Can Filecoin clear the $3.4 hurdle?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- FIL’s price has remained below $3.5 since September.

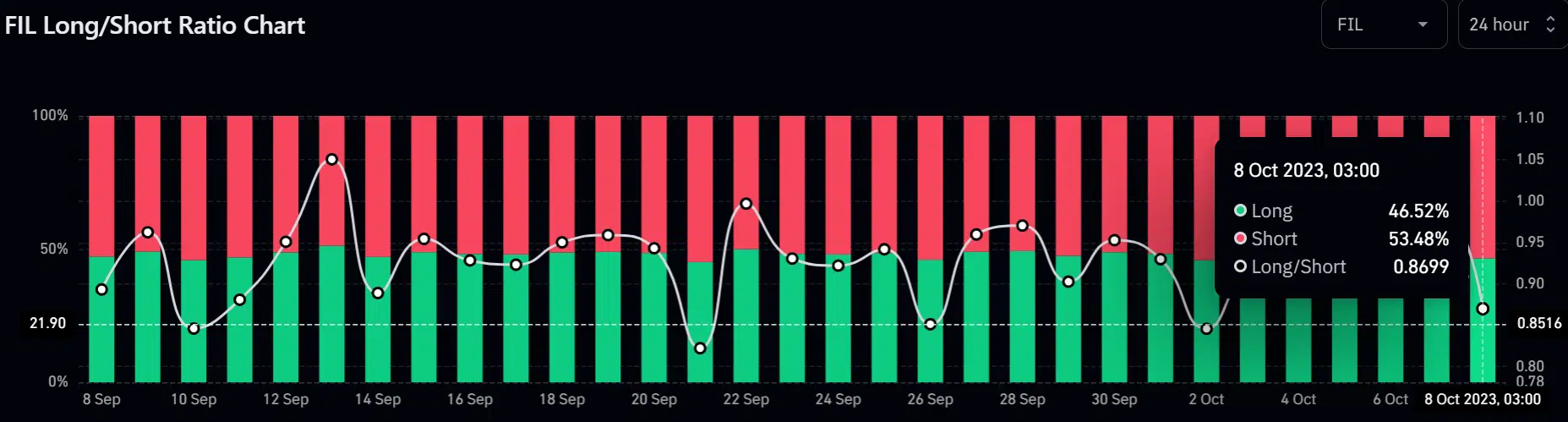

- Short bets overwhelmed long positions on 8 October.

Filecoin’s [FIL] recent rebound hit a familiar hurdle at $3.4 on 8 October. More short bets were recorded at the hurdle, suggesting further upside could be delayed at the roadblock again.

Is your portfolio green? Check out the FIL Profit Calculator

Meanwhile, Bitcoin [BTC] bulls and sellers jostled for control at $28k at press time. Any extra BTC losses could tip FIL sellers to exploit the $3.4 roadblock.

In the previous FIL price prediction, AMBCrypto was bearish on the asset after bulls retreated from $3.45. But bulls regained control and retested the overhead roadblock. Here’s what lower timeframe traders can look forward to.

Will the bulls smash the roadblock?

The roadblock and H12 bearish order block (OB) of $3.364 – $3.489 (white) have set FIL to three price reversals to the downside.

However, the recent reversal didn’t extend to the bullish zone and daily bullish OB of $2.950 – $3.127 (cyan). As such, the overall price action between mid-September and press time formed similar highs (at the roadblock) with higher lows – A typical rising triangle pattern.

The pattern is typically bullish, suggesting that a bullish breakout couldn’t be overlooked. If so, especially if BTC surges above $28k, FIL could clear the $3.4 roadblock and focus on the next target at the roadblock below $3.8.

Conversely, BTC faltering could set FIL to drop at the $3.4 hurdle. FIL could retreat to $3.2 and the daily bullish OB in such a case.

Meanwhile, the RSI exhibited a downtick but was positive at press time. It denotes buying pressure eased slightly. However, the CMF was negative, underscoring significant capital outflow from FIL markets.

More players tool short bets against Filecoin

How much are 1,10,100 FILs worth today?

The capital outflows at press time were followed by increasing short bets against the asset at press time. According to Coinglass’s FIL Long/Short Ratio, there are more short positions (>54%) compared to longs (46%), denoting more players expected reversal at the $3.4 hurdle.

But a bullish BTC could lead to a short-squeeze at the $3.4 roadblock and calls for seller caution. Notably, FIL’s Open Interest rates were up +10% as volume surged 70% at press time. It underscores the precarious FIL’s position and calls for closely tracking BTC price action.