Can Aave reach $450? Yes, but there are major conditions

- AAVE’s monthly outlook looking amazing, with a potential for a breakout.

- Aave dominated the DeFi sector as new initiative looked to drive adoption.

Aave [AAVE], one of the leading DeFi protocols, continues to demonstrate strong performance, showing resilience and potential for long-term market gains.

AAVE’s price chart is impressive on monthly timeframe, after breaking the downtrend and consolidating, with signs of an impending breakout. This breakout could signal a significant upward movement in the AAVE/USDT pair.

Aave’s last month volume spiked into resistance, suggesting that it is positioned for a potential price surge. With projections indicating a long-term target of $450 if it stays above $150.

This makes it a compelling investment opportunity for both long-term and short-term traders. The stochastic RSI at 83 indicated substantial buying pressure, reinforcing the positive outlook for its price action.

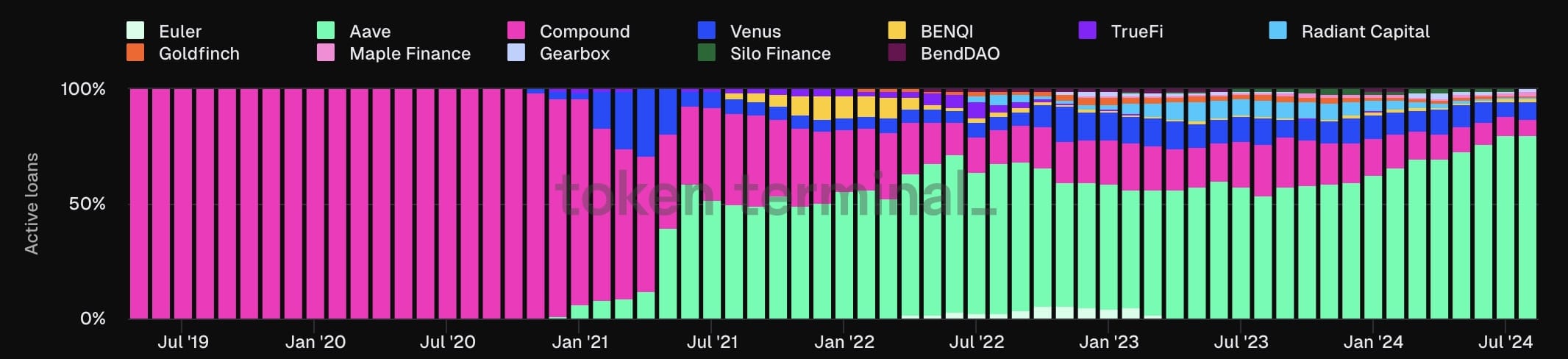

AAVE leads with active loans

Furthermore, on-chain data highlighted the increasing revenues of decentralized applications (dApps), leading to higher user engagement and utility.

Since 2021, Aave has led in the decentralized finance [DeFi] sector taking the spot for most active loans, showcasing real growth that continues to expand.

Its dominance in the DeFi space positions it as a key player with a bright future.

The lending protocol is at the forefront of the shift from meme coins to utility-focused projects. This is expected to positively impact Aave’s future price, as the platform continues to attract more users and investors.

