CAKE price craters 32% in January: Are February’s predictions better?

- CAKE’s price has dropped by over 30% in the last month.

- This has occurred despite the growth in PancakeSwap’s trading volume.

CAKE, the token that powers BNB Chain’s leading decentralized exchange (DEX) PancakeSwap, has witnessed a 32% decline in its value since it peaked at $3.6 on the 29th of December 2023, according to CoinMarketCap.

At press time, the token exchanged hands at a month-low of $2.45.

This price dip has occurred despite a recent surge in trading volume on the DEX.

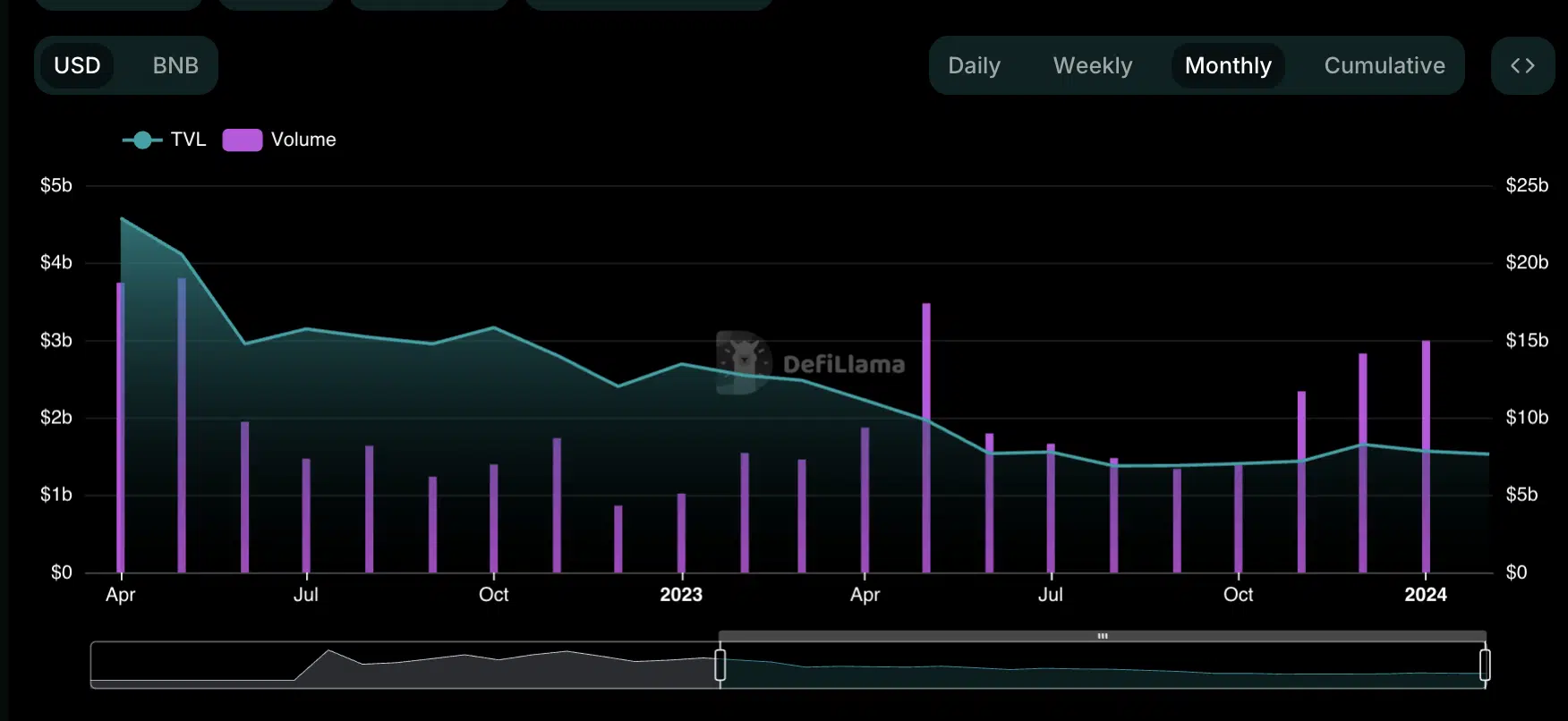

According to data from DefiLlama, in January, the trading volume on PancakeSwap totaled $15 billion, representing its highest since May 2023.

As of the 31st of January, PancakeSwap’s TVL was $1.56 billion, marking a 3% decline from December’s $1.52 billion.

Interestingly, despite the surge in trading volume on PancakeSwap, it recorded a double-digit decline in protocol fees in January.

Data from Token Terminal showed that the DEX recorded a total of $9.4 million in transaction fees in January. This represented a 16% decline from the $11.4 million it saw in fees in December.

Due to the decrease in transaction fees, protocol revenue from the same also plummeted. In January, PancakeSwap recorded $3.1 million in total monthly revenue.

In the preceding month, the protocol’s revenue totaled $3.6 million.

CAKE lovers avoid the sugar rush

CAKE’s momentum indicators rested below their respective center lines at the time of writing, suggesting a decline in buying pressure.

For example, the token’s Relative Strength Index (RSI) trended close to the oversold zone at 38.56, while its Money Flow Index (MFI) returned a value of 38.15.

At these values, these indicators suggested that CAKE sell-offs significantly outpaced accumulation.

Confirming the high bearish sentiments, CAKE’s MACD line (blue) was less than zero at -0.105.

When an asset’s MACD is lower than zero, it means that the shorter-term average is below the signal that selling pressure is stronger than buying pressure.

Read PancakeSwap’s [CAKE] Price Prediction 2023-24

Showing that CAKE’s recent high was reached a long time ago, its Aroon Up Line (orange) was 0%.

This indicator identifies trend strength and potential trend reversal points in a crypto asset’s price movement.