Buterin, Worldcoin, and how AI tokens are defining this cycle

- Cryptocurrencies with AI fundamentals are experiencing a high level of attention.

- The total market cap might inch toward $100 billion if 2024 replicates 2023’s performance.

The convergence of Artificial Intelligence [AI] and blockchain might be a powerful force to keep an eye on this bull cycle. But don’t just take my word for it, as I am just another human with an opinion.

However, I am not the only one who has been intrigued by this combination.

Vitalik Buterin, the co-founder of Ethereum [ETH] seems to share a similar view. But before I go forward, know that everything about this article is not streamlined to price predictions.

Instead, you might find facts and figures centering around development within the AI space.

If you are curious enough to stay glued to the end, you might learn a thing or two that explains how AI can impact the crypto economy going forward. But for now, back to Buterin.

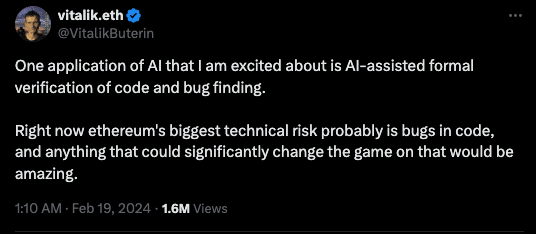

Ethereum holds AI in high regard

On the 19th of February, Buterin posted that he was excited about AI applications. However, he trimmed his interest to the verification of codes and bugs on the Ethereum blockchain.

According to Buterin, some of these applications can significantly “change the game.”

Before Buterin’s 2024 opinion, AI tokens have been outperforming a lot of other categories in the market. One perfect example is Fetch.ai [FET].

Interestingly, FET was developed on Ethereum as an open, permissionless, decentralized machine learning network. At press time, FET’s price has increased by 109.78% in the last 365 days.

Beyond the hype around AI, there have been other factors fueling the narrative. One undeniable one was the incredible adoption of ChatGPT in 2023, Open AI’s viral crypto chatbot.

The surging adoption of the tool had initially caused some controversy, with some saying that it was only a bubble that would fizzle out.

But Dan Ives, a popular tech analyst, had a contrary opinion. In June 2023, Ives told CNBC that bears who are skeptical about the sector might bite their fingers in regret.

He also called AI the fourth industrial revolution, noting,

“I think this is really transformational changes to technology that I think would change the tech space for the next 20-30 years.”

TAO, INJ, and others may not stop running

If Ives’ opinion about AI is anything to go by, then we can assume that AI tokens might rip hard during this bull cycle. AMBCrypto checked the chances by looking at Santiment’s on-chain screener.

According to our results from the Treemap, AI projects including Bittensor [TAO], The Graph [GRT], and Injective [INJ] have seen their prices skyrocket.

For TAO, its performance was something the crypto market has not seen in a long while. At press time, TAO changed hands at $641.53. This value represented a 508,010% increase within the last year.

INJ, on the other hand, has increased by 72.25% within the same period.

So, it was not surprising that the social volume around these tokens jumped. Social volume measures the rate at which the market is searching for a cryptocurrency.

If the reading increases, then it means interest in the project is high, and this could lead to higher prices.

But if the social volume drops, it indicates that the broader market is overlooking the project.

At the same time, you should note that if social volume foreshadows a price surge, there will be a time when the momentum will cool down.

Therefore, if you are thinking “up only” on all AI tokens, then you might be wrong.

Worldcoin joins the party

Despite the possibility of retracement, it does not look like the AI narrative will go away anytime soon. But this time, it is not just about ChatGPT.

Recently, OpenAI, led by Sam Altman, released a new AI tool called Sora. Unlike ChatGPT, Sora is a text-to-video tool.

Since its announcement on the 15th of February, the prices of tokens mentioned above have been surging.

Besides the ones listed, AMBCrypto reported that Worldcoin [WLD], also co-founded by Altman, reached a new All-Time High (ATH).

Should Sora experience the kind of adoption ChatGPT did, then WLD, alongside other AI tokens, might cross new ATHs. But if Sora doesn’t hit those levels, the peaks of these cryptocurrencies might not be as high.

AMBCrypto spoke to Eric Bravick about the potential of AI in the crypto space. Bravick is the Head Of Artificial Intelligence at CryptoOracle Collective.

According to him, the high level of utility AI has might make the tokens one of the best-performing assets of this cycle. He told us that,

“AI will remain relevant in the crypto space due to its high utility and potential for hype cycle sustainability, and crypto’s need for something new to cycle on will drive AI adoption.”

However, our conversation with Cuautemoc Weber was somewhat different. Weber is the CEO and Co-founder of Gateway.fm, a decentralized blockchain infrastructure node provider.

According to him, it might be difficult to forecast the long-term potential, but,

“There has been a notable uptick in the level of traction for AI-related tokens recently, with Worldcoin’s WLD token and Ocean Protocol’s OCEAN token demonstrating strong market performances. Whether this momentum endures in the long term is difficult to predict, but the integration of AI within the crypto ecosystem holds immense promise.”

GPUs prepare new ATHs for AI tokens

Another factor fueling the rise of AI-themed cryptocurrencies is the demand for Graphics Processing Units (GPUs). GPUs are an essential part of a modern artificial intelligence infrastructure.

In recent times, they have been developed and optimized specifically for deep learning.

We also had the opportunity to speak to Christopher Alexander. Alexander is the Chief Analytics Officer at Pioneer Development Group.

