BONK crypto pumps 90% – Will the 1 trillion token burn fuel further gains?

- BONK pumped 100% in the past week; will the uptrend continue?

- BonkDAO planned to burn 1T BONK by Christmas – A bullish cue?

The Solana [SOL]-based memecoin BONK rallied 100% in the past seven days, driven by an overall market pump and a massive deflationary plan to burn 1 trillion tokens.

On 15th November, Bonk DAO announced the deflationary plans with the 2024 Christmas deadline.

“The BONK DAO BURNmas SUPER thread. The Mission: Burn 1 Trillion $BONK by Christmas. The campaign features BONK burns based on specific engagement criteria.”

Immediately after the news, BONK pumped 27% and added on its weekly gains, which crossed 100% amid an extra weekend pump. For context, burning tokens reduces supply and ultimately boosts the value of the remaining assets.

What’s next for BONK?

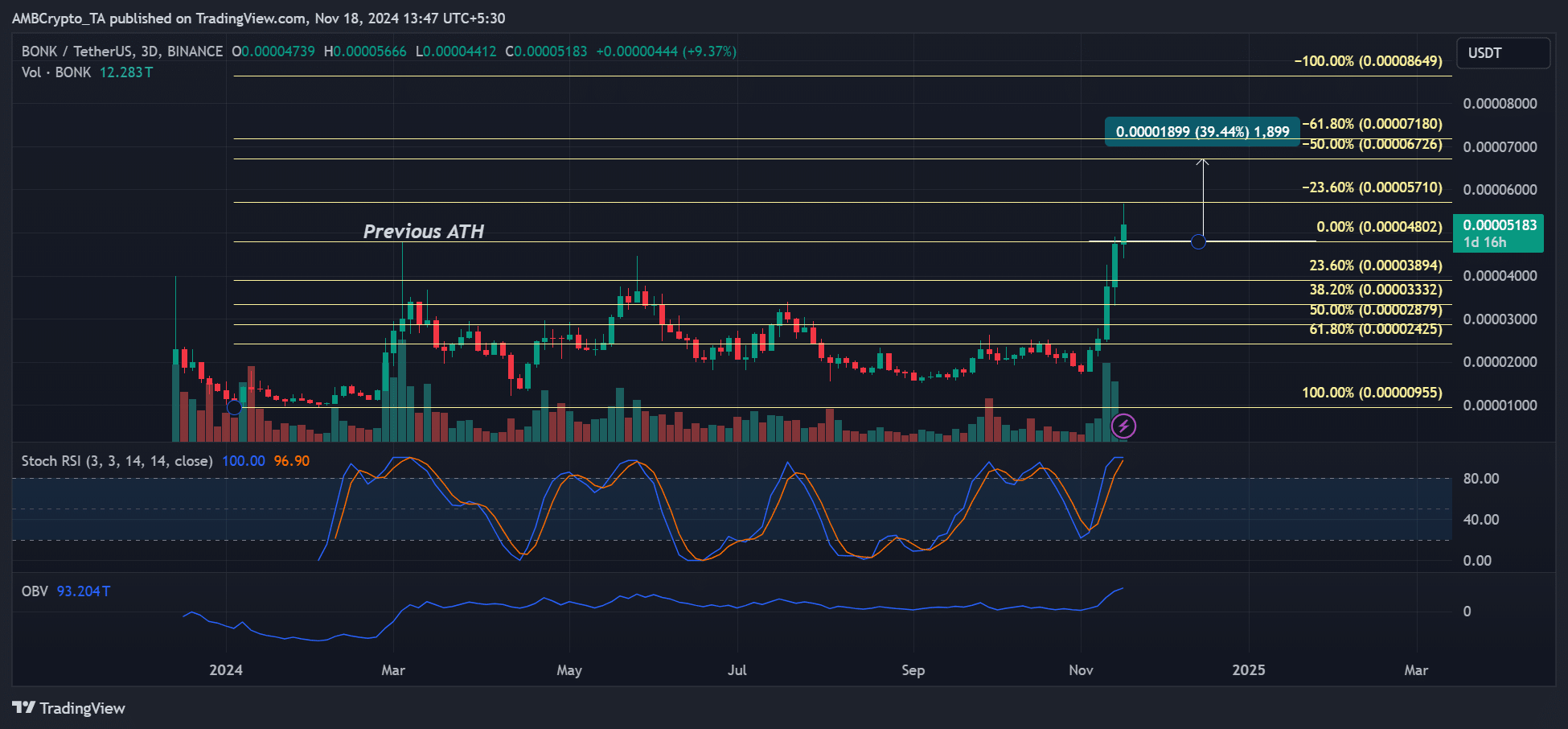

Last week’s remarkable rally pushed BONK into a price discovery phase. To explore the next likely targets, a Fibonacci retracement tool (yellow) was placed between the previous all-time high (ATH) and yearly low.

The extra pump on Sunday eyed the immediate bullish target of $0.000057 on the Fib tool. If the uptrend extended, the next target would be $0.000067, offering an extra 40% potential gains.

