Bitcoin, Ethereum crash – Here are the real reasons why

- Discussion around the cryptocurrencies tumbled as prices fell

- Whales are buying the BTC dip but others keep selling ETH

Until the 22nd of January, Bitcoin’s [BTC] price stayed above $40,000. Ethereum [ETH], so far, also changed hands above $2,400.

But the last 24 hours have been catastrophic for the top two cryptocurrencies. BTC slid by 3.00% while ETH’s value dropped by 3.59% within the same period. As a result of the decrease, conversations around the project fell.

What are the reasons behind the market decline?

The catalyst for the bloodbath continues to be fund flows from Grayscale Bitcoin Trust, formerly Grayscale Bitcoin Trust (GBTC). According to AMBCrypto’s analysis of CryptoQuant’s data, 14,291 Bitcoins flew out of the fund on 22 January, equal to $570 million as per prevailing market prices.

Since the launch of the ETF, Grayscale’s on-chain balance has fallen by 66,000 BTCs, most of which are getting liquidated in the secondary market.

There’s a lot of negativity too. Using the Social Volume screen on Santiment, AMBCrypto found that discussions about ETH fell by 21% compared to when the SEC approved the Bitcoin spot ETFs. For BTC, it was a 35% decline.

? #Bitcoin briefly fell below $40K for the first time since December 4th. Monday has been a bloodbath for most of the #crypto sector. Notably, there is 35% less discussion toward $BTC and 21% less toward $ETH compared to the prior #ETF approval week. #FUD is

(Cont) ? pic.twitter.com/iievb8mbHJ

— Santiment (@santimentfeed) January 22, 2024

Apart from the decline in messages connected to these cryptos, the drop also meant that traders had refrained from jumping in on the price movements.

Previously, AMBCrypto had assessed Bitcoin’s chances of dropping below $40,000 before January ends. In the article, we mentioned how it was possible. But the rate at which it occurred was something unexpected.

Down before the next “up only”

However, the drawdown could be a necessary correction Bitcoin and Ethereum need for a higher bounce. Regardless, there is a high chance that the recovery will not occur soon, as more decline could be on the way.

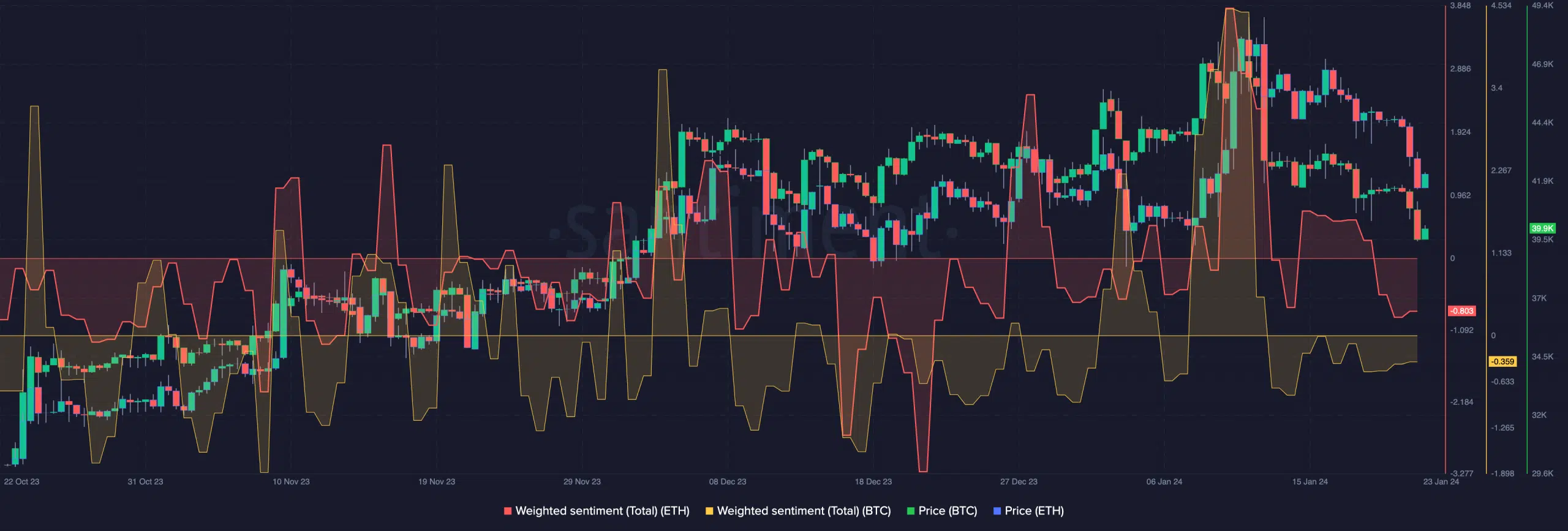

One of the reasons for the potential rebound could be linked to the Weighted Sentiment. At press time, Bitcoin’s Weighted Sentiment had slipped to 0.359.

On the other hand, the metric on ETH’s end also dropped to -0.803.

Weighted Sentiment measures the positive/negative comments about an asset. So, the decline into the negative region suggests the average perception around ETH and BTC was not optimistic.

But in terms of the price action, this decline could foreshadow a higher value for the cryptocurrencies. For example, on the 3oth of November 2023, Bitcoin’s price closed at $38,688.

At that time, the Weighted Sentiment was around the same value it was at press time.

On the same day, ETH’s price was $2,052., and the metric too was negative. Fast-forward to the 5th of December, Bitcoin’s price was $44,080 while ETH was $2,293.

Large investors want a discount

Besides this period, there are also several instances of the same movement. Therefore, there is a chance that when revival arrives, BTC and ETH might jump higher than $49,000 and $2,700 respectively.

In the meantime, some market participants seem to be taking action toward the potential rebound.

According to AMBCrypto’s assessment of Spot On Chain data, a whale bought $1.03 million worth of the BTC dip just before it fell below $40,000.

Another whale bought $600,000 worth of the coin as the price fell further. However, ETH has not enjoyed that goodwill yet, as it seems to be undergoing large-scale sell-offs.

Realistic or not, here’s ETH’s market cap in BTC’s terms

For instance, the Ethereum Foundation sold recently. In addition, Alameda Research and Celsius Network moved some ETH to Centralized Exchanges (CEXs).

With this in place, BTC could recover much faster than ETH, unless the whales decide to add ETH to the buying spree.