BTC options expiry to have this effect on the price with $48k resistance

“Wen 50k?”

This is undoubtedly the question of the day. Both fearful and greedy whispers rise around you as the metrics and indicators flash. Meanwhile, Bitcoin [BTC] struggles to keep its head up. 1 April might be April Fool’s Day but crypto investors don’t have time to play and here’s what you need to know at this crucial stage.

Totally out of your league. . or not

At press time, Bitcoin had plummeted by a dramatic 4.99% in the past 24 hours to revisit a price of $44,729.40. In the past week, however, the king coin increased by 1.49%.

This fall comes just hours after Glassnode’s co-founders posted that Bitcoin was “looking strong” as BTC crossed the $46k mark. Bitcoin’s latest U-turn reminds us exactly what volatility means in the crypto industry.

#Bitcoin is looking strong above $46k and making way towards the next resistance level at $48k.

Our signals turned bullish as $193mn flowed into #BTC, #ETH, and alts last week. Deep dive into crypto's comeback here?https://t.co/puXlRHCMaK pic.twitter.com/KnQR2JCFc4

— ??????????? (@Negentropic_) March 31, 2022

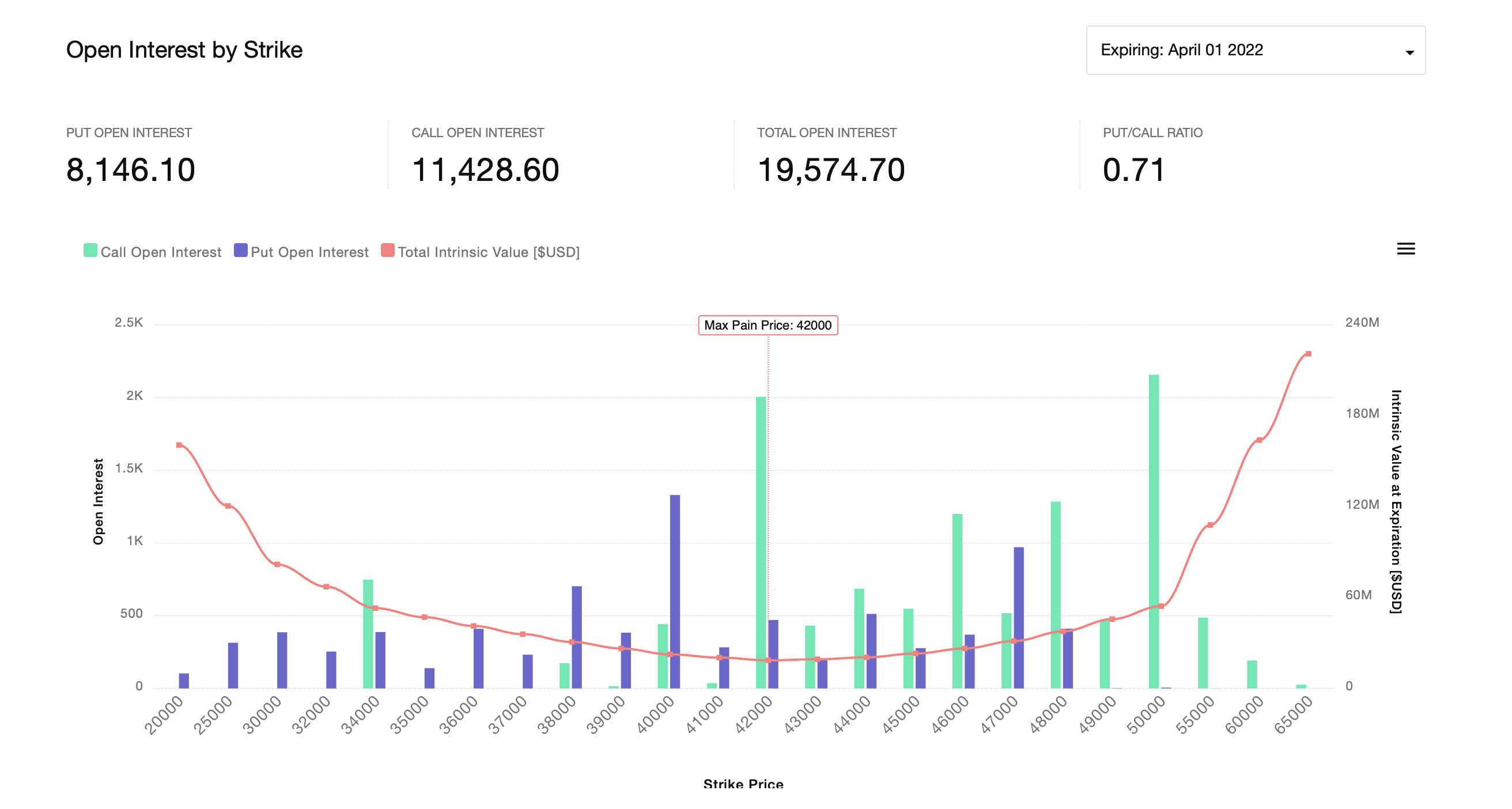

So what are the new support and resistance levels? While it’s hard to be sure, it certainly helps to look at the 2,411.60 Bitcoin call options and 1,319.50 put options expiring on 1 April – though these were changing at press time. For reference, the maximum pain price was set at $42,000. With the majority of call volumes concentrated around this price, it is likely that 42k could serve as resistance, perhaps partly explaining Bitcoin’s downward swing.

Looking at puts volume, there is a higher concentration at $40k than at $47k, which means the former could serve as a new support level.

Source: Coinoptionstrack.com

An awesome day for bears?

Red might anger bulls in the ring but makes crypto bears happy. That’s why some investors might be rejoicing to learn that the Awesome Oscillator [AO] price indicator flashed a tall red bar on 1 April 2022, its first since 15 March. For other short-term traders, this might be the hint they need to sell, in case the price dips any lower.

However, it seems investors aren’t losing their heads quite yet as the Bitcoin Fear and Greed Index revealed that sentiments were still in the neutral territory close to press time. Could things change soon? Well, a report by Glassnode Uncharted noted,

“We should remain cautious as the macro environment continues to drive crypto investor behavior: Following hawkish remarks made by the Fed, investor sentiment dropped.”

Exchanges usually bear the brunt of shock developments in crypto. On this occasion, however, data showed that Bitcoin saw around $413 million in outflows. This suggests that investors are still buying the king coin at discount prices.

Otherwise, Ethereum [ETH] and Tether [USDT] also noted outflows.

? Daily On-Chain Exchange Flow#Bitcoin $BTC

➡️ $1.1B in

⬅️ $1.5B out

? Net flow: -$413.0M#Ethereum $ETH

➡️ $626.7M in

⬅️ $928.2M out

? Net flow: -$301.5M#Tether (ERC20) $USDT

➡️ $704.8M in

⬅️ $725.1M out

? Net flow: -$20.3Mhttps://t.co/dk2HbGwhVw— glassnode alerts (@glassnodealerts) April 1, 2022