How traders can take advantage of Bitcoin’s latest sell-off

- BTC’s supply on exchanges increased, suggesting it was under selling pressure

- Bitcoin’s price increased by 2% in the last seven days, but miners were selling their holdings

The month of May was not in the best interest of investors, as Bitcoin’s [BTC] price registered quite a decline. BTC was 8% down as May closed out, the worst month since the last crypto winter. With roughly 6% down so far this quarter; is this the perfect time for investors to accumulate more Bitcoin?

Sell in May and go away was correct. #Bitcoin 8% down as May closes out, worse month since Nov 22.

Roughly 6% down so far this quarter; it looks like perfect accumulation to me after such a strong Q1. pic.twitter.com/Av2Hi7X5Mi— James V. Straten (@jimmyvs24) May 31, 2023

Bitcoin under fire

BTC’s weekly chart finally turned green after several days of sideways price action. According to CoinMarketCap, BTC’s price increased by more than 2% in the last seven days.

At the time of writing, it was trading at $26,890.89 with a market capitalization of over $521 billion. However, the latest data suggested that the uptrend might soon come to an end as selling pressure on BTC increases.

Bitcoin recently witnessed the 5th largest sell-off of this year. BTC worth over $400 million was sold primarily by Coinbase, which suggested that the coin was under selling pressure.

Yesterday, saw almost $400M of #Bitcoin sold, the fifth highest amount this year, primarily coming from @coinbase.

Rising #DXY and lack of liquidity regarding the debt ceiling could have bearish implications moving forward. pic.twitter.com/YdbXoFm5aH— James V. Straten (@jimmyvs24) May 31, 2023

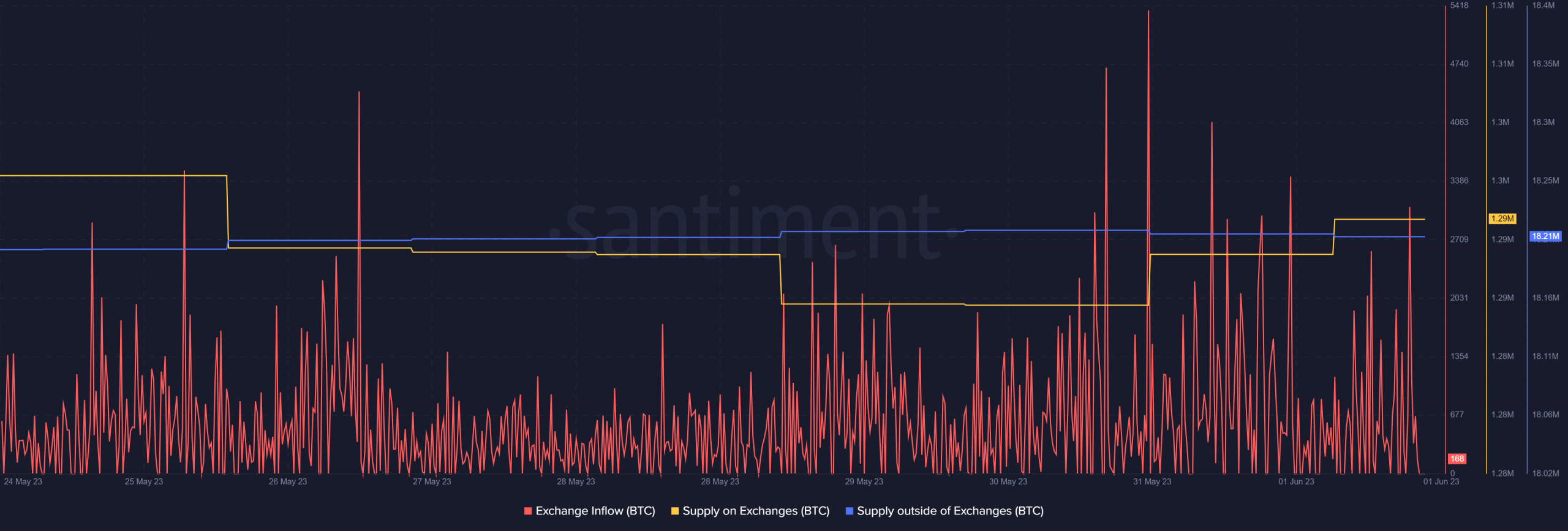

Not only this, but data from Santiment also suggested the same outcome. BTC’s supply on exchanges increased while its supply outside of exchanges remained pretty stagnant, which was a typical bearish signal.

