Can ETHPoW’s latest development work wonders for a struggling ETHW

Ethereum proof of work [ETHW] managed to make some noise in cryptocurrency market. In a tweet posted on 1 October, the new-found ETH chain, announced the launch of its first batch of dApps and services. The dApps would range from bridges,dex’s to NFTs.

We just released the 1st batch of the eco Dapps and services. https://t.co/0x0Ym05CKx

Feel free to add other Dapps in the comments –

1. Website

2. Functionality (keep it short, eg. dex)

3. A link to your product tutorial for ETHW users#ethw #ethpow $ethw #ethereumpow #buidl https://t.co/nNA6cUAS5Q— EthereumPoW (ETHW) Official #ETHW #ETHPoW (@EthereumPoW) October 1, 2022

Even though the ETHW community posted links to all the new dApps and services on their platform, there was a catch. ETHW stated that they wouldn’t be able to verify the legitimacy of all the projects listed on the network.

The list is for your information only.

We cannot endorse or verify the legitimacy of the projects listed.

DYOR DYOR DYOR #DYOR— EthereumPoW (ETHW) Official #ETHW #ETHPoW (@EthereumPoW) October 1, 2022

It also appeared that the ETHW team had been pooling their resources to encourage building on their ecosystem. However, will ETHW reacted positively to this massive ecosystem move made by the community?

Every action has a reaction…

According to OKLink, a blockchain information website, the total number of addresses grew by 5,059 as of 2 October. However, the total number of active addresses observed a massive decline. The total number of active addresses depreciated by 13,000 and stood at 34,000 at the time of writing.

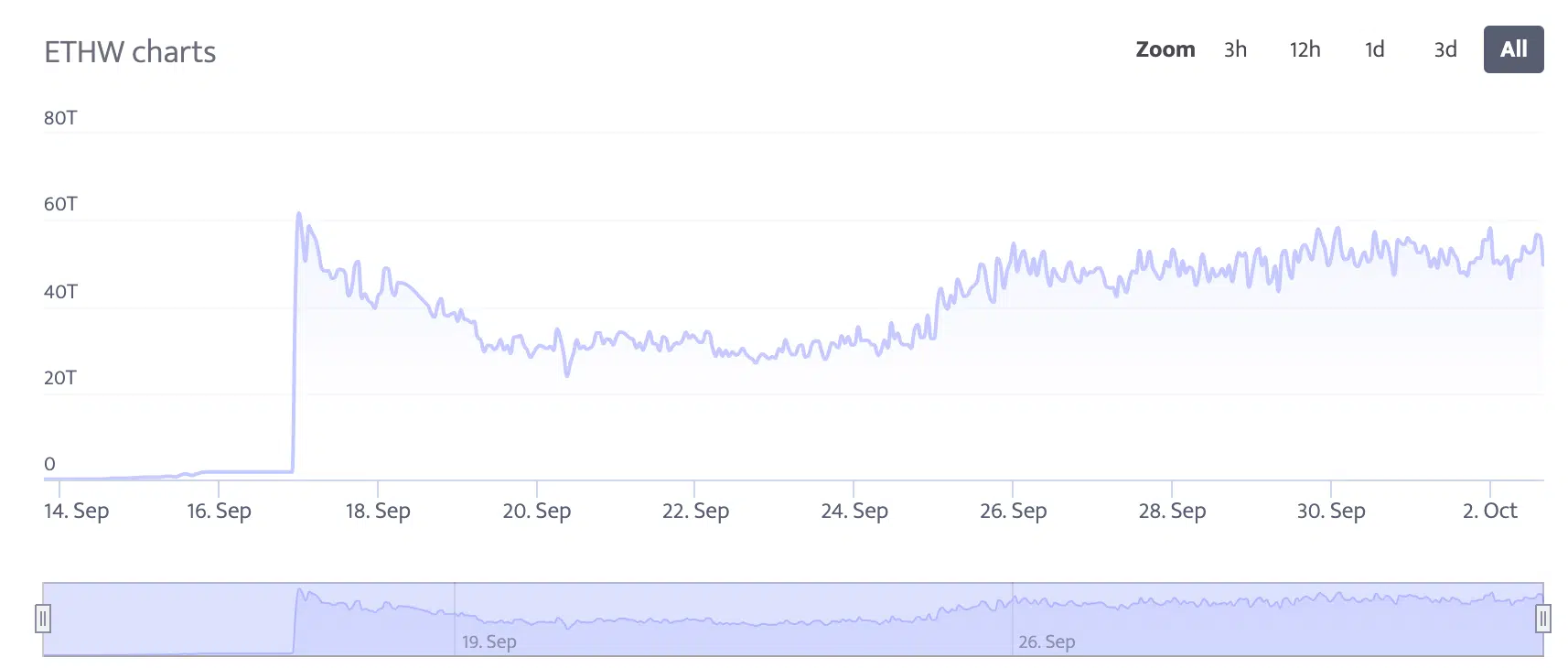

On the contrary, ETHW’s network hashrate was witnessing growth since 20 September, with slight or no volatility. This could indicate that the ETHW network was relatively strong and secure at the time of writing.

