Lido may be ending 2023 on a high, but there is a caveat

- TVL has grown by 3.5x since the beginning of 2023

- Increasing market share fueled security concerns for Ethereum

Lido Finance [LDO], the largest liquid staking protocol, recorded another fruitful month in November, confirming its place as one of 2023’s biggest success stories.

Sharp surge in staked ETH

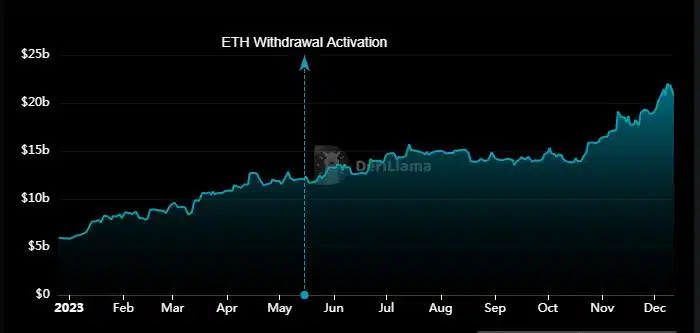

The total value locked (TVL) on the DeFi project went past $20 billion for the first time since April 2022, according to a November monthly report published by Lido. This marked a 18.61% hike since October.

AMBCrypto validated the statistics with DeFiLlama, which also revealed a 3.5x hike in TVL since the beginning of 2023. To put this in context, Lido’s TVL as of press time was more than the combined TVL of the second and third-ranked protocols on the list.

The deposits were significantly boosted after the launch of its version 2, which enabled users to withdraw their Staked ETH [stETH] to Ethereum [ETH]. With greater confidence in the staking process, users rushed to stake their ETH in pursuit of yields.

As per the report, staked ETH rose to 9.27 million, representing a marked increase of 5.17%. Moreover, ETH saw double-digit gains in its price in November, which further helped in boosting the USD value of the deposited funds.

Similarly, the number of unique ETH stakers exceeded the 200,000-mark, a hike of 2.96% from the previous month.

Not everything was worth celebrating

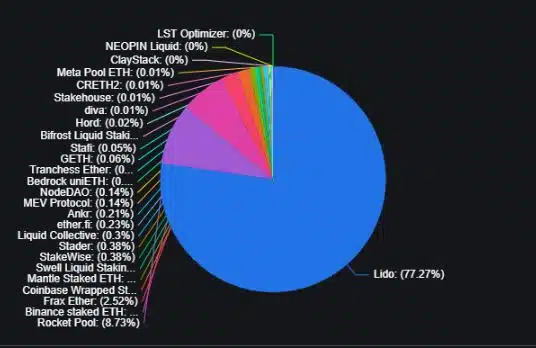

Clearly, Lido is the undisputed leader in liquid staking. Using DeFiLlama statistics, AMBCrypto uncovered an astounding 77.27% market share held by the staking powerhouse.

This aspect, however, has prompted concerns about centralization and the protocol posing a security risk to Ethereum. Without mincing words, Ethereum developer Evan van ness called Lido as the “biggest attack on Ethereum’s decentralization” in an X post some months ago.

Evan mentioned the 33% market share limit in the post, which if exceeded, may theoretically allow the protocol to manipulate the network.

Realistic or not, here’s LDO’s market cap in BTC’s terms

At the time of writing, the governance token of the protocol LDO was exchanging hands at $2.30, as per CoinMarketCap. Unlike the appreciation seen on the liquid staking front, the token has remained tepid of late, recording paltry gains of just 1.6%.