BUSD exchange outflows reach monthly peak as Paxos fuels mass exodus

- BUSD gets dumped after regulatory push against Paxos.

- The amount of BUST supply on exchanges is now down to its lowest point this month.

The regulatory hammer has fallen hard and this time it has come down hard on Paxos, the issuer of BUSD. As a result, a bank-run type of event ensued as investors dropped BUSD.

To recap, the U.S. Securities and Exchange Commission (SEC) recently deployed regulatory measures forcing Paxos to stop issuing BUSD.

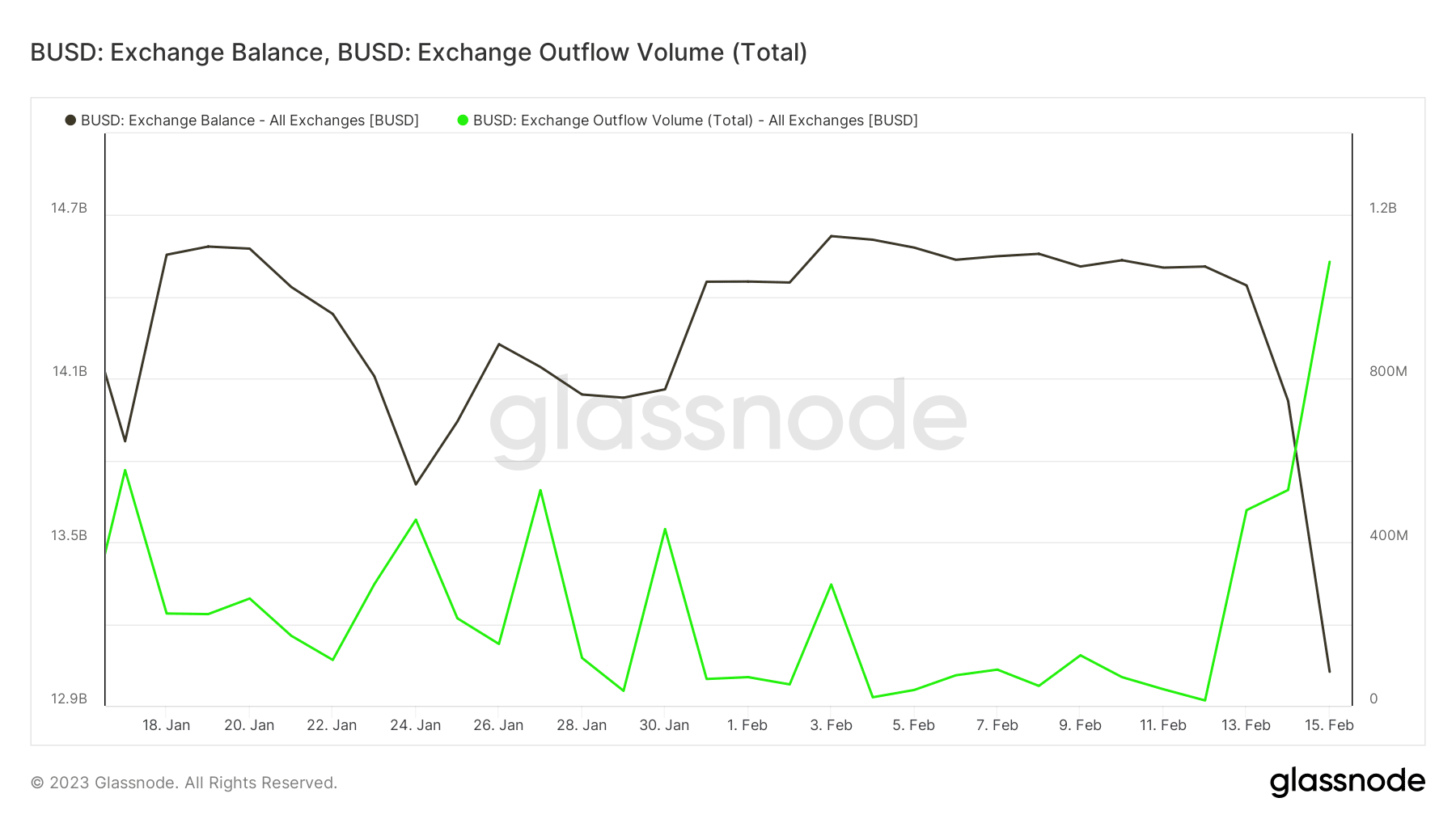

Prior to the halt order, roughly 35% of all Binance volumes involved BUSD. The situation forced many holders to exit the stablecoin. The latest Glassnode data revealed that BUSD exchange outflow volume reached a monthly peak of $15,342,884.87.

