Can Ethereum’s rebound change the game for Lido?

- Lido’s price rise leads to an increase in the market cap of liquid staking assets.

- At the time of this writing, LDO was trading at approximately $2.13

As the past week drew to a close and the new one began, Ethereum [ETH] experienced a minor rebound. Similarly, Lido Dao witnessed a comparable movement.

Data indicates that while the volume of staked Ethereum continued to rise, the dominance of the DAO also persisted.

Lido’s rise helps liquid staking market cap

Data from Santiment indicates that Liquid staking assets experienced a favorable performance over the weekend, with Lido being one of the notable gainers.

Reports show that the market capitalization of liquid staking assets surged by more than 5%. Specifically, LDO demonstrated a commendable increase of over 5% during this period.

How Lido has trended

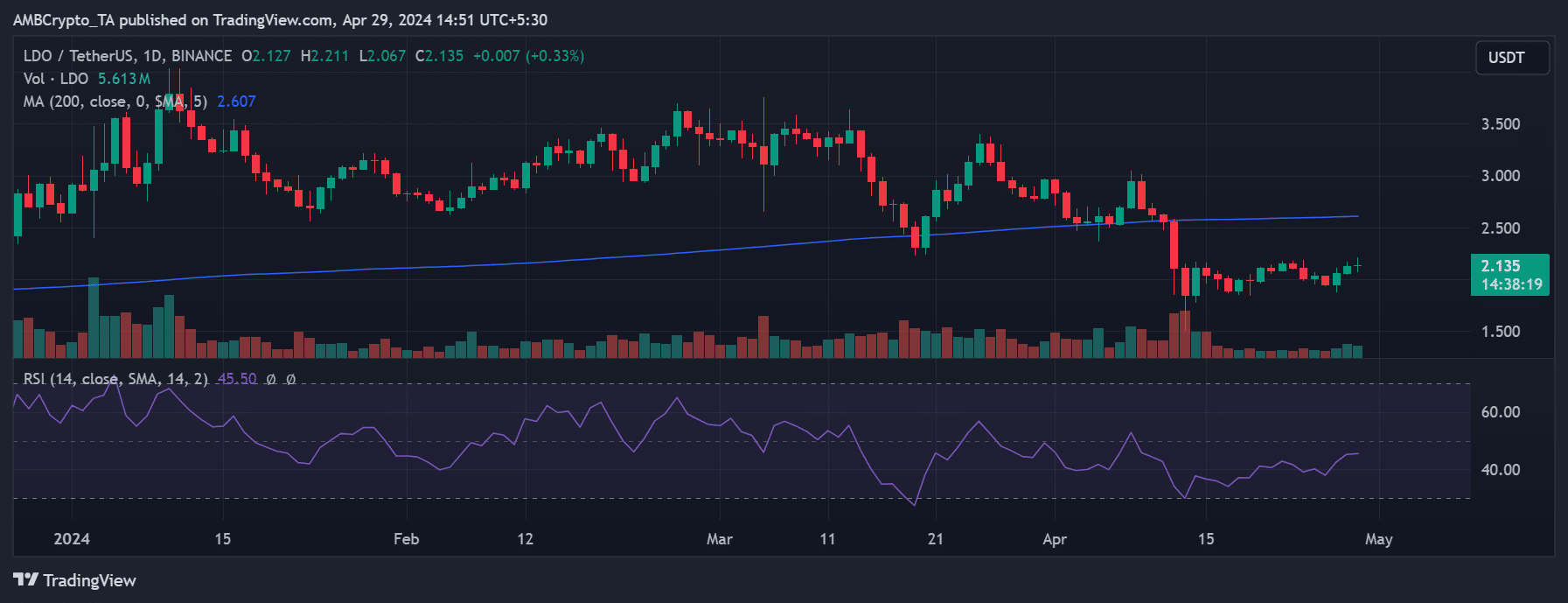

Analysis of Lido Dao’s price trend on a daily timeframe chart revealed a positive trajectory at the end of the previous week.

On 27th April, LDO experienced a notable increase of over 5%, reaching a trading price of approximately $2.05. The following day, 28th April, the upward trend continued with a further 3% increase, pushing the price to around $2.12.

At the time of this writing, it was trading at approximately $2.13, with a slight increase of less than 1%.

If this trend persists until the end of 29th April, it will mark the first and only three consecutive days of uptrend for LDO in the month. Before this, the last occurrence of such an uptrend was observed in March, happening only once.

Additionally, analysis of its Relative Strength Index (RSI) indicates that despite the recent positive movements, LDO remains in a bearish trend.

At the time of this writing, the RSI was below the neutral zone. Further examination suggests that since February, LDO has not sustained an extended period above the neutral zone, indicating a prevailing bearish trend in recent months.

However, despite the price fluctuations, the platform continues to maintain dominance in Ethereum staking.

Lido gets the most Ethereum stakes

According to data from Dune Analytics, more than 32 million Ethereum have been staked thus far, accounting for over 27% of the total supply.

Notably, Lido contributes significantly to this figure, representing 28% of the total staked ETH. This equates to over 9.3 million ETH staked through Lido.

Is your portfolio green? Check out the Lido Profit Calculator

Furthermore, the data reveals that staking activity has increased by approximately 6% over the last six months, indicating the platform’s continued dominance in Ethereum staking.

However, a closer examination of the data also unveils a recent decline in staking netflow over the past few weeks. This decline has coincided with decreases in Lido’s native token (LDO) and Ethereum prices.