BUSD burn and its Ethereum connection: All you need to know

- On 22 February, Binance burned $2 billion worth of BUSD.

- BUSD went a bit over its peg after the burn as its reserve on Binance continued to reduce.

Issues with the Securities and Exchange Commission have made Binance USD [BUSD] a major topic of conversation. However, despite this, work with the stablecoin proceeded as normal. Inasmuch, the official account of Binance revealed it would burn about $2 billion worth of BUSD on 22 February.

Later today, #Binance will burn $2bn worth of idle BUSD on BNB Chain.

The same amount of BUSD on the Ethereum network, which was used as collateral, will then be released.

— Binance (@binance) February 22, 2023

Furthermore, Binance would release an equivalent amount, used as collateral, on the Ethereum [ETH] network.

After the announcement, a trace of the BSCscan showed that the burn had happened. According to the scanner, the stated sum was transmitted from a Binance address to a burn address in a single transaction on 22 February at 04:14:27 PM +UTC.

Peg sustained as volume remains high

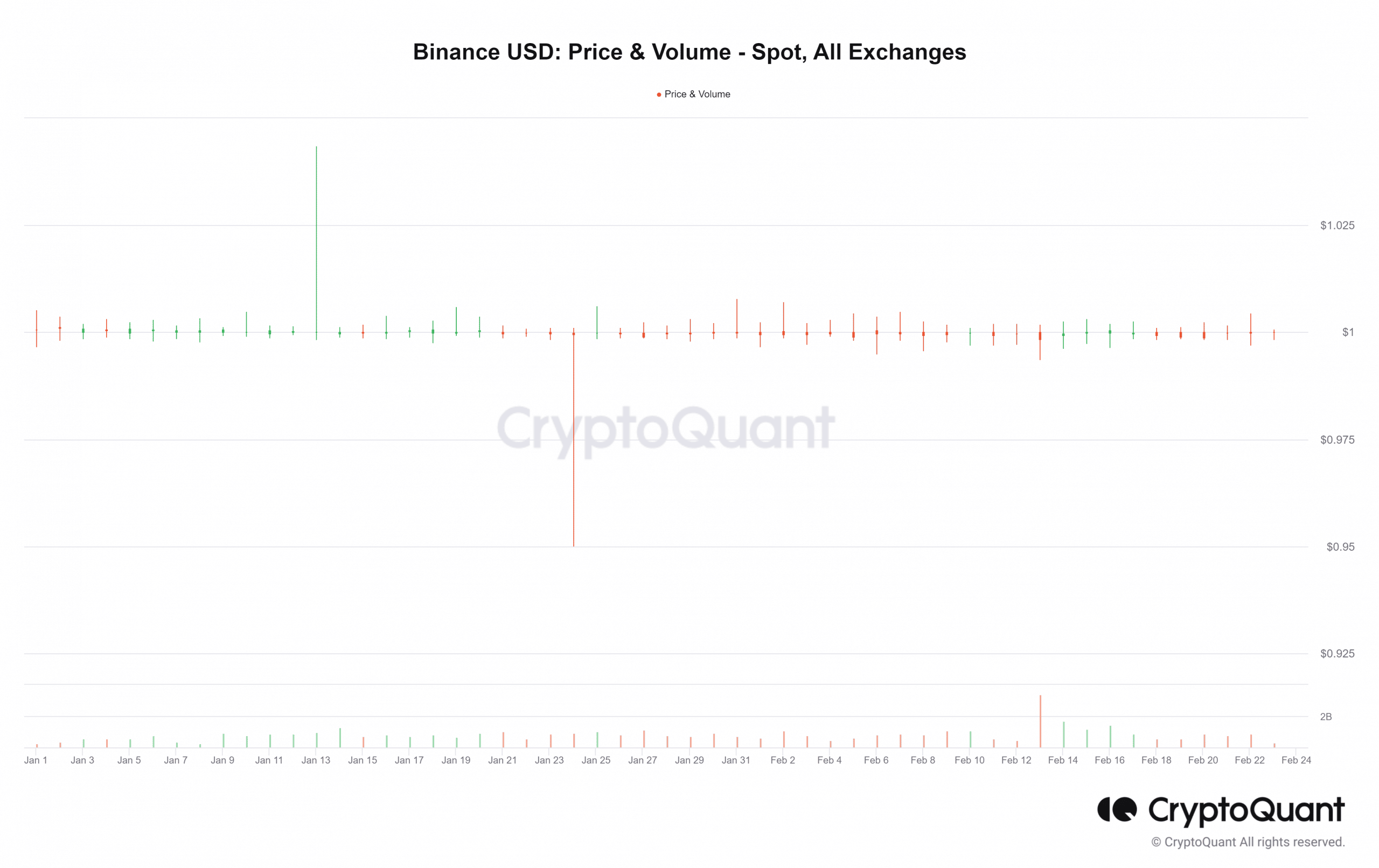

BUSD traded above the $1 peg after the burn, according to the spot price on CryptoQuant. One Binance USD was worth $1.02 as of the time of writing. Going beyond the peg is not unusual for the stablecoin, but the current price demonstrated no adverse reactions to the event.

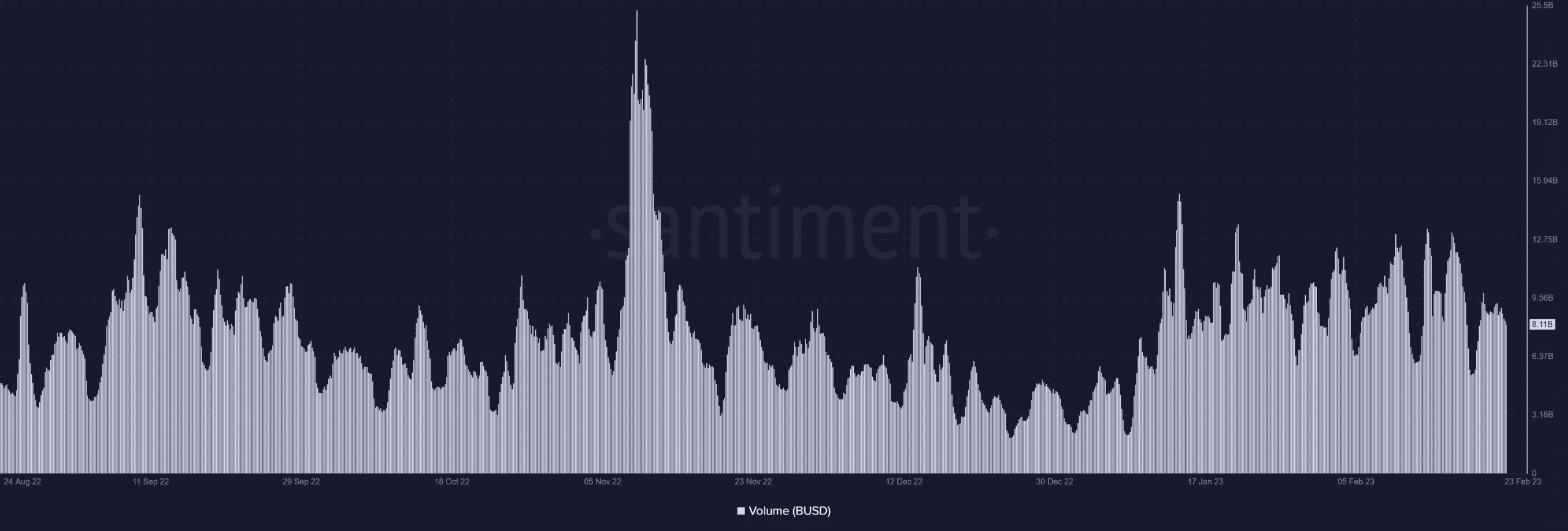

Santiment’s volume indicator also showed a relatively high Binance USD transaction volume. With the trade session still open as of this writing, the volume registered was over eight billion.

