Can AAVE witness a bullish rebound soon?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- AAVE remained under the weight of heavy selling pressure.

- However, on-chain metrics suggested that bulls could be preparing to rally soon.

Aave [AAVE] maintained its bearish sentiment on the higher timeframes, with price unable to break above the bearish trendline. Despite the token’s soft bounce from the $50 psychological zone in mid-August, bulls have failed to rally due to the intense selling pressure.

Read Aave’s [AAVE] Price Prediction 2023-24

As of press time, Bitcoin [BTC] was still trading under $26k, hinting at further bearish activities in the market.

Bulls continued to struggle under bearish market structure

The Relative Strength Index (RSI) highlighted strong bearish momentum, with the indicator remaining under the neutral 50 since 30 July. On the other hand, the Chaikin Money Flow (CMF) stayed above the zero mark, hinting at the willingness of investors to commit more funds.

The price action on the 12-hour timeframe showed a bullish attempt at a reversal on 29 August. However, it was swiftly curtailed by the bearish trendline with AAVE dropping another 10% between 30 August and 1 September.

With the bearish trendline continuing to limit buyers, the possibility of a bullish rebound lies at the $50 support level. The confluence of the level with the bullish order block could present a good risk-to-reward ratio for AAVE buyers.

Rising mean coin age suggested bulls could be preparing to rally again

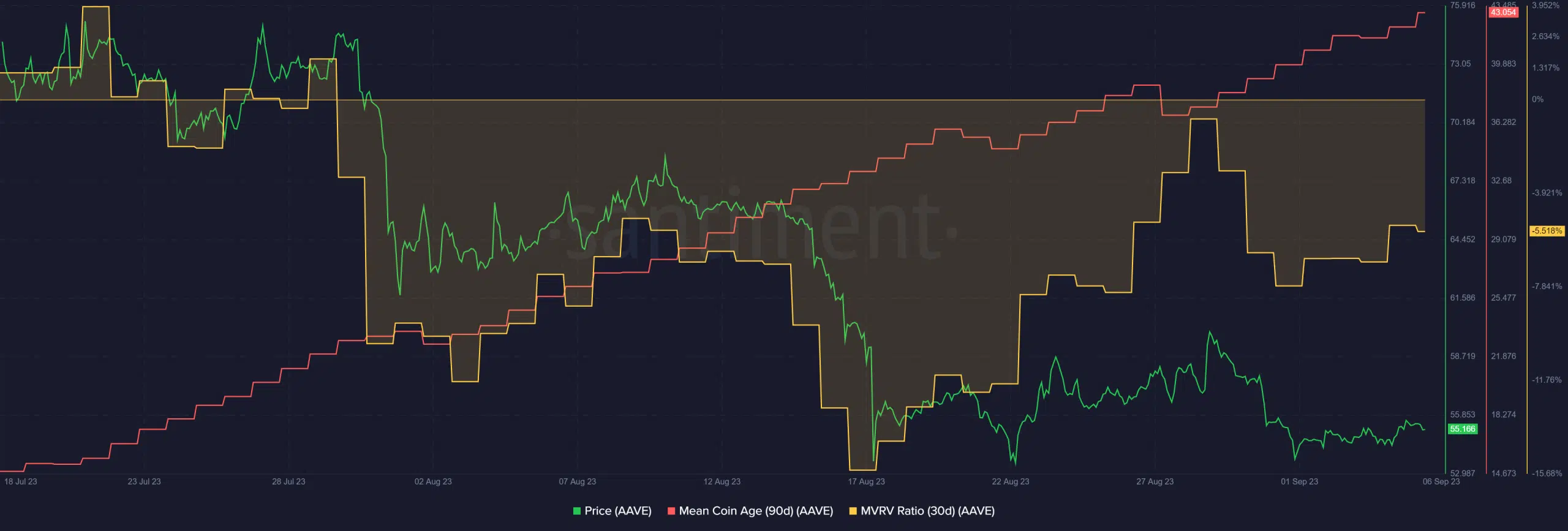

The 90d mean coin age data from Santiment showed that long-term holders were still bullish about AAVE. The mean coin age trended upwards since mid-July to signal a network-wide accumulation.

How much are 1,10,100 AAVEs worth today?

Similarly, the 30d Market Value to Realized Value (MVRV) showed that short-term holders were close to flipping their unrealized losses to gains, as the metric stood at -5.51%.

This suggested that a dip to the $50 psychological level could present bulls with an irresistible opportunity to rally, as evidenced by the price action in mid-June.