But BONK grabbing the extra gains could only be feasible if the mememcoin stayed above its previous ATH.

That said, technical indicators showed massive buying interest but an overheated market scenario. The Stochastic RSI was in oversold territory, while the OBV (On Balance Volume) reached new highs.

BONK whales trim exposure

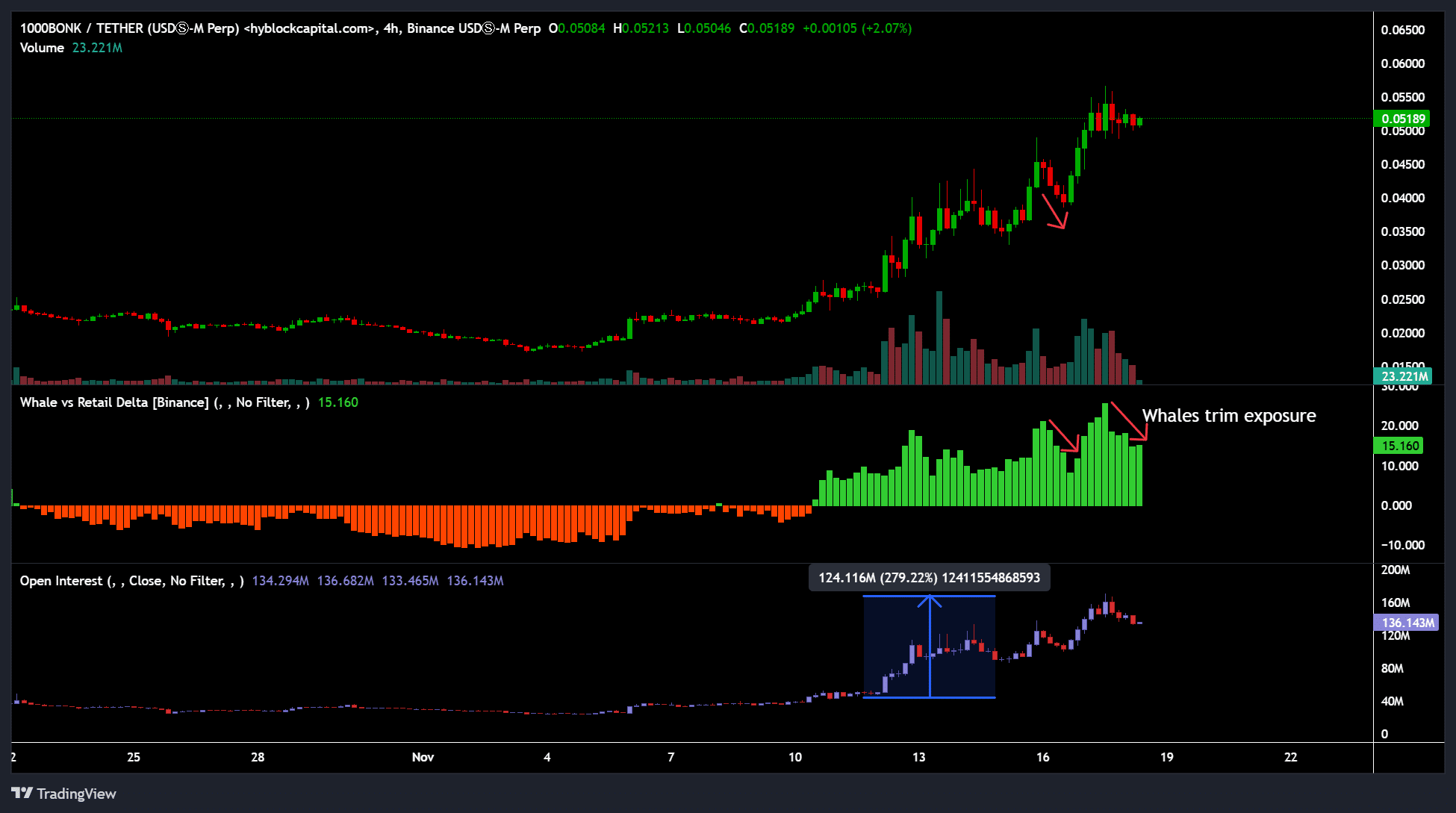

On the market positioning front, whales slightly trimmed their exposure after last week’s rally, as indicated by the retreating Whale vs. Retail Delta indicator.

Reduced whale exposure usually tends to trigger a consolidation or price decline. BONK could face a cool-off and pullback if they continue shedding their positions.

On the contrary, increased whale exposure always signals a potential price rally.

Read Bonk [BONK] Price Prediction 2024-2025

Interestingly, leveraged bulls also FOMO’ed on the BONK’s rally. The OI (open interest) rates surged 3X, from about $50M to over $150M in just days. This suggested that leveraged players took massive debts to place bullish bets on BONK.

Market pundits expect the BONK rally to extend, partly due to the expected 1T token burn. However, the broader market sentiment could determine the next price direction for the memecoin.