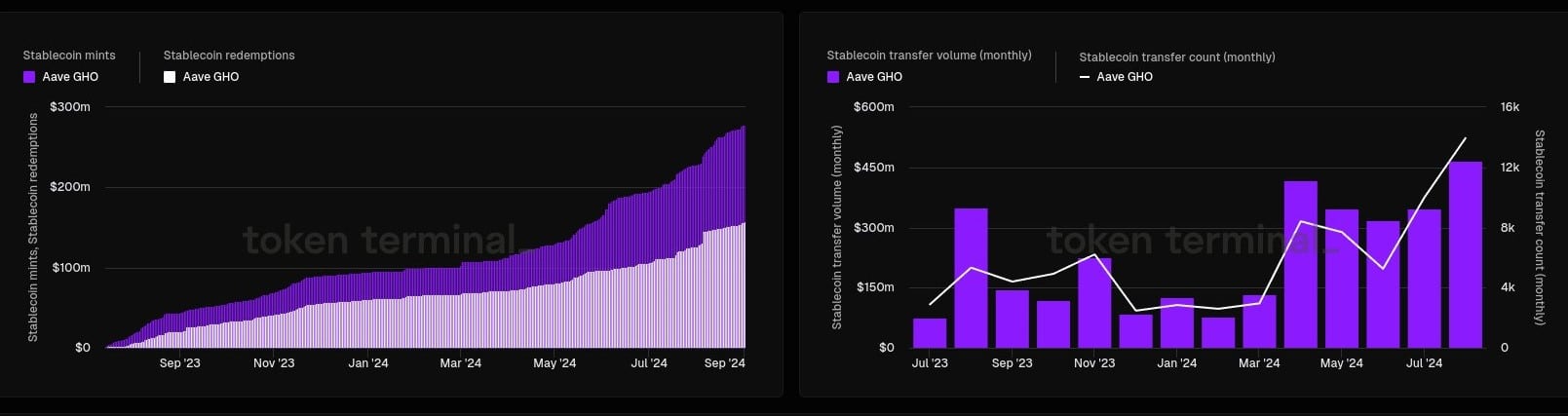

The Aave stablecoin (GHO) has also seen significant growth, with its transfer volume peaking in August despite broader market declines.

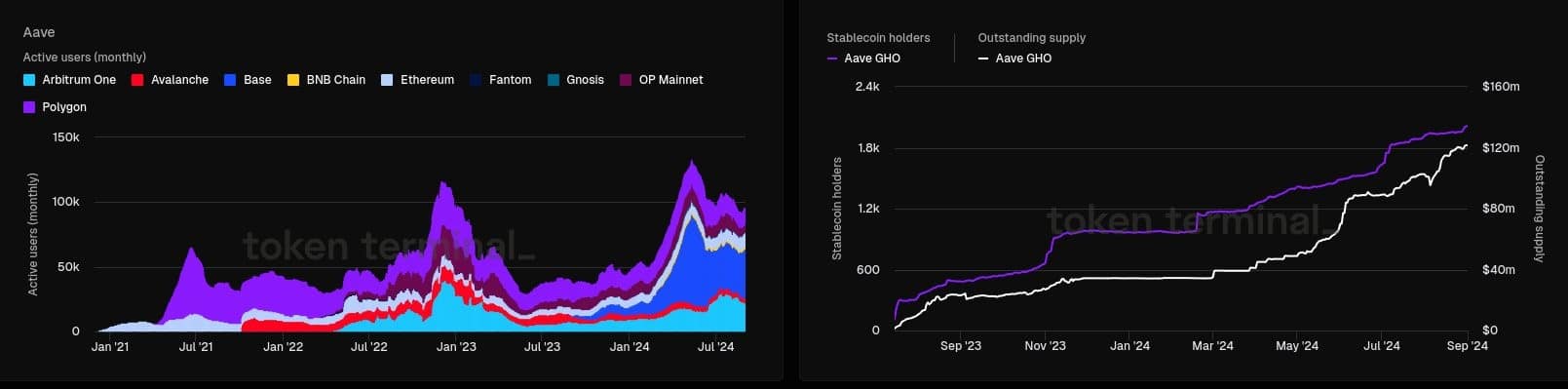

Active users and GHO supply

The stablecoin’s supply has reached an all-time high, and the number of GHO holders continues to grow, further supporting this positive outlook.

Additionally, its monthly active users have surged across various blockchain networks, including Arbitrum, Avalanche, Base, BNB Chain, Ethereum, among others.

Meanwhile, it has introduced the Sky Aave Force initiative, which aims to drive mass adoption and bridge the gap between DeFi and TradFi.

Read Aave’s [AAVE] Price Prediction 2024–2025

Sky proposed integrating USDS and Savings USDS on Aave V3 with native token rewards, creating a new Sparkdotfi/Aave market, exclusive rewards and more.

Aave’s ongoing developments and strong market performance suggest that AAVE’s price could see significant gains in the future. Aave’s strength in the DeFi space could drive the broader crypto market higher.