Additionally, the development could make miners more interested in ETHW. However, miners also need to consider network difficulty as another key component.

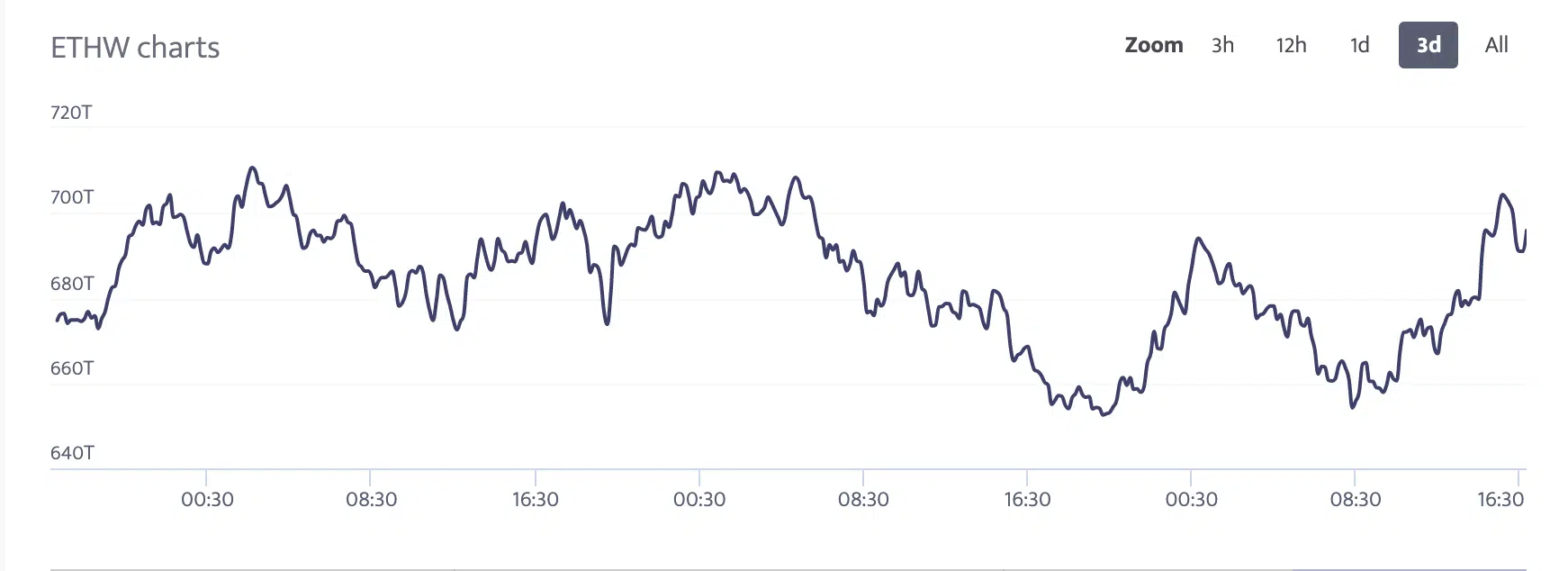

As can be seen from the image below, ETHW’s mining difficulty had been volatile over the last three days. With increasing volatility in this metric, miners may not be able to make a concrete decision about starting mining activities on ETHW.

Another cause of concern for miners and potential investors could be the price of ETHW. ETHW was trading at $10.67 at press time and was down by 3.2% in the last 24 hours.

A price for everything

After testing the $14.184 resistance on the 29 September, ETHW’s price went on a downward trajectory. However, at the time of writing, ETHW’s price retested the $10.47 support.

The Relative Strength Index (RSI) at 38.36 indicated that the momentum was with the sellers. The Chaikin Money Flow (CMF) didn’t print an optimistic outlook for the future of ETHW as well. At -0.23, the indicator inferred that the future of ETHW was bearish and the money flow was with the sellers.

Traders are thus advised to be cautious when entering into an ETHW trade as the lack of significant trading volume may lead to the token being manipulated by whales. Readers must also look into other developments before placing their bets.