During a quick chat with him, we asked how long he thinks AI would remain relevant to the crypto ecosystem. Here’s what he had to say,

“The decentralized computing power of blockchain means that AI crypto efforts may soon be able to compete with some of the world’s most powerful supercomputers, at a fraction of the cost to operate. I think blockchain has enormous potential to develop and operate some of the most effective AI tools and servers ever created.”

Interestingly, this is where tokens like Render [RNDR] come in. RNDR is the ERC-20 utility token of the Render network. For those unfamiliar, Render is a distributed GPU rendering network built on Ethereum.

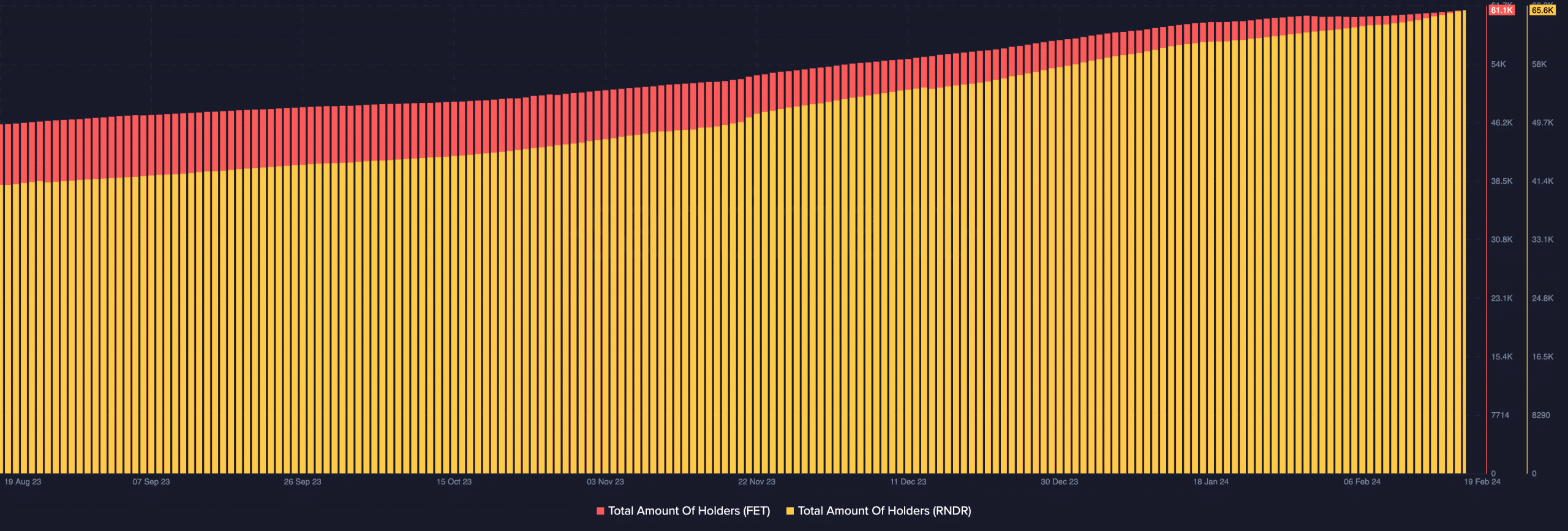

Over the last 365 days, RNDR’s price has increased by 236.54%. When AMBCrypto checked the total number of RNDR holders, we observed that the count had been growing.

For instance, the number of holders as of August 2023 was a little under 40,000. But at press time, the number had increased to 65,600. It was a similar situation with FET, whose holder count climbed to 61,100.

Eyes on the mid to low cap as demand rises

The increasing number of holders was proof that the broader market was aligning with the prospect that AI tokens might run rampant when the bull market starts properly.

At press time, the total market cap for the AI category in the market was $10.28 billion.

However, macroeconomic factors like the AI semiconductor market might propel the value higher. For example, a recent article by NIKKEI Asia noted that global demand for semiconductors would jump by Q2 2024.

Also, business intelligence platform Statista mentioned that,

“The AI semiconductor market is expected to surge to $119.4 billion in 2027, comprising nearly 20% of the global semiconductor market.”

If this is the case, then the market cap of AI-themed cryptocurrencies would most likely climb. However, it remains uncertain if the market cap will cross $100 billion this cycle.

For it to achieve that, then the average values of tokens in the category would need to increase by 10x.

While this is not impossible, it looks like a target too high. Regardless of that, there seem to be mid to low-cap cryptocurrencies that might hit 5x or 10x. This projection was due to the surrounding narrative.

Two major examples are PAAL AI [PAAL] and Sleepless AI [AI].

PAAL is an AI token built on Ethereum. At press time, PAAL’s market cap was $285.11 million. Should ETH’s price rally amid the AI hype, then PAAL might have an amazing uptick.

Sleepless AI, on the other hand, is backed by the gaming narrative. It was launched on the Binance Launchpad and had a market cap of $226.4 million at the time of writing the report.

Realistic or not, here’s FET’s market cap in INJ’s terms

In addition, our discussion with Bravick also led to his thoughts about the long-term relevance. Bravick, when asked if the AI and crypto marriage would remain for a while, said,

“I expect we will see a surge of token launches in the next 10 years related to AI, with potential use cases involving privacy advocates and AI-powered systems. AI will also transform UX in crypto, abstracting away engineering hours and making development more accessible.”