BONK price prediction: Assessing odds of a potential 22% rally

- If the memecoin maintains its strength and upward momentum, it could rally another 60% to reach $0.000026.

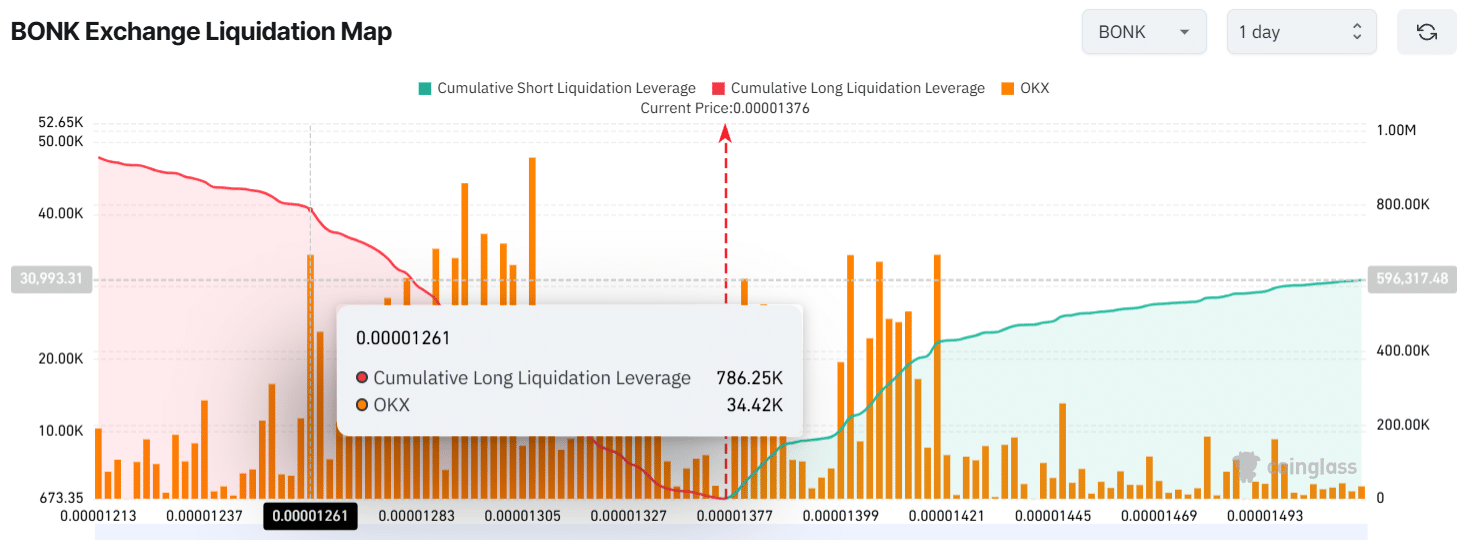

- Traders are over-leveraged at $0.00001261 on the lower side and $0.00001419 on the upper side.

After a significant price decline, Bonk [BONK] appears to be shifting market sentiment and is now poised for massive upside momentum. Data reveals that the memecoin has steadily declined by 76% since November 2024.

Amid this downturn, BONK has successfully retested its crucial support level at $0.0000102 and formed a Doji candle on the weekly timeframe, signaling a potential price reversal.

However, the memecoin has already begun moving upward and recently breached mild resistance near the $0.000013 mark. At press time, BONK was trading near $0.0000138, registering an 8% gain in the past 24 hours.

