Can Chainlink’s next NFT gamble change the game for stablecoins

The hype of NFTs has led to the involvement of major alts like Ethereum and Solana. However, a lot of DeFi projects have one project in common – Chainlink. Thanks to its oracles, it provides real-time data to the smart contracts that make trading of these NFTs easier.

However, Chainlink’s newest integration has given NFTs a new life by doing something unimaginable.

Another chapter for NFTs?

NFTs are known for their illiquid status at most times. Then again, we also have CryptoPunks, the biggest NFT collection by both market cap and volume. These CryptoPunks are often in demand and their liquidity is good.

Regardless of this, thanks to a new primitive form of DeFi called Non-Fungible Debt Positions (NFDPs), these illiquid assets can be turned into something more than just static investments.

JPEG’d have introduced a new way to collateralize NFTs by depositing them into a smart contract. This will allow them to mint a synthetic stablecoin called PUSd.

Now, stablecoins are often considered the safest asset in terms of investment, as well as for DeFi solutions. Up until now, these stablecoins were either backed by fiat, crypto-tokens or functioned according to the terms of a smart contract.

Adding NFTs to that collateral list could attract investors, limiting their investments to these punks. Even though the PUSd stablecoin is currently limited only to the network, it could inspire a new form of stablecoin based on an illiquid asset.

For pricing the NFTs as collateral, Chainlink has integrated with the network and will use Price Feeds to do so.

What’s to remember is that even after collateralizing their NFTs, owners will not lose ownership of their assets. Instead, they’ll actually earn from it.

Here’s the hiccup

Right now, NFTs are still considered a bubble that can burst once the hype dies down. The problem is it’s slowly kind of happening at the moment.

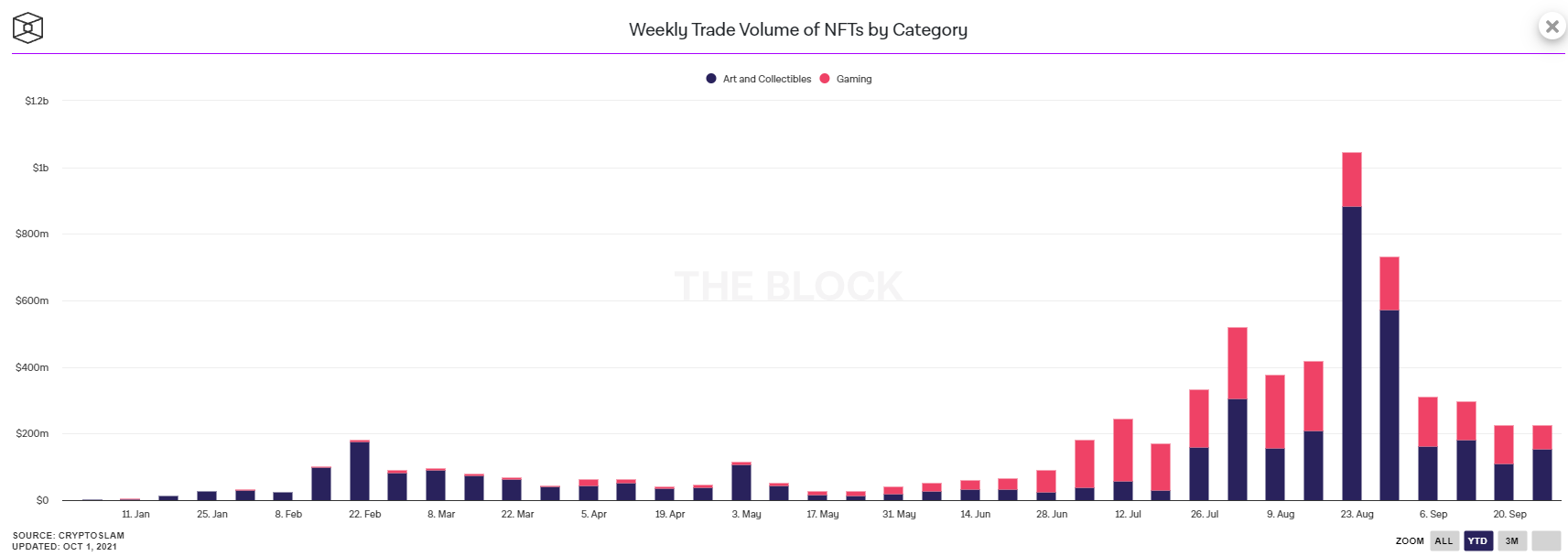

In August, the total volumes of traded NFTs hit $3.09 billion. The same in September fell to $1.05 billion. Volumes this week, in fact, were at their lowest level in 3 months.

NFT weekly volumes have dropped | Source: The Block – AMBCrypto

Ergo, if tomorrow these NFTs lose their value, the stablecoin could crash as well. However, the positive outlook is that unlike many stablecoin frauds in the past, NFT-backed coins will be safe. Especially since the collateral is the very asset you own.