Additionally, Bitcoin’s exchange inflow also spiked, further increasing the chances of a price decline in the coming days.

Source: Santiment

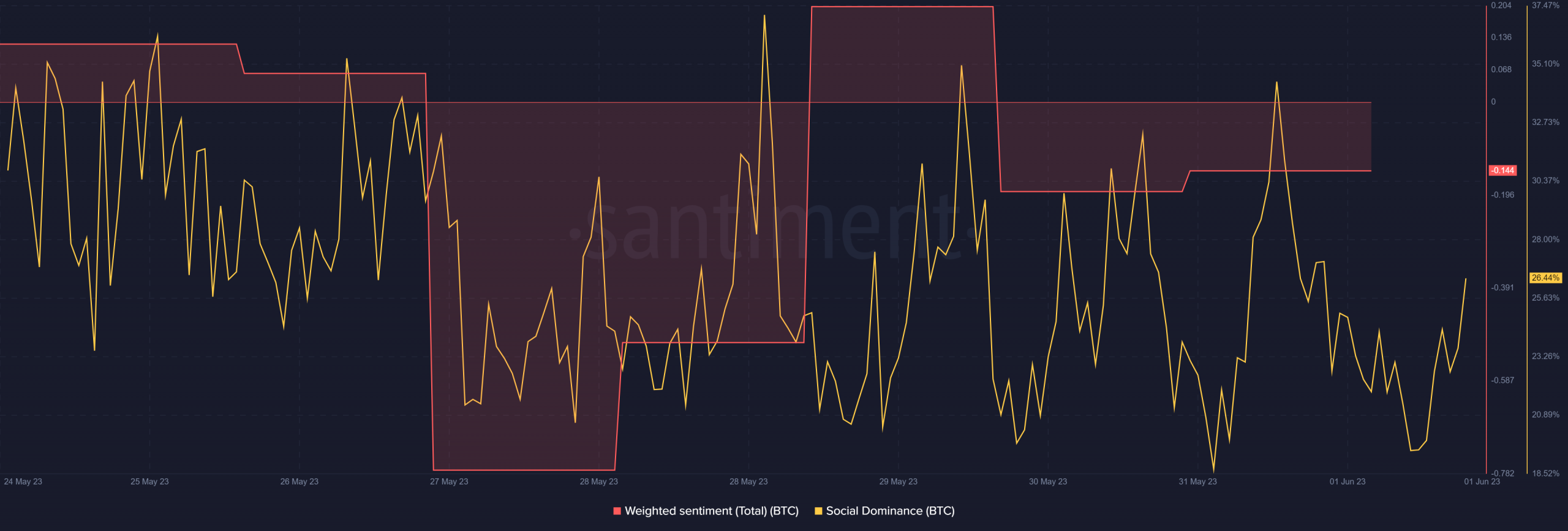

To add to the aforementioned narrative, selling pressure also had an impact on sentiments around the king of cryptos. As per the chart, BTC’s weighted sentiment declined after spiking on 29 May.

This reflected that negative sentiment dominated the market. Its social dominance, however, remained high, reflecting BTC’s popularity in the crypto market.

These metrics favored the bears…

A look at CryptoQuant’s data revealed that BTC’s net deposits on exchanges were higher compared to the last seven days, further indicating selling pressure. Additionally, it was interesting to note that miners were selling their assets.

Bitcoin’s Miners’ Position Index (MPI) was red, suggesting that miners were selling more holdings compared to its one-year average.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Is this the right time to accumulate Bitcoin?

BTC might witness another price correction as several market indicators were bearish. The Moving Average Convergence Divergence (MACD) displayed the possibility of a bearish crossover.

Its Relative Strength Index (RSI) registered a downtick, which looked concerning. However, Bitcoin’s Money Flow Index (MFI) went up slightly, which was a positive sign.

Therefore, before BTC begins its next bull rally, this might be a good opportunity for investors to accumulate more BTC.