Can BNB’s dwindling metrics find stability in Greenfield? Examining…

-Over the last month, the number of BNB stakeholders decreased.

-BNB’s weighted sentiments went down, but price action remained bullish.

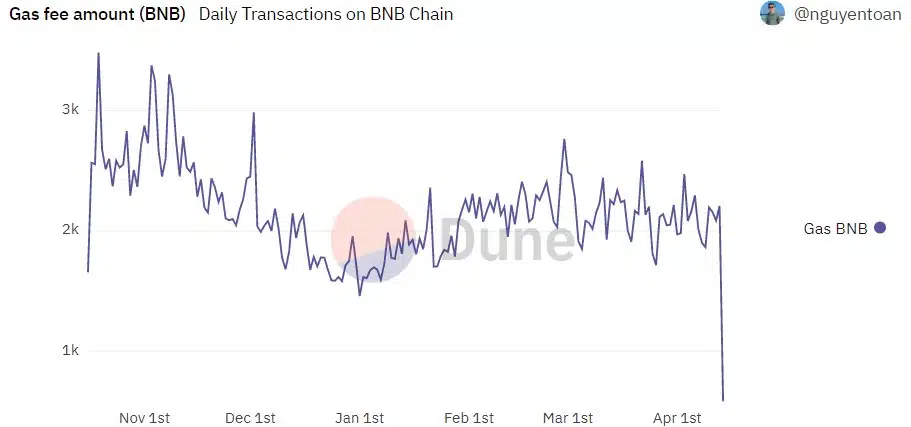

BNB Chain [BNB] has been witnessing a decline in its gas fee amount, which looked bothersome as it indicated less network usage. The decline in network usage also affected the blockchain’s revenue. As per Token Terminal, BNB was not on the list of the top 10 blockchains in terms of revenue.

Read Binance Coin’s [BNB] Price Prediction 2023-24.

Another negative signal was revealed by Staking Rewards. As per its chart, BNB stakers declined sharply over the last month. In the last 24 hours alone, the number of stakers declined by over 4%.

Can Greenfield be the savior?

However, the good news was that the Greenfield testnet launch looked promising. The new launch can help the blockchain attract new users, propping up network usage.

The BNB Greenfield is a blockchain and storage platform that seeks to unleash the power of decentralized technology on data ownership and the data economy. Soon after BNB launched the Congo testnet, it also made Greenfield’s code open source.

BNB Greenfield's code is now open source ?

Everyone's invited to experiment with Greenfield's features and code, give us feedback, and co-build this promising ecosystem!

Find out how you can start developing today by reading this blog from @v_bnbchain.https://t.co/SwnLxdGAE4

— BNB Chain (@BNBCHAIN) April 13, 2023

The BNB Chain’s core developer community has a tradition of open-sourcing important code with full permissions to benefit the community.

Apart from the Greenfield update, on 12 April, the BNB Smart Chain also carried out the ‘Plank’ hard fork, which was designed to increase the layer-1 network’s reliability and security. The hard fork can also help garner more user interest, as it’s related to security.

