Can Bitcoin [BTC] defy the infamous ‘March Chronicle’ in 2023?

- BTC’s price action has the potential to go against the usual March decline.

- Coins that had moved in the last decade were now more than those held on exchanges.

Bitcoin [BTC] has the “habit” of performing woefully in March over the years, making it the second worst month over the years, bar 2013. While the first two months of the year may have been off to an excellent beginning, investors might need to watch out for the red-loving month, Miles Deutscher opined.

2023 is off to a good start for #Bitcoin, with 2 consecutive green months (assuming today's monthly close holds).

But looking ahead: Historically, March has been the 2nd worst performing month – with an average $BTC return of -5.72% (exc. 2013).

What's your outlook for March?? pic.twitter.com/jm3JB0JJ0y

— Miles Deutscher (@milesdeutscher) February 28, 2023

Is your portfolio green? Check out the Bitcoin Profit Calculator

Can the king coin disregard the trend?

During the first 30 days of the year, BTC went on a 40% uptick. Although the second month was not as impressive, the king coin gained 6.71% in the last 14 days, as shown by CoinGecko. So, does the technical outlook support a green continuation or would it end in a fallback?

Considering the Exponential Moving Average (EMA), it was possible that BTC could trend toward its performance ten years back. This was because the 20-day EMA (blue) was above the 50-day EMA (yellow).

While the short to mid-term might offer gain opportunities, the Relative Strength Index (RSI) remained in a neutral state at 50.98. This implies that the momentum at press time did tend in support of a strong bullish or bearish sentiment.

Strong-willed holders of the decade surpass…

In an interesting update, on-chain analyst and Reflective Research co-founder Will Clemente shared that 10-year dormant addresses were more than BTC held on exchanges at press time.

This may, however, not be surprising, since it was unusual for long-term holders to suddenly exit their positions. But short-term speculators mostly failed to see out the bear market season.

Another on-chain analyst, Willy Woo, seemed unsurprised by the data. Noting that 2.6 million BTC has not moved within the period, Woo mentioned that Chainalysis projected the number to grow to 3.7 million by 2030.

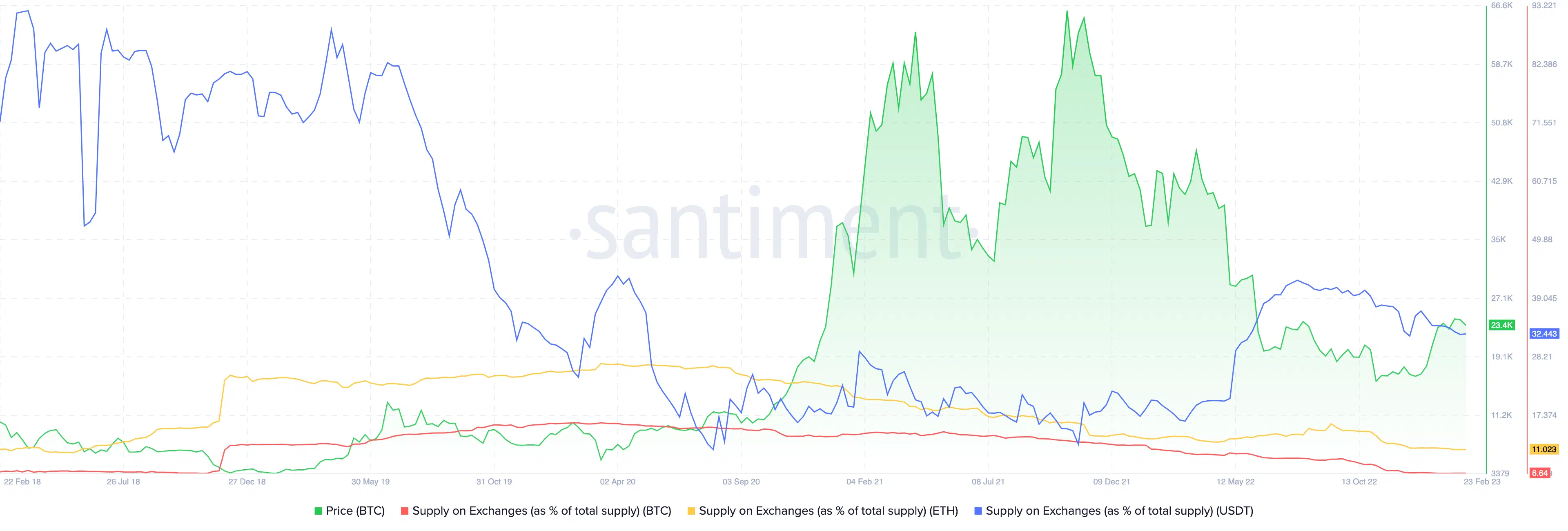

Well, the reasons for the unmoved addresses outpacing current exchange holdings could be linked to the November 2022 FTX collapse. This was also reaffirmed by Santiment, as both BTC and Ethereum’s [ETH] five-year exchange supplies hit the lowest.

Realistic or not, here’s BTC’s market cap in ETH’s terms

Furthermore, Bitcoin Quant Trader Charles Edwards tweeted that the January uptick was no coincidence. He went ahead to say that it was the start of the bull market while giving his reasons.

January was massive for Bitcoin, not just because price went up a lot. I believe it was the start of the bull market for Bitcoin for these 9 reasons:

— Charles Edwards (@caprioleio) February 28, 2023

Edwards pointed to several factors, including macroeconomic change and miners’ unprofitability. However, he hammered on the 2024 halving effect, noting that,

“We are at optimal halving cycle timing where Bitcoin typically bottoms (Q4 2022 and Q1 2023). Like clockwork, Bitcoin has bottomed in the window 12-18months prior to every halving in the past.”