Ethereum Foundation sells 1700 ETH: What now?

- The non-profit arm of the Ethereum Foundation sold some of its holdings.

- Traders opened more short positions moments after the sale.

On-chain data from Arkham Intelligence showed that the Ethereum [ETH] Foundation sold 1,700 ETH, and exchanged it for 2.7 USD Coin [USDC] on 9 October.

How much are 1,10,100 ETHs worth today?

According to the foundation’s wallet 0x9eE457023bB3De16D51A003a247BaEaD7fce313, the sell-off took place on the Uniswap [UNI] exchange.

However, the foundation did not abruptly sell the altcoins without a prior plan. According to Arkham, the non-profit organization sent the coins from its Gnosis Safe Proxy wallet five days ago.

Few ETH left in the wallet

Commonly used by Decentralized Autonomous Organizations (DAOs), a Gnosis Safe is a smart contract multi-sig wallet running on Ethereum that requires a minimum number of people to approve a transaction.

After the sale, Ethereum returned 494,000 USDC to the foundation’s wallet before resending it to the Gnosis Safe. Also, the assets left on the Ethereum Foundation wallet include 240.67 ETH, 49,658 DAI, 10,125 ARB, and 7,096 USDC.

However, a look at the foundation’s X (formerly Twitter) page showed that it was unclear why the coins were sold.

ETH immediately felt the impact of the sale as the price dropped by 1.45 % within 2 hours that the action took place. As a result, the coin price fell below the $1,600 threshold, which it had held for a while. But how about traders?

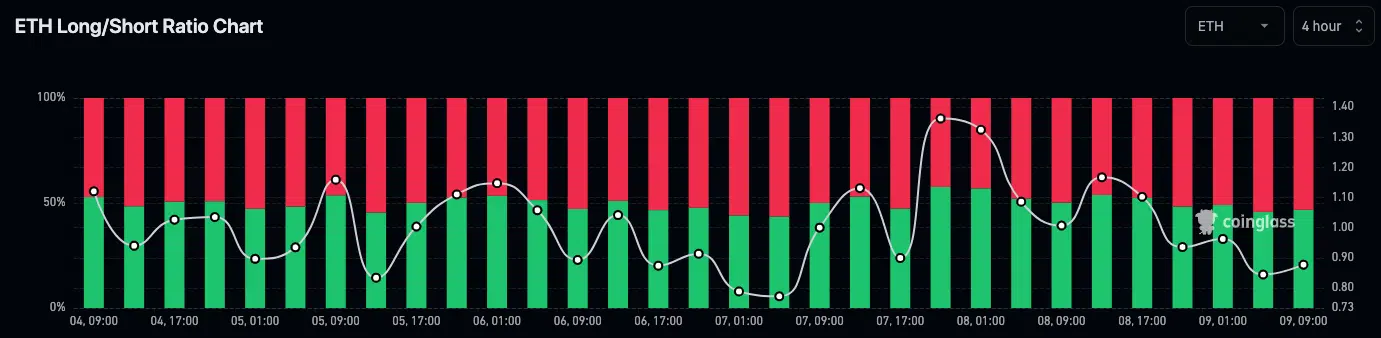

According to Coinglass, ETH’s 4-hour Long/Short Ratio was 0.87. Typically, values over 1 of this indicator suggest more long positions than shorts. Conversely, a Long/Short Ratio of less than 1 means that there are more short positions than long.

Watch out for more downside

Therefore, ETH’s aforementioned Long/Short Ratio means traders share the sentiment that the price may decrease further.

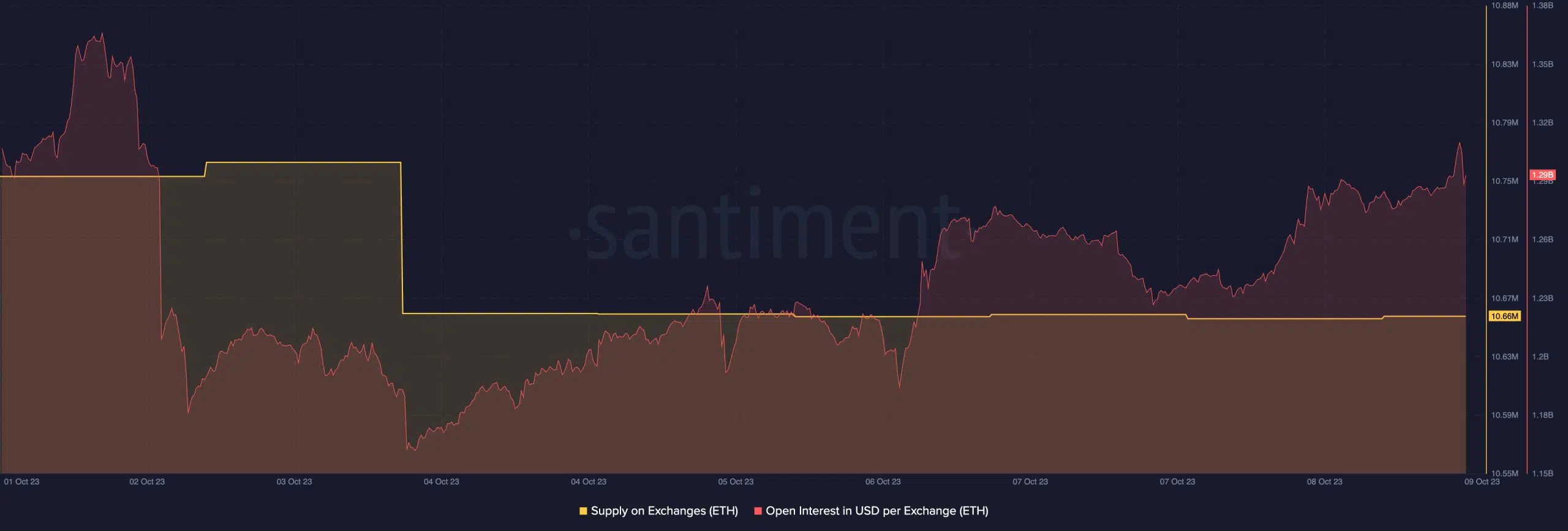

However, the price of ETH may not go below $1,500 in the short term. This is because the Supply on Exchanges stayed put around the same point it has since last week.

Supply on Exchanges is a measure of the number of coins sent into exchange wallets from external addresses. If the metric spikes, then it means there could be an impending selling pressure.

Therefore, the flatlined status means there was enough strength from ETH to withstand the foundation’s sale.

Is your portfolio green? Check out the ETH Profit Calculator

Meanwhile, traders who opt to go long may need to watch out for the rising Open Interest on exchanges. As an indicator of market sentiment, the Open Interest on exchanges can tell when there is an increase in exchange activity.

However, the increase in this metric could be connected to spot or derivatives trading. While it may be uncertain which actions are being taken on these platforms, it is also necessary to be wary of opening long positions.