? $BUSD Exchange Outflow Volume (7d MA) just reached a 1-month high of $15,342,884.87

View metric:https://t.co/olk7GPZVzT pic.twitter.com/hk019PX9fx

— glassnode alerts (@glassnodealerts) February 16, 2023

While BUSD exchange outflows have soared to a 4-week high, the amount of BUST supply on exchanges is now down to its lowest point this month.

Where is the BUSD liquidity flowing?

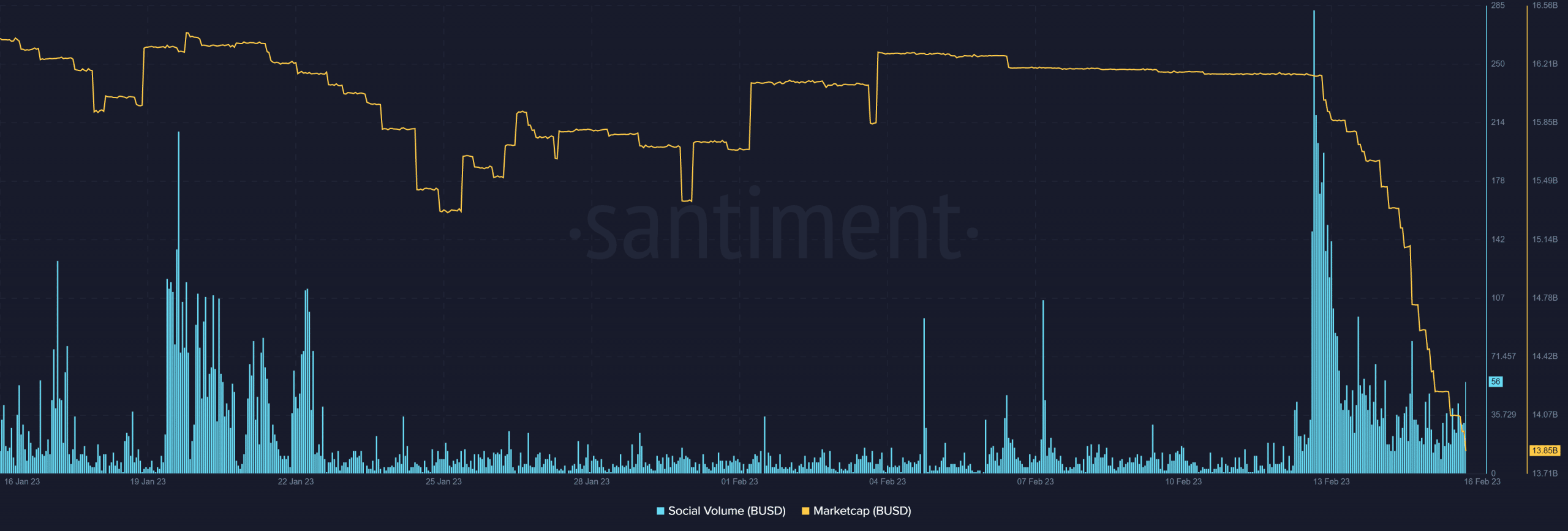

According to a recent Santiment analysis, BUSD holders are moving their funds mostly to other stablecoins. As expected, these outflows have severely drawn down BUSD’s market cap.

