Can BTC endure the pain of the crossfire between STHs and market panic

- BTC short-term holders could be the reason for BTC’s latest price drop as per CryptoQuant’s latest analsysis

- However, as of 10 May, market panic and FUD led to BTC dropping from $28k to 26k in an hour

There has been a lot of speculation in the market ever since Bitcoin [BTC] fell from its high of $29,703 on 5 May to $27,333 on 8 May. Although BTC exchanged hands 0.65% higher over the last 24 hours, its seven-day performance still flashed red at press time.

The fall of BTC could be a solid indication that there was massive ongoing selling activity in the market. As per the CryptoQuant analyst onchained, short-term holders could be blamed for BTC’s movement in the red.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Can’t hold on to BTC anymore?

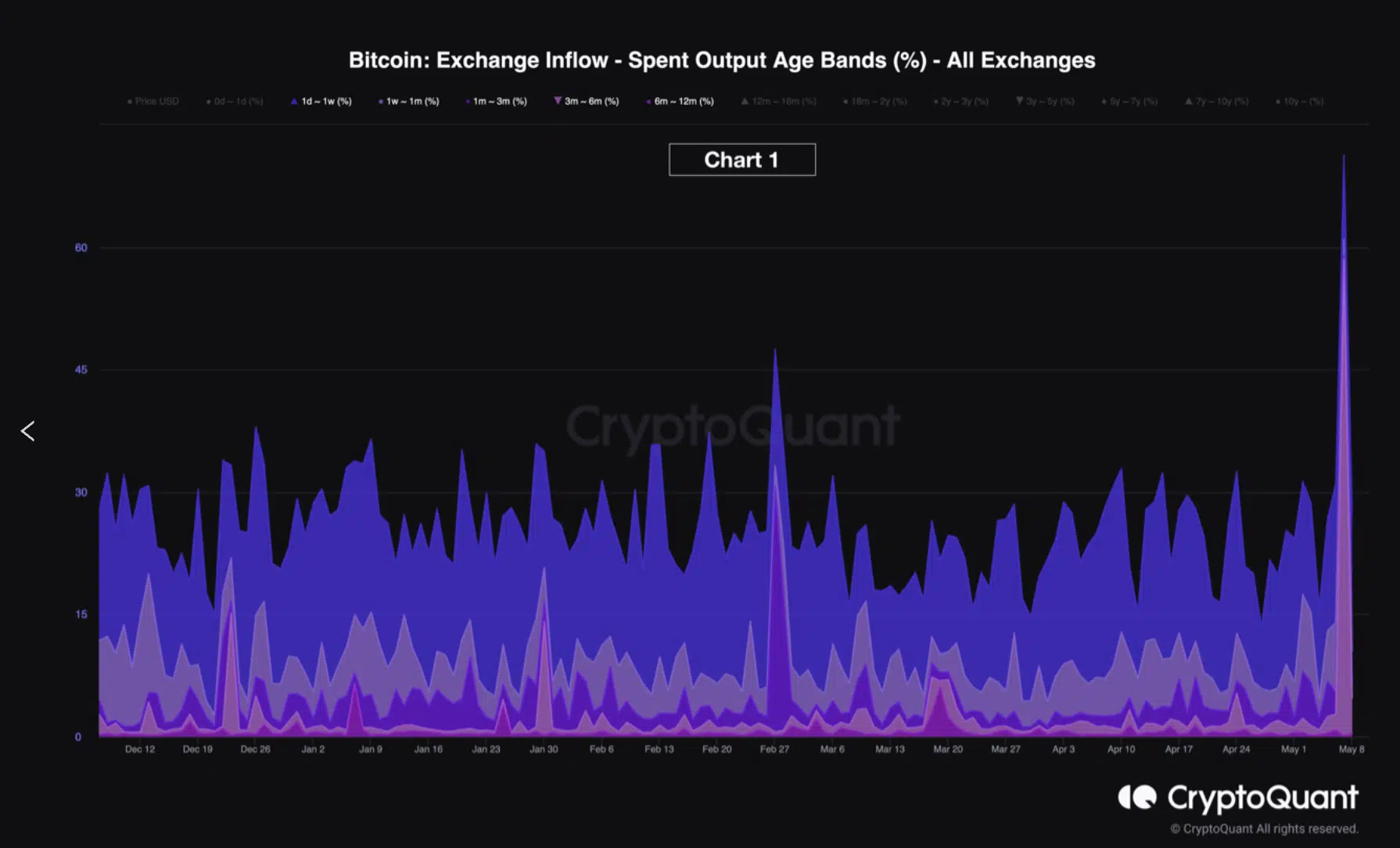

As per the CryptoQuant analyst, the analysis of Exchange Inflow Spent Outputs Age Bands (%) reveals which holders influence BTC’s price. BTC’s drop from $31k to 27k was a result of the increased inflow of BTC into exchanges. As per onchained, 58.33% of spent outputs, acquired between November to January, were transferred to exchanges.

These holdings were acquired between 15.4k to 18.3k and were held on for a period of 3 to 6 months. Furthermore, these holdings made a significant portion of the spend output.

Additionally, the second significant age band that transferred their BTC to exchanges held onto it between a day and a week. This age band comprised 10.27% of the total outputs.

