Can Ethereum afford to miss the train when it comes to NFTs?

Institutional investors have been flooding the Bitcoin market, with their price gains over the past year providing ample evidence of the same. In fact, according to many, it was this flood of institutional entry that allowed the world’s largest cryptocurrency to go on a bull run and climb to its latest ATH on the charts. However, Bitcoin isn’t the only popular deal in the market. Thanks to the fact that the market is slowly becoming mainstream, institutions are investing in other forms too.

Bitcoin’s popularity and success have reaped rewards for the rest of the market, including the cryptocurrency industry’s alts, with Ethereum being one of them. Ergo, investment in Bitcoin has seeped into Ethereum as well. However, institutional investment in Ethereum is not the only way by which it as a platform stands to benefit. The emergence of Non-fungible tokens is a case in point here.

In order to understand this, it is also crucial to acknowledge the world of Non-fungible Tokens, commonly referred to as NFTs. A recent report by LongHash highlighted that institutions are exploring new business models based on blockchain and it is in this context that Ethereum-based Non-Fungible Tokens and digital collectibles are coming in.

According to the report, since the 1970s, a variety of art funds have become available, funds that give investors access to the growth that can come from owning one-of-a-kind assets such as paintings. Such art funds’ market may be transforming now to include NFTs and this, to a significant degree, further expands the range Ethereum as a platform is able to operate on and take advantage of.

The report went on to highlight that,

“It’s not just individual art collectors who are investing in NFTs. On February 12, 2021, Coatue Management, a well-known hedge fund, led a $250 million funding round for Dapper Labs, an NFT blockchain game development team, shocking the blockchain industry with the team’s $2 billion valuation.”

In the case of Ethereum, it is important to note that many of the main NFT projects on Ethereum are marketplaces for digital collectibles, such as OpenSea and Rarible. With regard to both of these market places, the report observed that they have thousands of daily active users, with their weekly transaction volume climbing to millions of dollars.

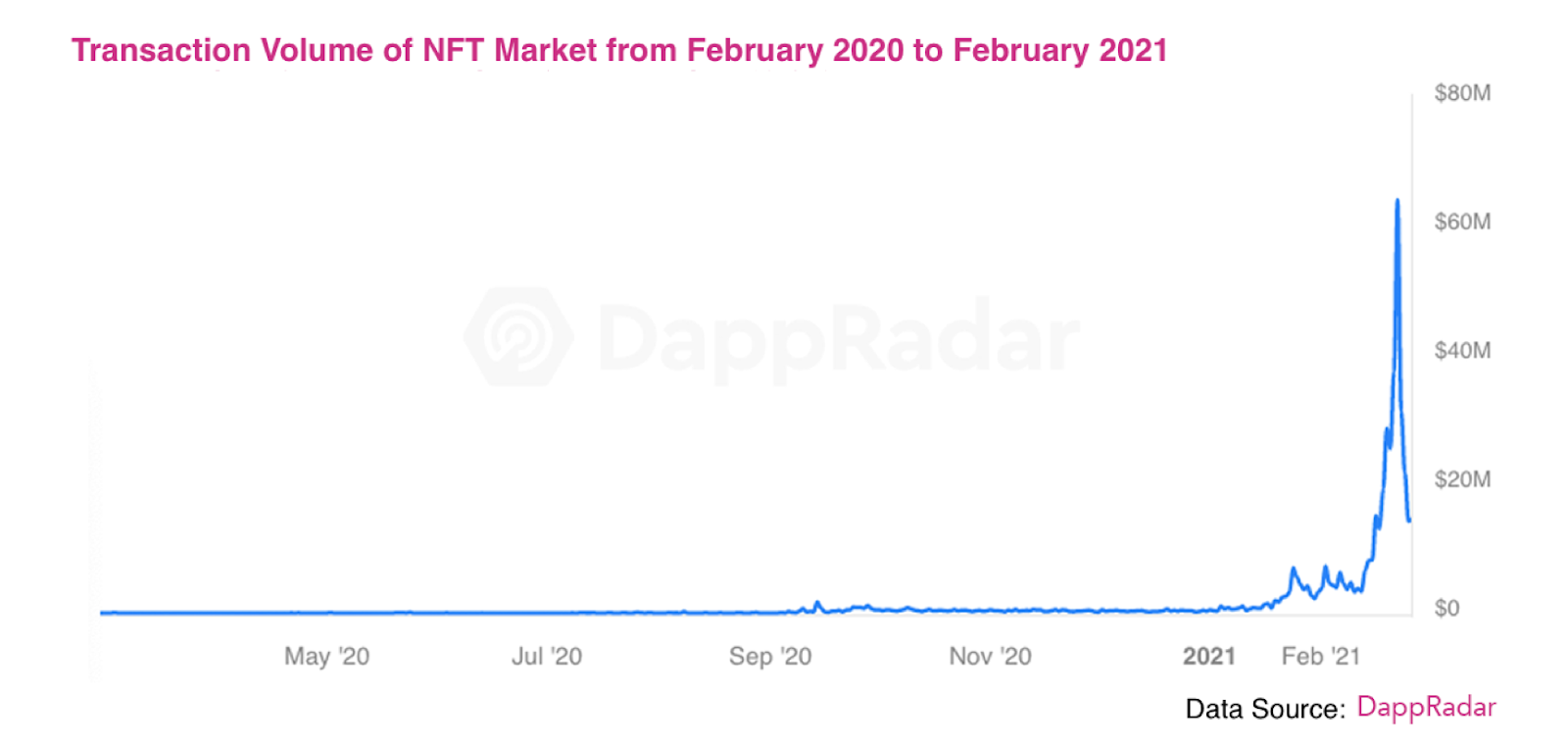

Ergo, the growth of the NFT market cannot be overlooked. From a single-day transaction volume of around $37,000, the volume surged and hit a whopping $64 million on 22 February 2021. The report added,