Technical analysis and price action of memecoin

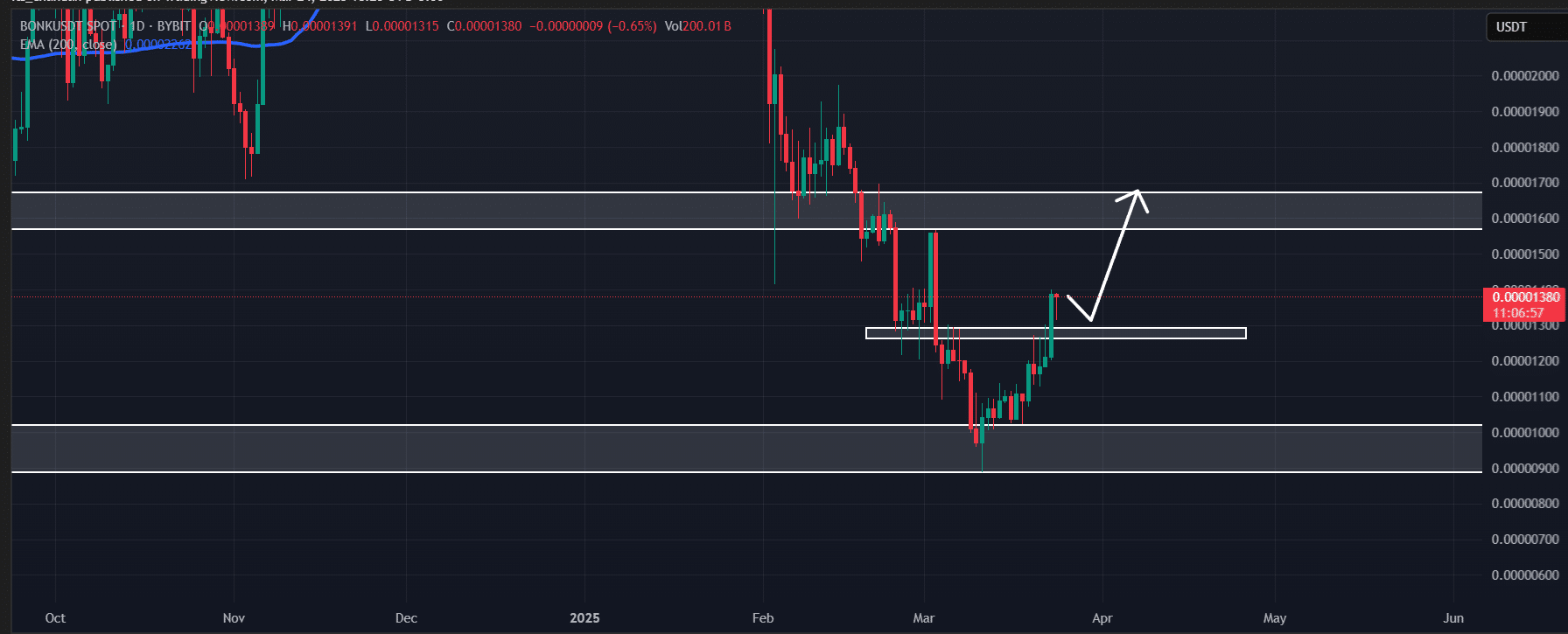

Within a day, BONK’s trading volume increased by 110%, showing heightened participation from traders and investors. AMBCrypto’s technical analysis indicates a bullish outlook for BONK after its breakout above a key resistance level.

The token is now positioned for a 22% upside move, aiming for the next resistance at $0.000017. This level previously served as an important support, further reinforcing its significance in the current market trend.

If the memecoin sustains its strength and momentum, BONK could rally 60% and reach $0.000026 in the coming days.

Despite its bullish movement, BONK remains below the 200 Exponential Moving Average (EMA) on the daily timeframe, indicating a downtrend.

Bullish on-chain metrics

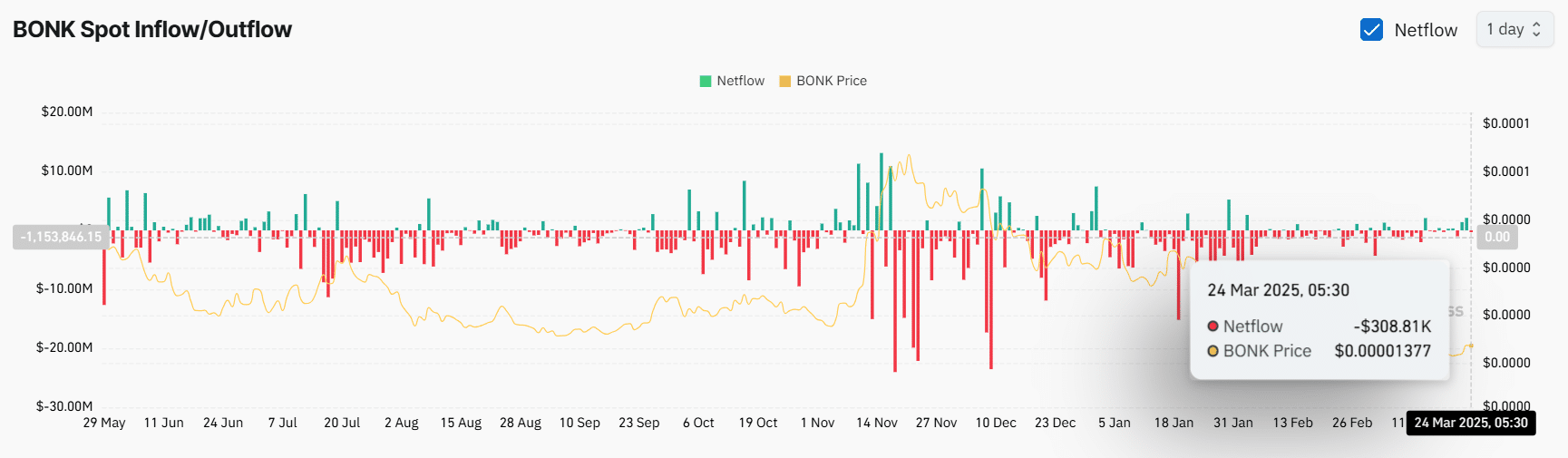

With a bullish outlook, investors and long-term holders have been accumulating the memecoin, as reported by the on-chain analytics firm Coinglass.

Data from Spot Inflow/Outflow reveals that exchanges across the crypto landscape have begun experiencing significant outflows, indicating potential accumulation by long-term holders.

At the time of writing, the exchanges have recorded an outflow of $310K worth of BONK in the past 24 hours.

Such outflows from exchanges indicate potential accumulation, which can create buying pressure and drive further upside momentum.

Traders over-leveraged levels

Long-term holders and whales are actively participating, with intraday traders also joining the trend on the long side.

Data shows traders are over-leveraged, with $0.00001261 as the lower level and $0.00001419 as the upper level. As of this writing, traders held $785K in long positions and $425K in short positions, reflecting a strong bias toward longs.

This data confirms that bulls are currently dominating the asset and could support the memecoin in its upcoming rally.