Sentiments around BNB were surprising

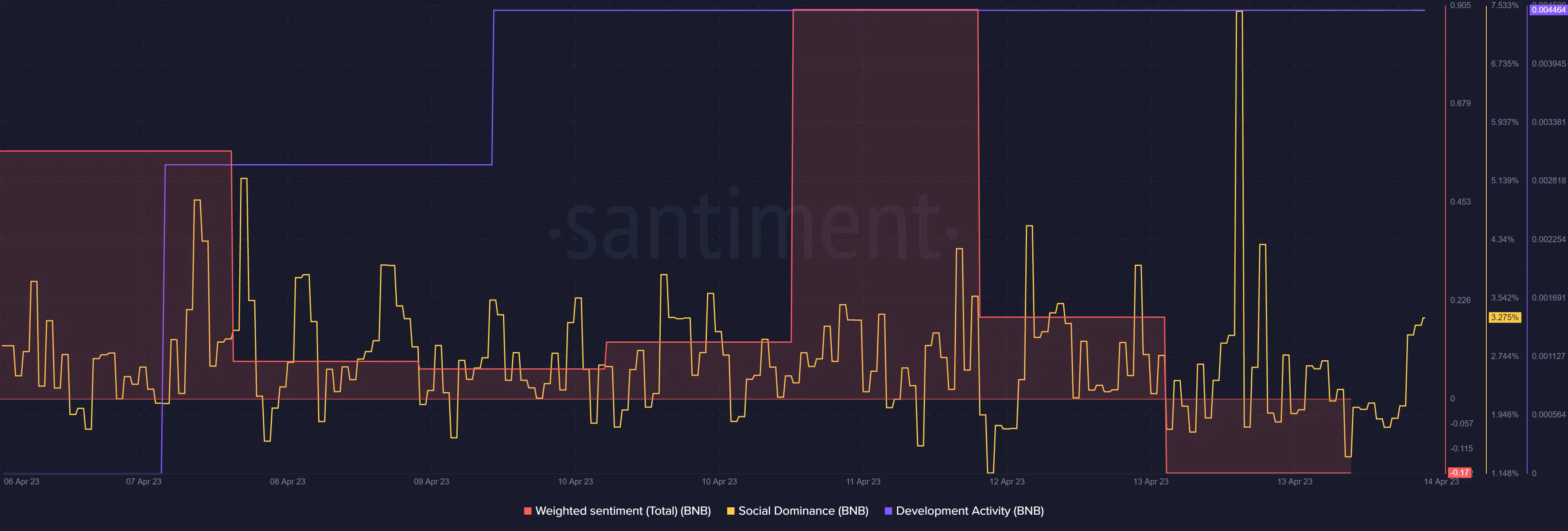

Despite these positive updates, sentiments around BNB remained negative. This was evident from a look at BNB’s decline in weighted sentiment.

Nonetheless, BNB’s social dominance was high, suggesting that it remained a topic of discussion in the crypto community. Thanks to the updates, BNB’s development activity also surged, which is generally a positive signal.

Is your portfolio green? Check the BNB Profit Calculator

BNB rides the bull market

BNB has been comfortably registering gains over the last few days, thanks to the ongoing bullish market condition. According to CoinMarketCap, BNB’s price was up by over 7% in the last seven days. At the time of writing, it was trading at $332.98, with a market capitalization of over $51.9 billion.

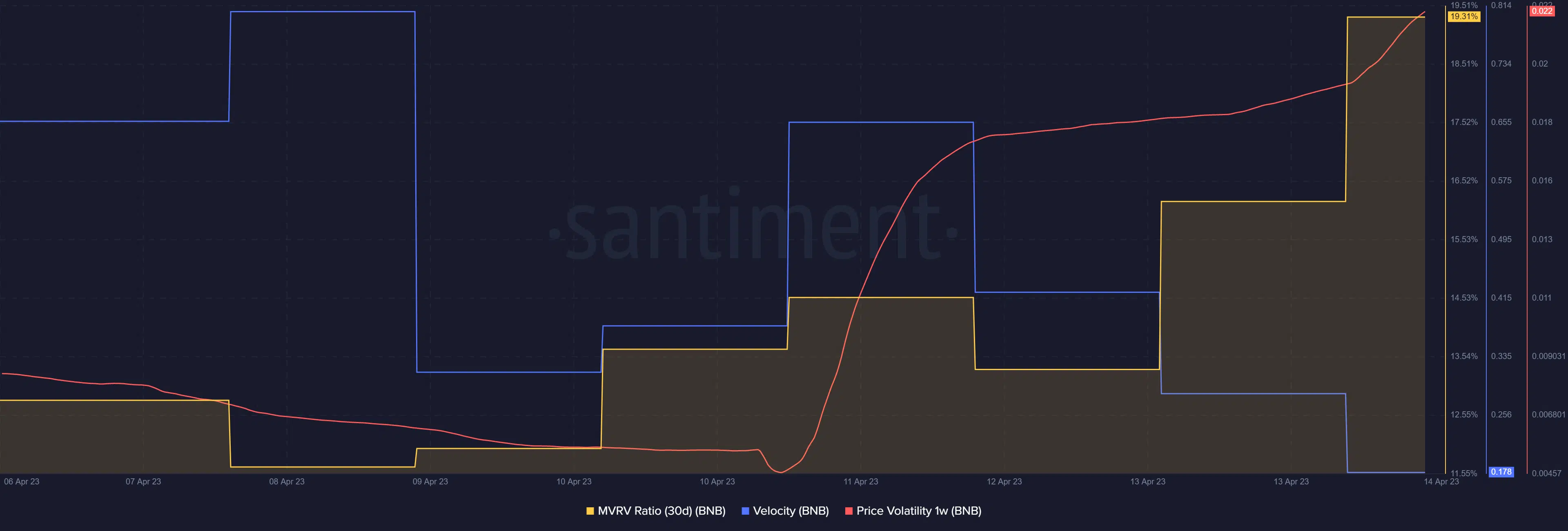

BNB’s MVRV ratio has increased sharply of late, which can be attributed to the recent price uptick. BNB’s price might continue to rise as its 1-week price volatility was high. However, the network’s velocity registered a decline, which was negative.