BONK price prediction: A 30% bounce after a 15% drop?

- BONK has slim chances of a short-term bounce.

- The technical and social indicators were not favorable to the buyers.

Bonk’s [BONK] price prediction for May showed losses were more likely than a breakout. The technical indicators did not highlight buyer strength.

An earlier AMBCrypto report underlined that BONK could face losses, and the meme coin has shed just over 13% since then.

Analysis of the Futures data showed that enthusiasm was falling and speculators were not confident about BONK’s short-term bullish prospects. Here are the key levels traders should watch out for.

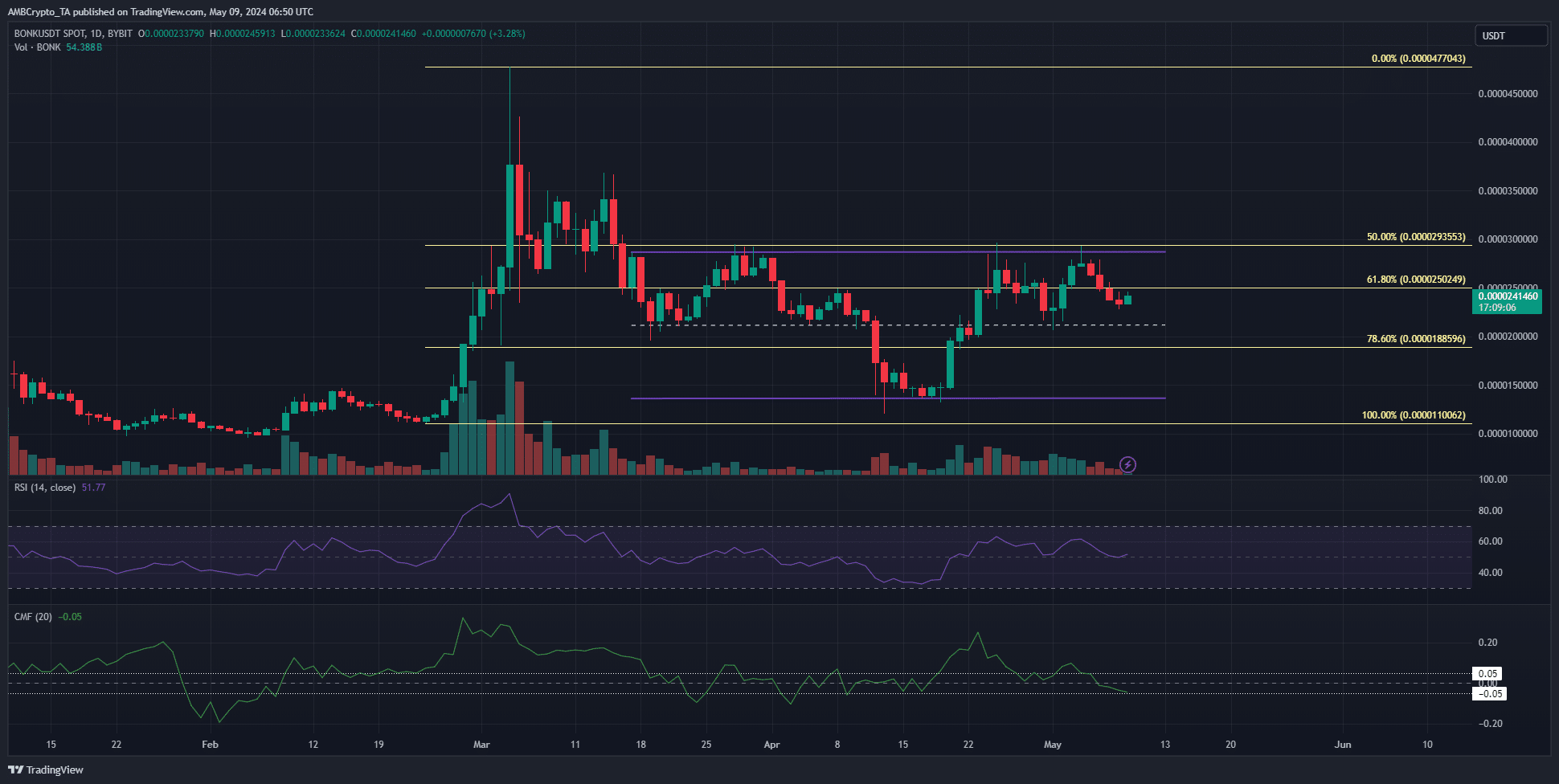

The range formation gave clues for the next trend

The two-month range was highlighted in purple and extended from $0.0000136 to $0.0000286.

