Bitcoin, Ethereum lose over the weekend: What’s next?

- BTC dropped to $41,158 while ETH sank below $2,200 during the weekend.

- The market was expected to go sideways until the year-end.

Crypto trading activity cooled off in the last non-holiday weekend of the year, the first possible sign that the peak of 2023 may have been achieved and that the market will remain sideways until 2024 arrives.

Over the weekend, the world’s largest cryptocurrency, Bitcoin [BTC], dipped below $42,000. The descent accelerated in the last 24 hours with BTC dropping to $41,158 as of this writing, AMBCrypto spotted using CoinMarketCap’s data.

Ethereum [ETH], the second-largest digital asset, fell below $2,200, as participants booked profits before retreating for festivities. With losses of more than 2% in 24 hours, ETH was trading at $2,172 at press time.

Trading activity declines

Bitcoin has led the broader market rally over the last two months, driven by enthusiasm over the approval of spot ETF applications in the U.S. market.

Bullish expectations led investors to stack their portfolios with BTCs, resulting in heightened trading activity.

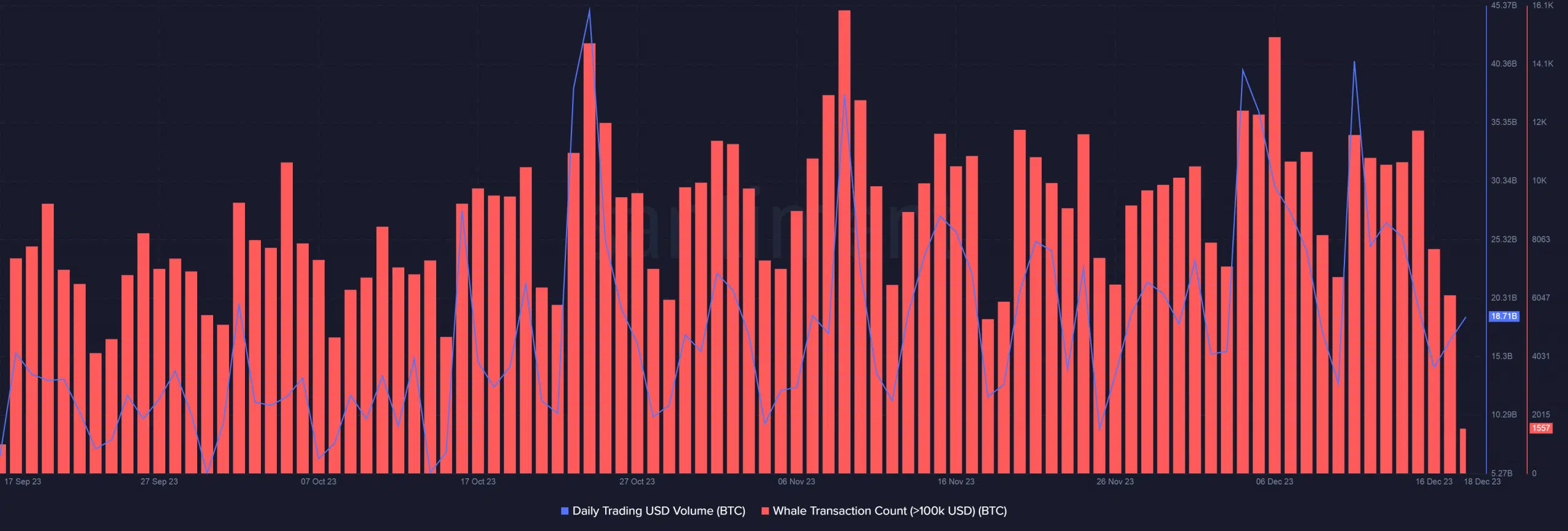

However, over the last week, daily trading volume fell by 60%, as per AMBCrypto’s analysis of Santiment data.

Even the whale investors, who generally use calmer periods for accumulation, stayed away from trading, as evidenced by a sharp drop in large transactions.

The amount of coins moving to exchanges also revealed a noticeable drop. From 45,269 BTCs a week before, the exchange inflows plunged to 15,675 on the 17th of December, a sure sign of falling trading activity.

Derivatives market also go quiet

Speculative interest in the king coin also started fading as the year drew to a close. The Open Interest (OI) in BTC futures dropped more than 9% from last week to $16.95 billion at press time, AMBCrypto observed using Coinglass data.

The drop in OI coinciding with the drop in market price is typically viewed with pessimism by market experts. However, the current situation could just be a year-end blip rather than a long-term trend.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Shivam Thakral, CEO of Indian cryptocurrency exchange BuyUcoin, weighed in on the market situation in a quote shared with AMBCrypto.

He noted,

“As we approach the holiday season, we can expect some dip in trading activity due to which the market may remain at current levels. The Bitcoin ETF approval clock is ticking and we can expect a crypto super cycle in 2024 once the final approval is achieved.”