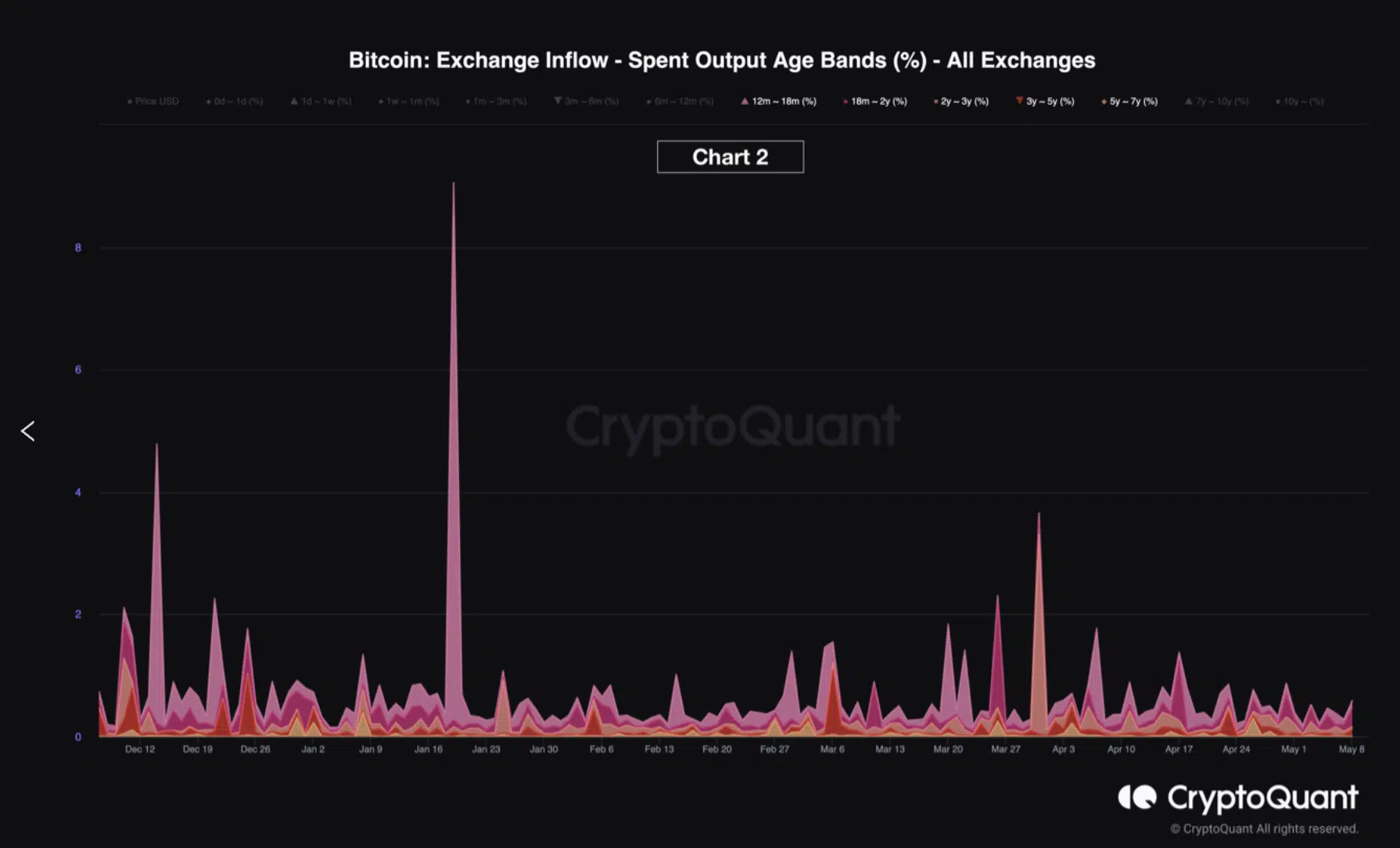

Contrary to the activity of short-term holders, the analysis pointed out that long-term holders took a different route. As seen below, long-term holders didn’t contribute much towards the spend outputs.

Spend output for holders of 6 to 12 months comprised 0.38%, whereas 0.12% output belonged to holders between 12 to 18 months. Furthermore, spend outputs for holders of 2 to 3 years stood at 0.3% and for 3 to 5 years stood at 0.444%.

The horrid state of BTC

The king of cryptocurrencies went from $28,221 to $26,996 in a matter of minutes on 10 May. This panic and FUD in the market could be due to the fake news of the U.S. government selling its holdings.

The now-deleted tweet by a crypto analyst @1kbeetlejuice stated that the U.S. government had sold its BTC holdings. The analyst published a thread explaining the error that led to the panic.

Furthermore, it was also proved that the U.S. government didn’t make any changes to their holdings as of 10 May.

被叫醒了,还没有仔细的看下跌的原因,估计要早晨了,但是看了眼数据发现所谓的美国政府卖出 #BTC 是FUD,目前看来美国城府持有的205,514枚BTC,起码到现在为止还没有任何移动的迹象。 pic.twitter.com/hXKYbaVHXZ

— Phyrex (@Phyrex_Ni) May 10, 2023

With regards to the FUD of the last few hours, BTC did manage to recover and at press time, was trading up by 0.34% in the last hour. However, it surely didn’t mean that BTC was off the hook. A look at BTC’s four-hour chart indicated that its Relative Strength Index (RSI) stood at 39.99.

Is your portfolio green? Check out the Bitcoin Profit Calculator

What was even more worrying was that it stood in freefall and would drop lower in the presence of ongoing sell pressure. Furthermore, at press time, although the MACD line (blue) was moving above the signal line (red), it could change its course. BTC’s Chaikin Money Flow (CMF) also stood at 0.00 at the time of writing.

Considering the shaky position of short-term traders combined with the panic caused in the market, BTC’s position could be in a tight spot. As per a tweet from crypto trader Ash Crypto, the latest FUD in the market could have led to a significant number of small traders getting wiped out from the market.

IN TODAY’S US SELLING BITCOIN FUD

$100 MILLION LIQUIDATED IN 1HR

IMAGINE AMOUNT OF SMALL TRADERS WHO GOT WIPED OUT BECAUSE OF ALL THESE MANIPULATIONS pic.twitter.com/O4bg5KeBNF

— Ash Crypto (@Ashcryptoreal) May 10, 2023