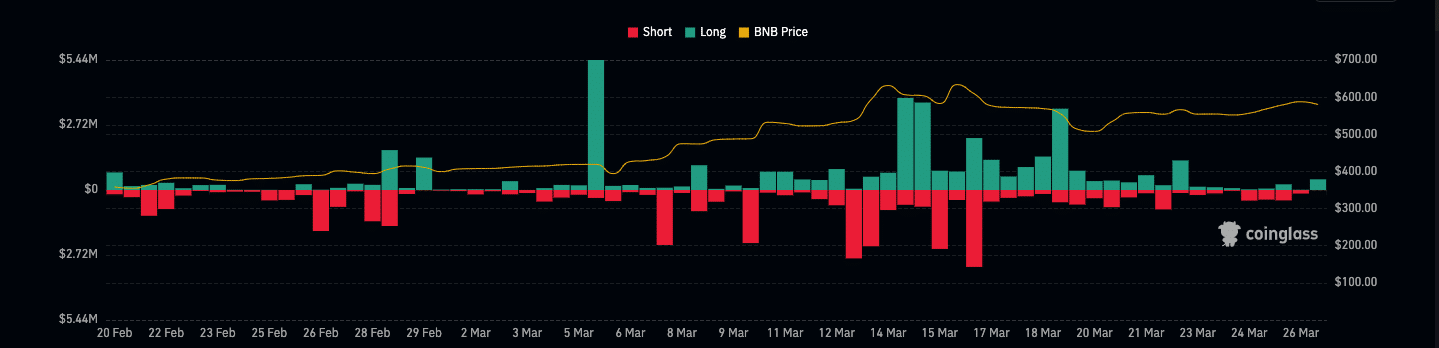

In the meantime, there have been more long liquidations than shorts. Liquidation occurs when a trader cannot maintain a leveraged position due to the inability to meet margin provisions.

As a result, exchanges are forced to close their positions to avoid further losses.

Is your portfolio green? Check the Binance Coin Profit Calculator

Thus, the liquidation data below indicated that those who had futures contracts predicting a price increase have been affected by the recent decline.

As it stands, many call options might experience a wipeout when the month ends. However, if BNB’s price swings upwards, puts might take their place.