BTC and ETH see declining whale interest, is another bear cycle imminent?

- Bitcoin’s total number of whales reached a three-year low at press time.

- However, several on-chain metrics favored the bulls and suggested an uptrend.

Santiment’s analyst, in a 3 March YouTube stream, pointed out the dwindling interest of the whales in Bitcoin [BTC] and Ethereum [ETH]. As BTC’s price increased a few days ago, whales continued to dump their holdings. This is a cause for concern, as it could lead to a further drop in the king coin’s value.

After the sudden market drop about 10 hours ago, #crypto is back in recovery mode. But will it be short-lived? Are whales already making their moves with #Bitcoin back to $22.5k? Join our stream and find out!

Twitter: https://t.co/tdV9sHBGhA

Youtube: https://t.co/QkbjmwURfY pic.twitter.com/V5SyUVT3gG— Santiment (@santimentfeed) March 3, 2023

Read Bitcoin’s [BTC] Price Prediction 2023-24

In addition to that, Glassnode’s data revealed that Bitcoin’s total number of whales reached a three-year low on 4 March, reaching 1,663.

? #Bitcoin $BTC Number of Whales just reached a 3-year low of 1,663

Previous 3-year low of 1,665 was observed on 28 February 2023

View metric:https://t.co/k1K8OK2tl3 pic.twitter.com/Y6BKGhVIhG

— glassnode alerts (@glassnodealerts) March 4, 2023

Ethereum whales following Bitcoin’s trend?

It was rather interesting to note that a similar trend was seen on Ethereum’s chart as whales continued to dump, despite the price pump. However, the reason behind ETH whales’ movement could be different, as they might be moving their assets to staking contracts ahead of the Shanghai upgrade.

Other side of the story

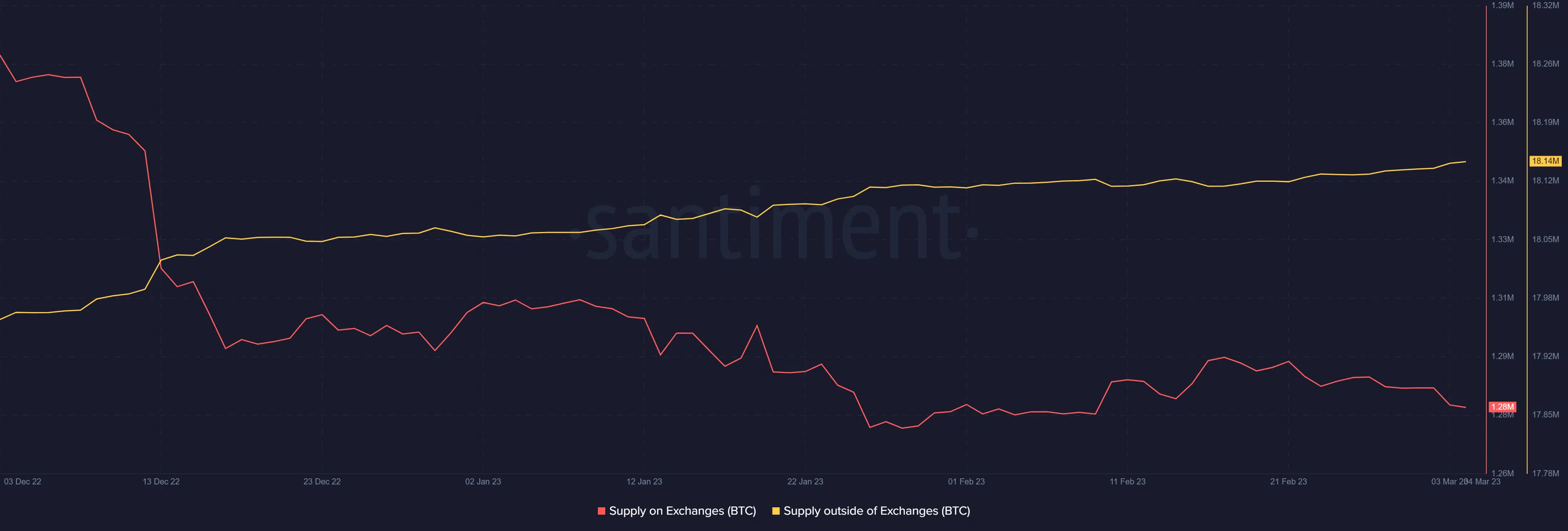

However, though the whales decreased their holdings, other on-chain metrics were bullish on BTC. For instance, BTC’s supply on exchanges decreased considerably, along with an uptick in supply outside exchanges. This was a positive update, as it suggested that the border market was confident in BTC.