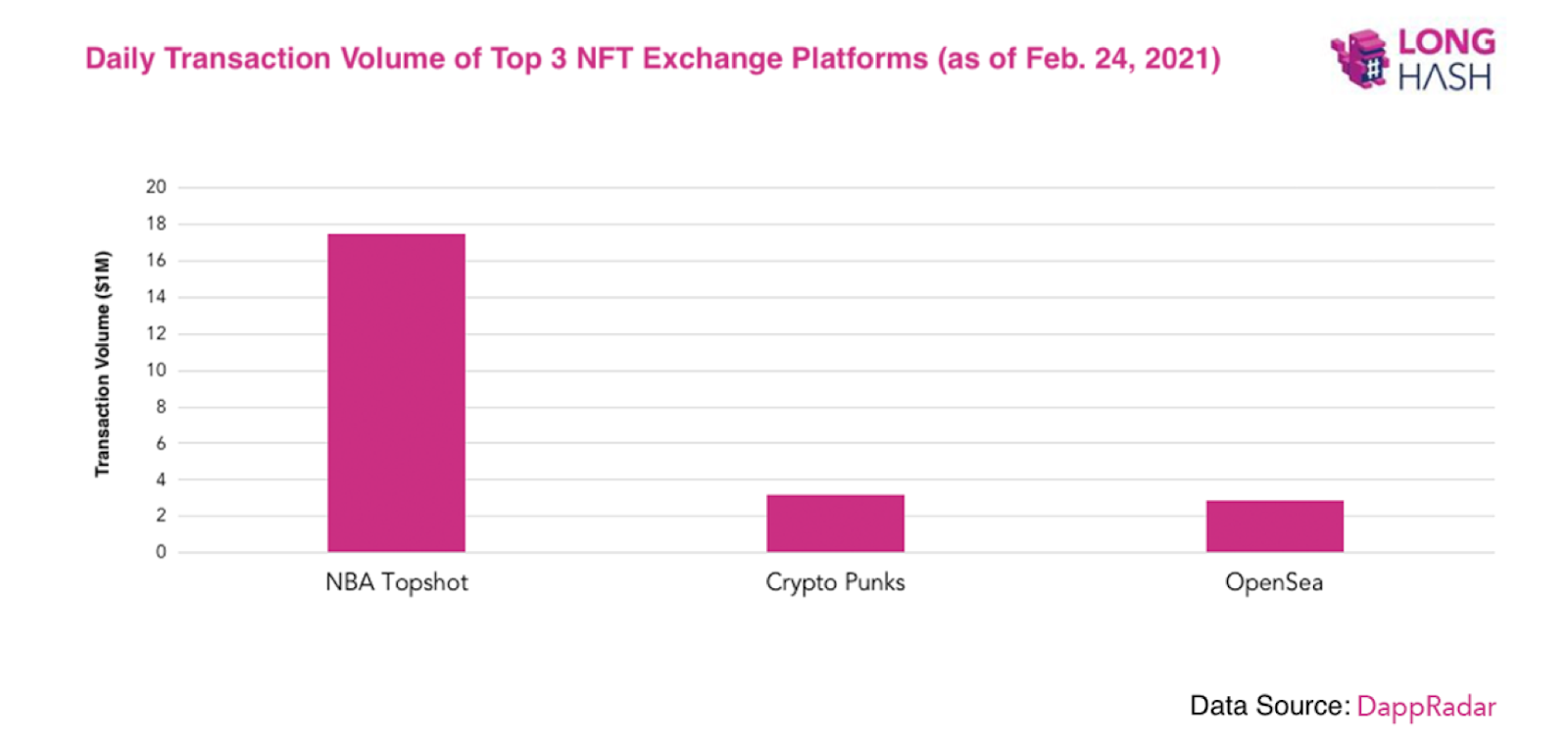

“According to DappRadar, the top 3 NFT products (in terms of trading volume) are NBA Top Shot (based on Flow), Crypto Punks collectibles (based on Ethereum), and OpenSea, an NFT exchange. “

While this may seem like yet another game-changer for Ethereum, akin to what DeFi has done for the platform, there are issues the world’s largest altcoin has to address if it has to retain its relevance in the world of NFTs. The scalability woes it endured when DeFi blew up in the market and surged in popularity can come back to haunt Ethereum in the present case as well.

LongHash’s report highlighted that because of Ethereum’s poor scalability, DApp developers have also been trying to build NFT-exclusive chains since 2018 such as WAX and Flow. Crypto-punk collectibles, based on Ethereum despite being one of the top three NFTs in the market in terms of daily transaction volume, trails NBA Top Shot (based on Flow) significantly, according to data provided by LongHash.

This goes to show that just as the NFT market is there for the taking from Ethereum’s point of view, addressing its scalability issues is of paramount importance if this opportunity is not to be lost in the coming year.

At the moment, NFTs are still a fairly new and emerging market and just as institutions doubled down on BTC last year, 2021 may see a similar influx with regard to NFTs. Given Ethereum’s promise as a platform, this year could be the year ETH gains massively.