Can AVAX defend the $10 psychological level?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- AVAX’s sellers pushed the altcoin to a key bullish zone.

- Demand in the Futures market dipped slightly.

Aggressive Avalanche [AVAX] sellers grabbed +15% shorting gains after dragging the altcoin from a recent high of $11.88 to a press time value of <$10. But the pullback has hit key bullish zones.

Is your portfolio green? Check out the AVAX Profit Calculator

AMBCrypto’s recent AVAX price analysis projected that the earlier bullish momentum could tip AVAX to $11. The projection was validated, but sellers entered the market after AVAX hit a key roadblock.

Will $10 stop the plunge?

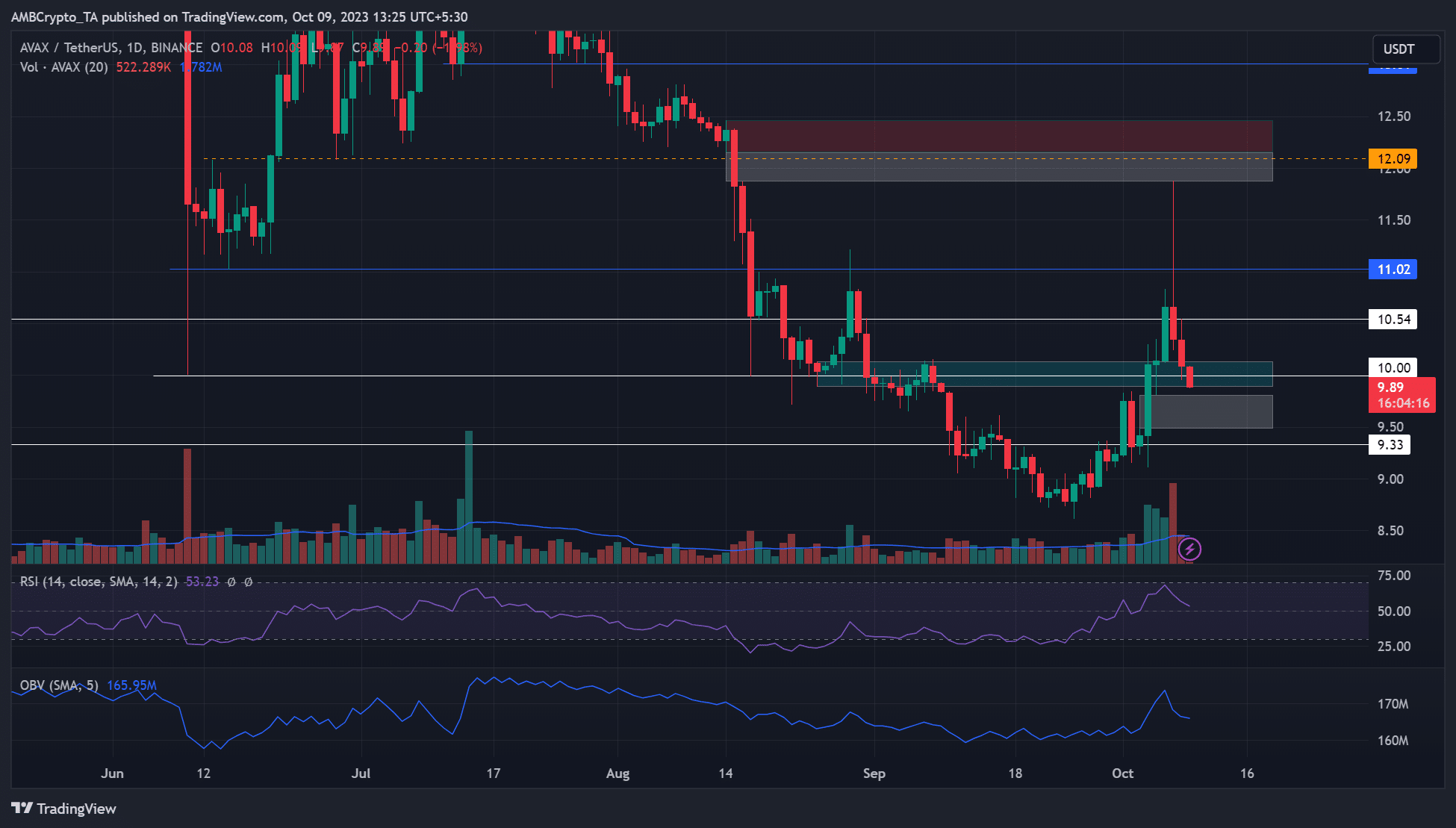

AVAX’s recovery faced price rejection at a price imbalance area of $11.88 – $12.15 (white). A daily bearish order block (OB) of $12.15 – $12.46 (red) exists above the price imbalance sellers exploited for recent market re-entry.