The price witnessed two rejections from the range highs in the past two weeks, but has not yet sunk below the mid-range support.

The RSI on the daily chart was at 51.7 to indicate momentum favored neither the buyers nor the sellers. Similarly, the CMF was also at -0.05.

This level is a threshold, and a lower reading will indicate significant capital outflow and selling pressure.

The lower timeframe price action showed that the $0.0000209 level was support and that another short-term range was formed in the upper half of the larger range.

Hence, scalp traders could look to buy a retest of this support with a tight stop-loss.

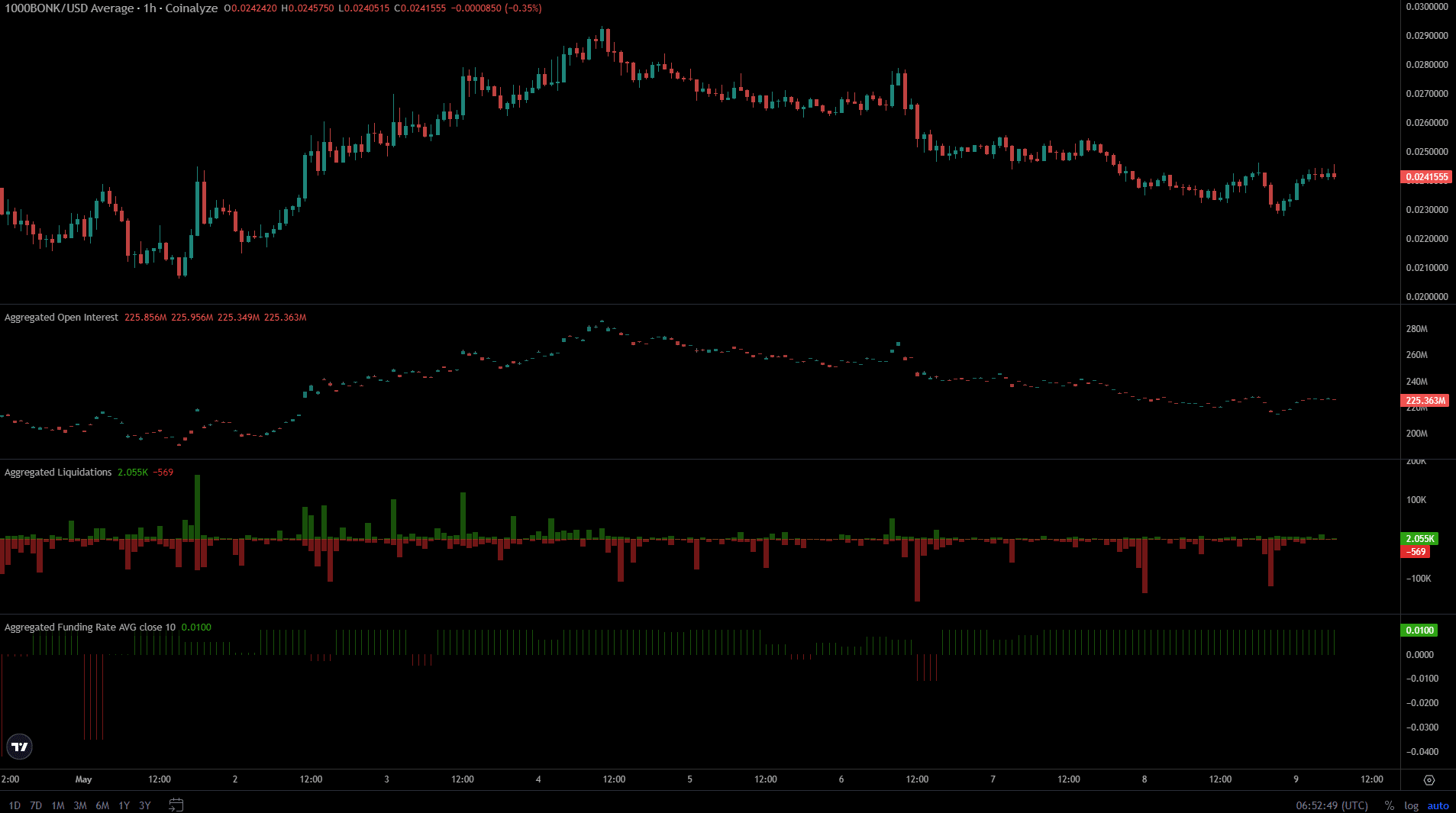

Source: Coinalyze

While the BONK price prediction indicated a short-term bounce from $0.0000209 was likely, it might not initiate a strong uptrend.

The Open Interest has been trending downward over the past three weeks to show speculators were sidelined.