As per CryptoQuant’s data, BTC’s netflow on exchanges was low compared to the last seven days, which also looked promising as it indicated less selling pressure. Additionally, BTC’s Binary CDD was green, which meant that long-term holders’ movement in the last seven days was lower than the average, suggesting their will to hold the asset.

Another major bull signal for BTC was that its Relative Strength Index (RSI) was in an oversold position at press time, which increased the chances of a price hike in the coming days. Not only that, but the number of new addresses reached a 21-month high, further establishing investors’ faith in BTC.

? #Bitcoin $BTC Number of New Addresses (7d MA) just reached a 21-month high of 19,869.101

Previous 21-month high of 19,839.119 was observed on 14 November 2022

View metric:https://t.co/tDzY9Fl7QL pic.twitter.com/zVNOCTxkcG

— glassnode alerts (@glassnodealerts) March 4, 2023

Is your portfolio green? Check the Bitcoin Profit Calculator

However, a bearish outcome can’t be ruled out yet

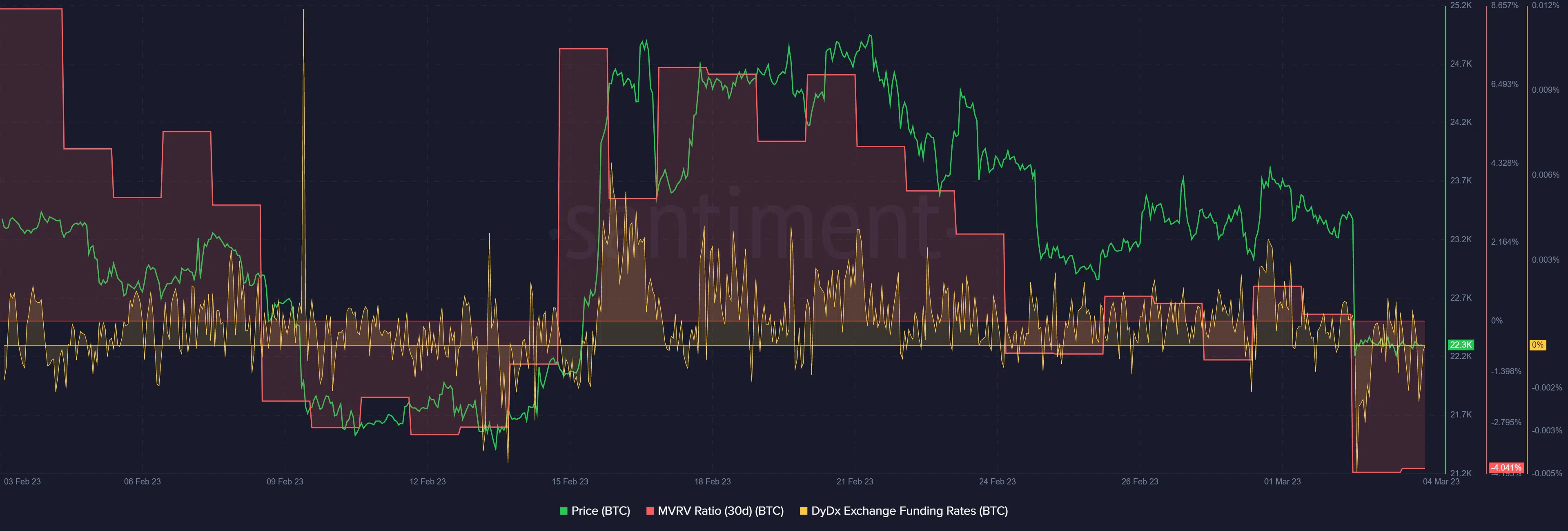

While the aforementioned metrics supported the chances of an uptrend, a few other metrics were still in the bears’ favor. BTC’s MVRV Ratio declined because of the recent downtrend, which could result in a further price plummet. Demand from the derivatives market also seemed to have declined as BTC’s DyDx funding rate went down.

The number of active wallets used to send and receive coins has decreased. Therefore, considering all the datasets, it was only time to answer which way BTC’s price moves in the near term. At press time, BTC was trading at $22,362.03 with a market capitalization of over $431 billion.