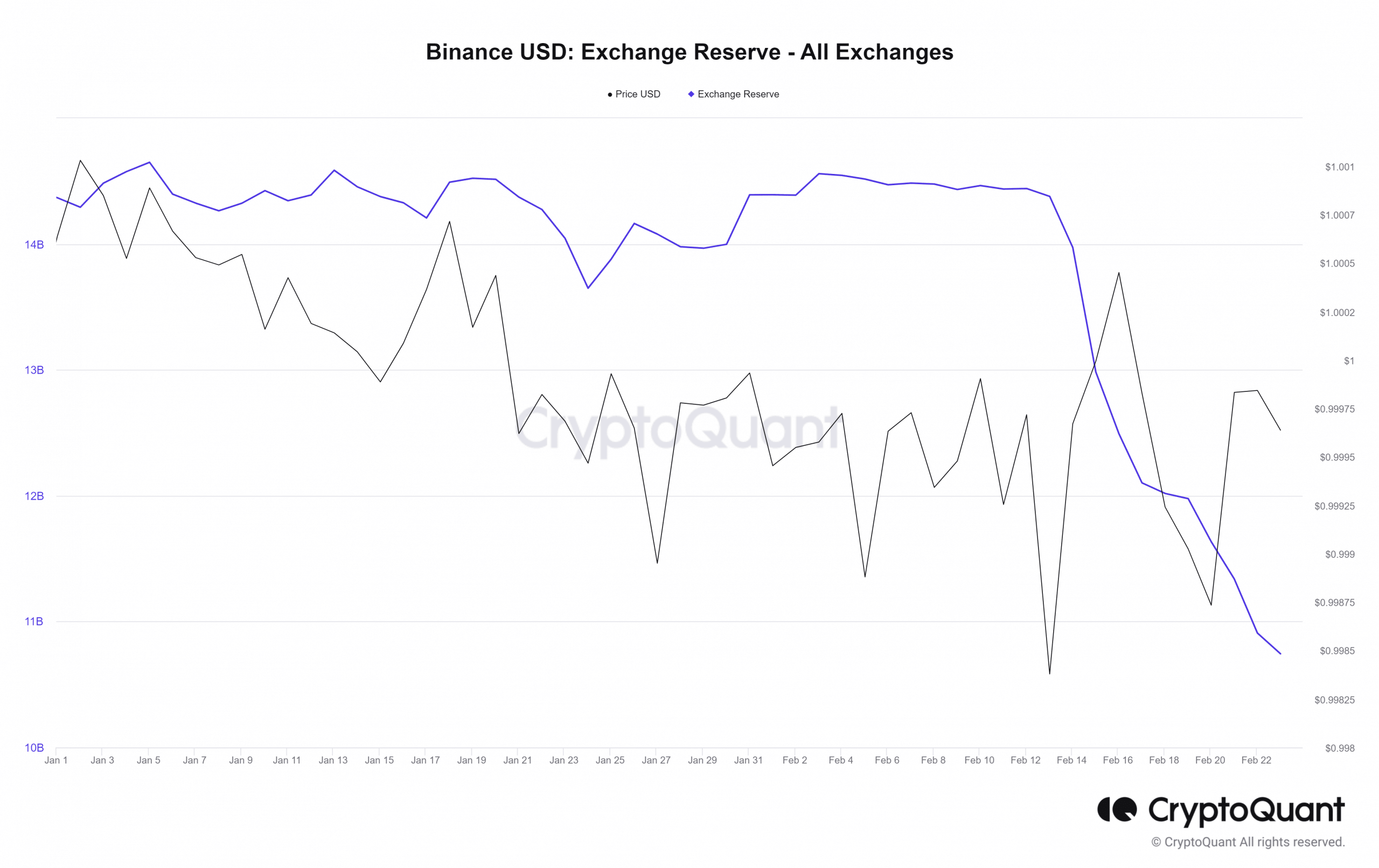

BUSD reserve sees continuous dip

Three billion dollars’ worth of Binance USD was redeemed after Paxos’ 13 February announcement that it would cease minting the stablecoin. In addition, the total BUSD held in exchange reserves has decreased from $14.3 billion to $10.7 billion. So, a decrease of over 21% or over $3 billion has been recorded until press time.