Can higher low be the next probability for The Graph (GRT) investors

The Graph (GRT) achieved a new April low on 25 April at $0.32, allowing its price to extend its monthly decline past 40%. It quickly bounced back slightly over 20% from its new monthly low.

GRT’s current monthly low represents a 40.81% from its 0.55% monthly high that it achieved on 2 April. Looking back at GRT’s price action from mid-April, one can see a lot of sideways action characterized by low volumes. The cryptocurrency failed to secure significant buying volume despite the bearish trend exhaustion.

The $0.34 price level acted as healthy support with healthy accumulation countered any selling pressure within that price range. The price may have lacked significant buying pressure because the overall crypto market was on a bearish trajectory. However, GRT bulls finally got a chance to flex their muscles as the global market cap bounced back above $1.8 trillion.

Is GRT ready for more upside?

The strong uptick might be a sign that GRT is ripe for a bullish recovery considering that it is heavily discounted from its $2.8 ATH. The lack of strong bullish pressure is evident in GRT’s inability to hold on to the strong gains achieved between 25-26 April.

This is despite healthy accumulation indicated by the MFI, as well as the RSI’s sustained lateral performance in the last 10 days.

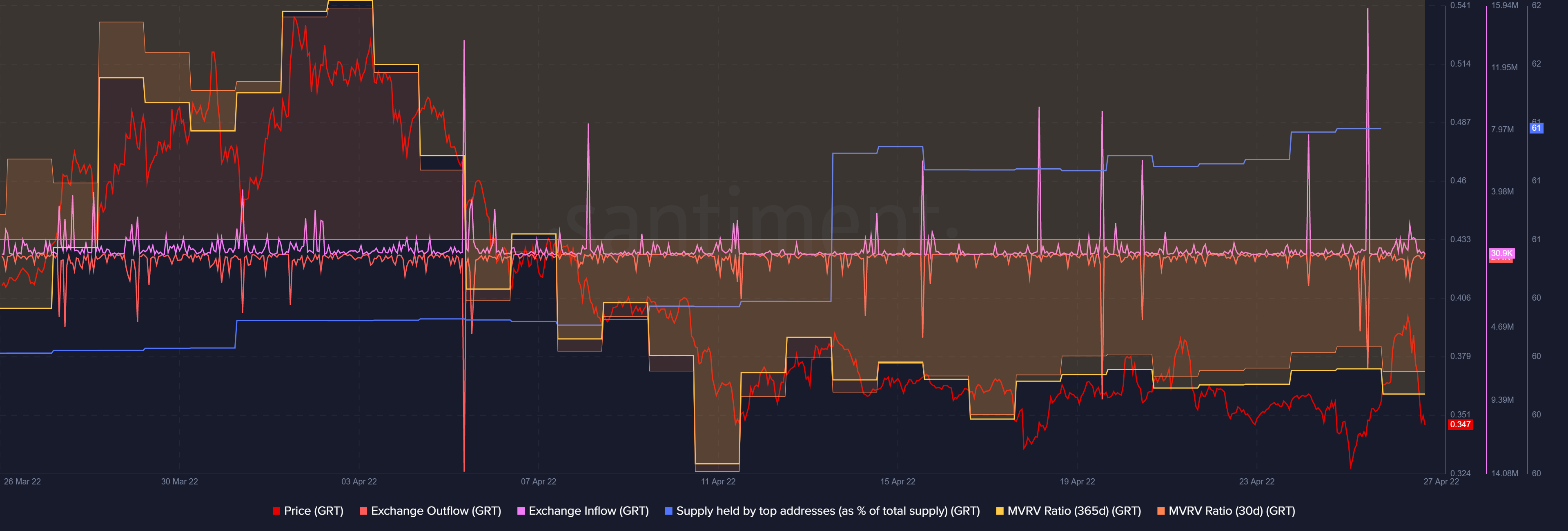

GRT’s on-chain metrics seem to be showing heavy whale activity. For example, there have been spikes in exchange inflows and outflows in the last few days.

The supply held by top addresses has increased in the last four weeks. Its 30-day MVRV ratio registered upticks followed by dips, forming an overall lateral performance from mid-April.

On-chain metrics reveal…

The exchange inflows match the outflows and they also align with the MVRV ratio’s performance. This might be a sign that whales are currently playing the market by buying the dips and selling after slight upticks so they can accumulate more. It also explains why the supply held by top addresses has been increasing in the last 30 days.

As far as price direction is concerned, the currently discounted price level makes it a healthy time to be accumulating GRT. Accumulation is more likely to happen near the bottom, or when there is a perception that the price is oversold. The whales seem to be playing with the market psychology, especially with the upside expectations.

The above conclusion does not necessarily mean that the price cannot seek more downside. The whales can crash the price, pushing it to lower lows if they embark on another massive selloff. However, the extent of the downside would depend on whether this would trigger panic selling by HODLers in the retail market.