The latter drew down by 2.142 billion within the last four days. This drawdown kicked off with a spike in social volume.

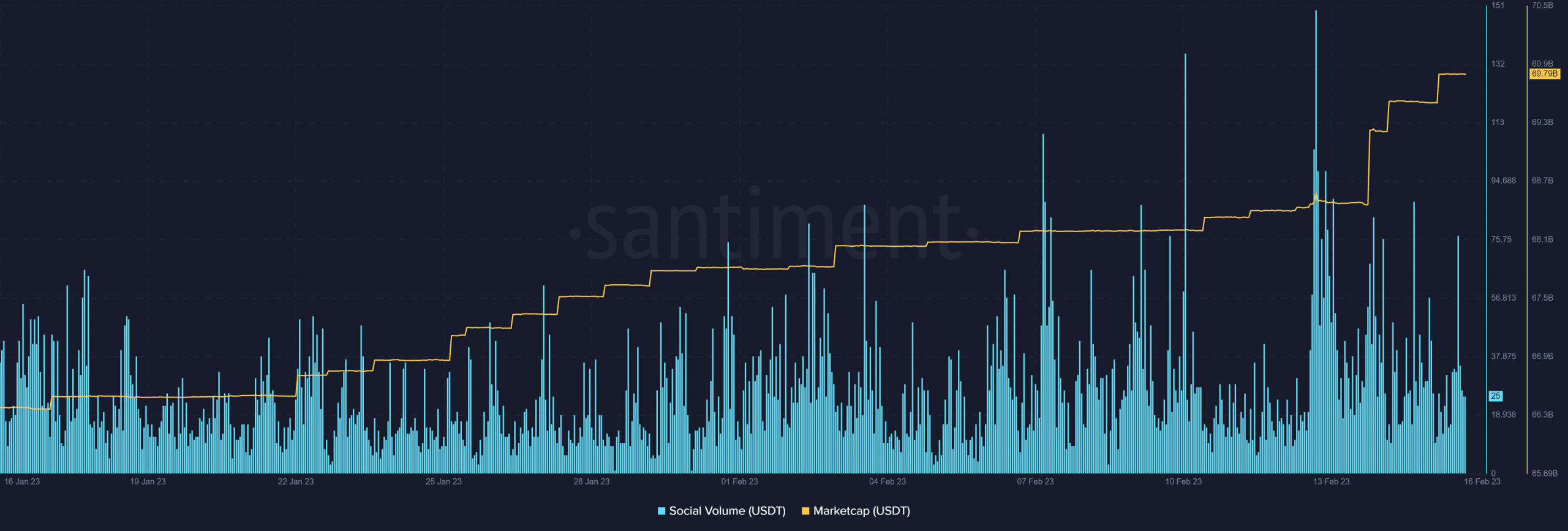

On the other side of the spectrum, USDT’s market cap experienced a surge from around the same time that BUSD’s market cap crashed. For perspective, USDT’s market cap gained by roughly $1.2 billion within the last four days.

USDC’s market cap also increased by a substantial margin. Some of the liquidity exiting BUSD may have also flowed into Bitcoin and stablecoins.

The global crypto market cap stood at $1.13 after a 7.28% gain in the last 24 hours at press time. The same market cap hovered within the $1.02 range a few days ago, confirming a wave of liquidity influx this week.

Are Binance reserves in trouble?

Such heavy outflows are bound to trigger concerns about the state of the Binance exchange considering that BNB held a major position.

In other words, this BNB exodus is the latest event to put Binance reserves to the test considering that it had more than $13.4 billion worth of the stablecoin.

Fortunately, Binance has large reserves that are distributed across multiple assets including a variety of other stablecoins. The BNB exodus does not appear to have had much of an impact on the Binance Smart Chain or BNB at the time of writing.