They were unwilling to go long on the asset, but were not actively shorting the token either. This was inferred from the funding rate, which was just above zero.

The liquidations suggested that each sharp drop in the past week was accompanied by a gaggle of long liquidations, which pushed prices lower.

Do the social metrics signal a turnaround for BONK?

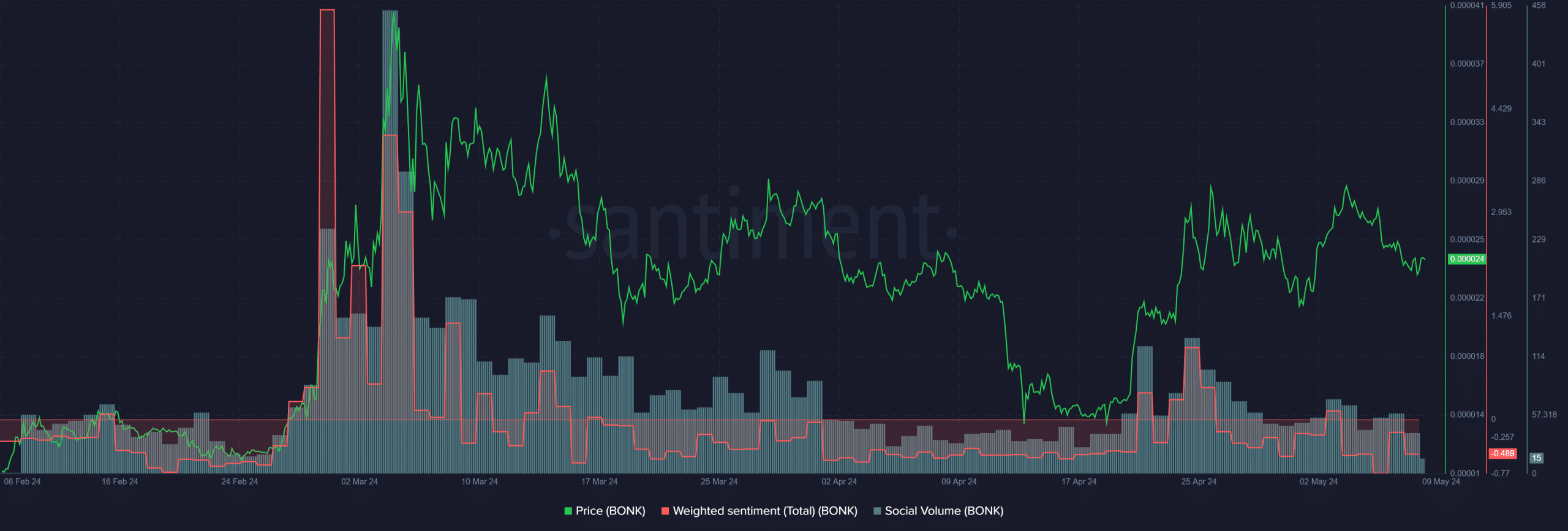

Source: Santiment

The social volume has been trending downward since the 25th of April. The 3-day interval weighted sentiment was positive on that day, but has since been negative for the most part.

Read Bonk’s [BONK] Price Prediction 2024-25

With little demand and enthusiasm in the markets and on social media, it was likely that BONK would continue its short-term range and bounce from the $0.0000209 level.

However, selling pressure on Bitcoin [BTC] could propel BONK toward the range lows at $0.0000136.