But the pullback has hit a key bullish level and a previously invalidated daily bullish OB of $9.89 – $10.13 (cyan). Below the bullish OB, another price imbalance/liquidity area of $9.49 – $9.81 (white).

So, the AVAX’s drop could ease at the above two levels if BTC doesn’t post excessive losses in the next few days. As such, $9.5 and $10 could be key buying interest levels, with immediate bullish targets at $10.54 and $11.02.

Conversely, an extended plunge below $9.49 (price imbalance) will weaken AVAX’s more. In such an extremely bearish scenario, the next supports are $9.3 and $9.0.

Meanwhile, the RSI retreated toward the 50-median level at press time, denoting sell pressure heightened in the past few days. An RSI rebound at the 50-mark will confirm a potential price reversal at $9.5 or $10.

However, the demand for AVAX declined, too, as shown by the OBV’s downtick.

Demand for AVAX in the derivatives segment improved

Source: Coinglass

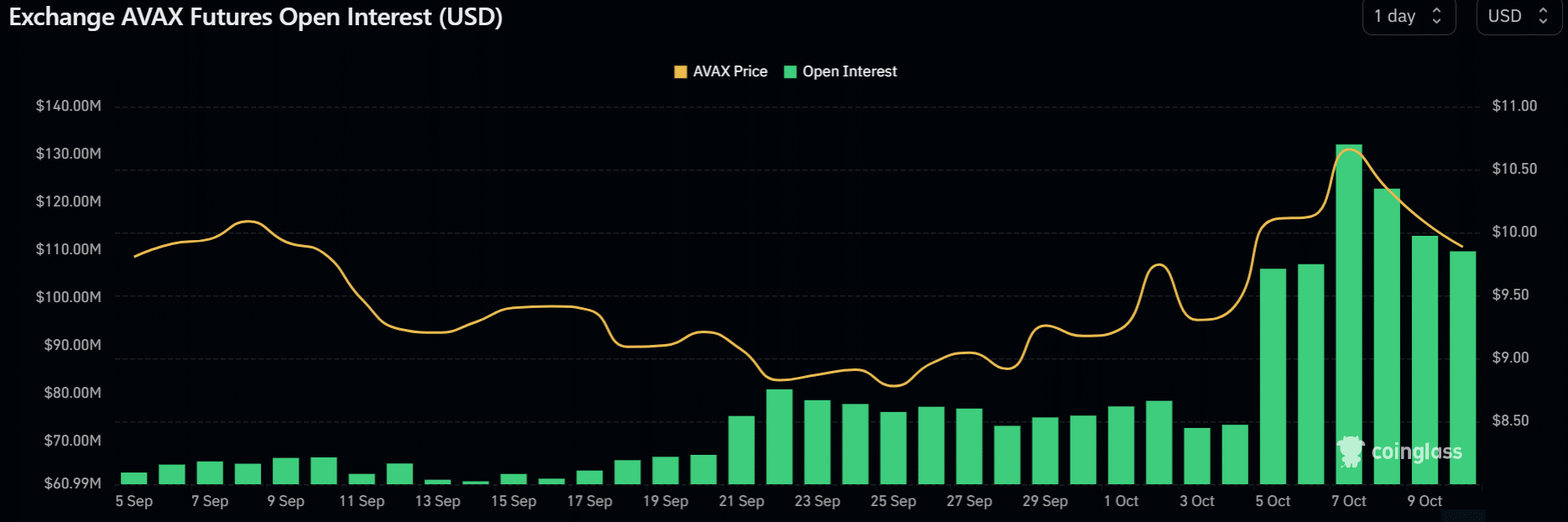

According to Coinglass, the AVAX’s Open Interest (OI) rates were muted in September but improved in early October. The metric surged to >$130 million by 7 October, but retreated afterward.

How much are 1,10,100 AVAXs worth today?

It shows demand for AVAX in the Futures market improved but dropped in the past two days.

A dip in volume and liquidation of more long positions in the past 24 hours before press time further cemented the above bearish sentiment in the Futures market.