BNB’s price reversal could be imminent on the retest of this level

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

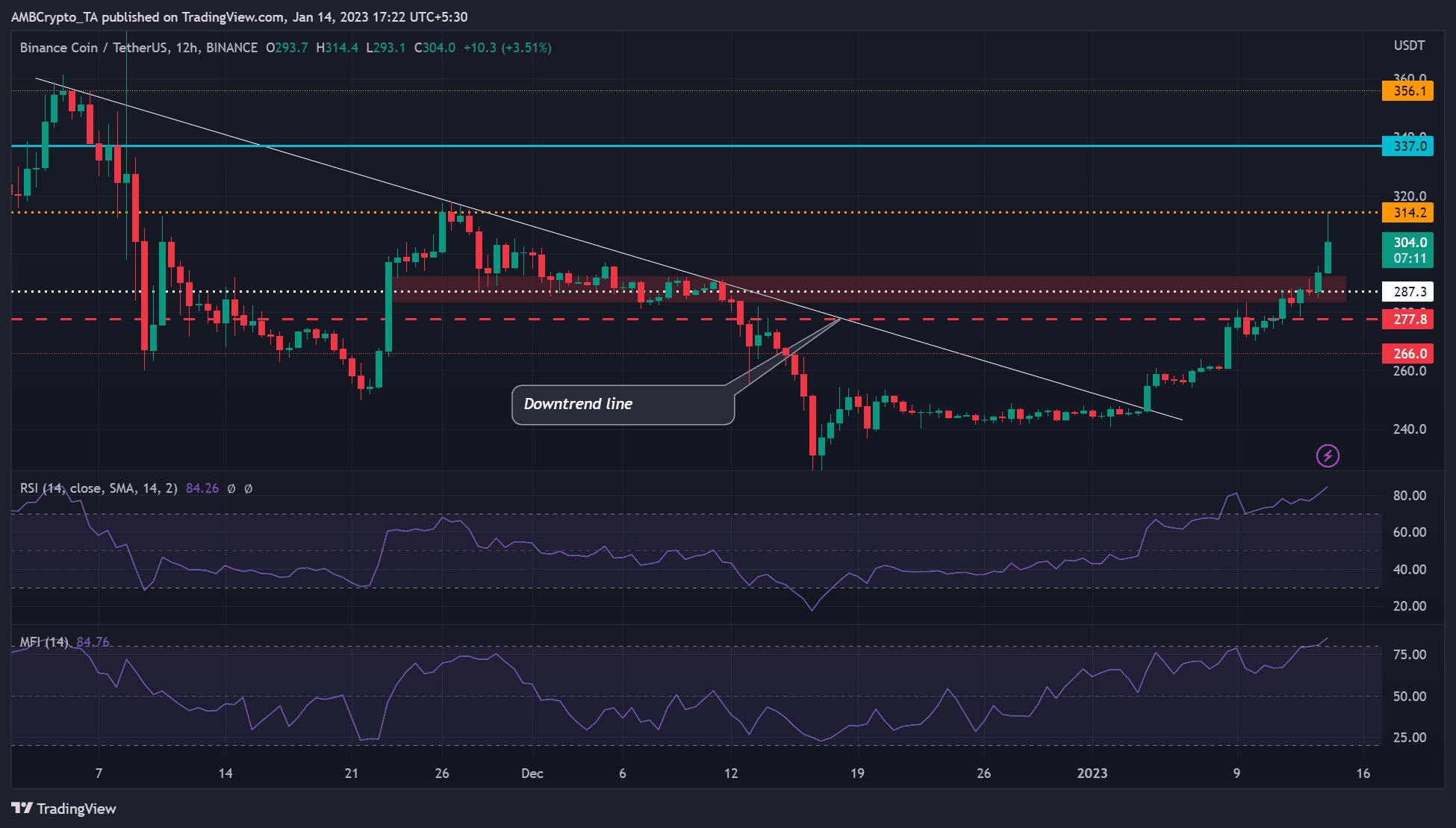

- BNB could break below $287.3 support.

- A break above $314.2 would invalidate the bias.

Binance coin [BNB] posted an impressive performance after sustaining massive FUD at the end of last year. It surged from $240 to over $310 in the past two weeks, offering investors a 30% gain.

However, it faced a price rejection at $314.2, a key resistance zone at the end of November 2022. At press time, it was trading at $302.4 and could drop further.

Read BNB Price Prediction 2023-24

The $287.3 support: Is a breach below it likely?

On the 12-hour chart, the Relative Strength Index (RSI) and the Money Flow Index (MFI) were in the overbought zone. This implies that the buying pressure was strong, but the overbought condition also set BNB for a possible trend reversal.

Besides, BTC’s rally only lasted three days during the last U.S. CPI release on 13 December. If the trend repeats, BTC’s bullish momentum could ease, tipping BNB bears to act.

Therefore, selling pressure could increase in the coming day(s). This could push BNB to retest the $287.3 support or break below it. BNB’s decline below the support could be kept in check by $283.3 or $277.8. These levels can serve as short-selling targets for bears if the trend reversal is confirmed.

However, bulls could still attempt to retest the $314.2 resistance or break above it, especially if BTC remains bullish. Such an upswing would render the above bearish bias null. The upside move will allow bulls to aim at BNB’s November high of $360 if they clear the $337 obstacle.

How much are 1,10,100 BNBs worth today?

BNB saw an increase in daily active addresses but a decline in sentiment

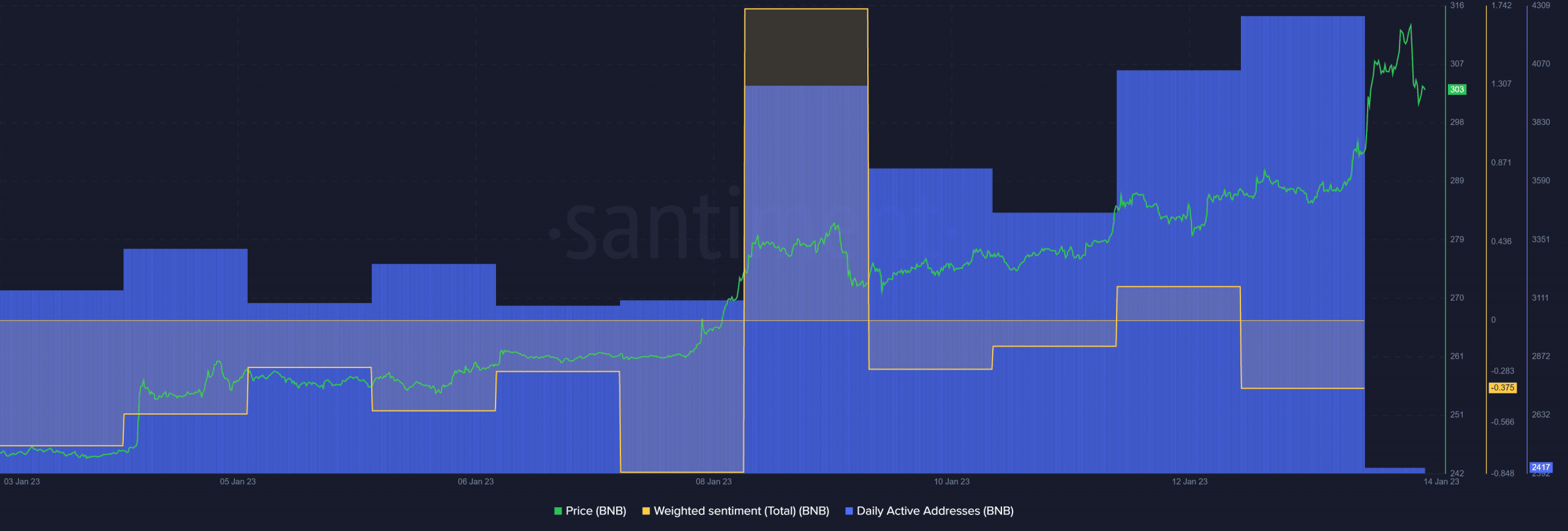

Santiment data showed that BNB’s daily active addresses increased steadily, indicating more accounts traded BNB as prices surged, boosting the recent uptrend momentum.

However, at press time, the weighted sentiment moved to the negative side. It indicates a drop in investors’ confidence and outlook for the asset, which could slightly undermine BNB’s bull run.

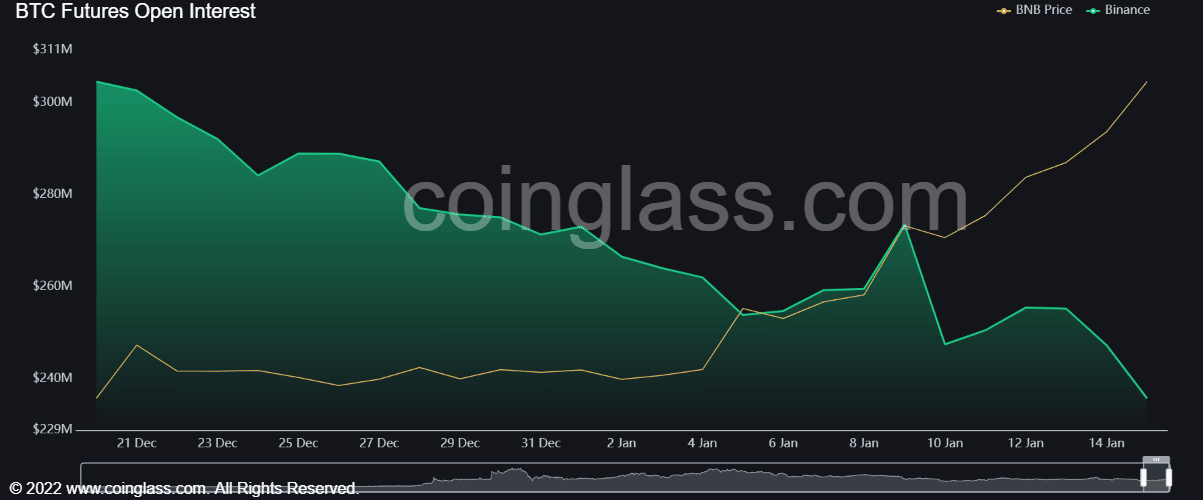

In addition, BNB’s open interest rate (OI) has been declining since late December last year. At press time, the OI fell further despite BNB’s price rally. The price/OI divergence could indicate a slowing uptrend momentum and a likely trend reversal.

![Tron [TRX]](https://ambcrypto.com/wp-content/uploads/2025/08/Tron-TRX-400x240.webp)