Can LINK’s price and volume surge distract traders from these troubles?

- Substantial LINK deposits sparked uncertainty regarding the cryptocurrency’s trajectory as it experienced a surge in price.

- Despite the recent price increase, Chainlink lagged in user growth and witnessed a decline in development activity.

The movement of large sums of Chainlink[LINK] captured the crypto community’s attention. This triggered speculation about the cryptocurrency’s next moves. As various altcoins surged in the wake of Bitcoin’s [BTC] rally, LINK seemed to lag behind, raising concerns among traders and investors.

Is your portfolio green? Check out the Chainlink Profit Calculator

Large addresses make moves

One noteworthy aspect was the apparent lack of whale interest in LINK. Data from Arkham Intelligence revealed a substantial deposit of $7 million worth of LINK to Binance over just an eight-hour period by a significant CEX trader, known as 0x5bA.

Strikingly, LINK’s price saw a 6.5% decline during this deposit, highlighting the potential impact of whale movements on the cryptocurrency.

0x5bA still holds another $3M of LINK.

Shall we check back again in 8 hours?

Follow their movements for yourself on Arkham:https://t.co/kkwEZkueR7

— Arkham (@ArkhamIntel) October 23, 2023

Despite the lack of substantial whale interest, LINK displayed notable price and volume surges in the past three days. It gained over 30% since the start of the weekend. This trend was further exemplified when 0x5bA deposited $3 million worth of tokens to Binance after receiving over $10 million in LINK earlier.

This wave of large-scale transfers can have a significant impact on LINK’s price dynamics. At the time of writing, LINK was trading at $10.264. However, the number of LINK holders decreased substantially in recent days, accompanied by a notable decline in LINK’s velocity.

Despite these challenges, a substantial number of traders remained optimistic about LINK’s price growth. Coinglass data revealed that long positions made up 56.9% of all trades, indicating sustained trader confidence in LINK’s potential.

Realistic or not, here’s LINK’s market cap in BTC’s terms

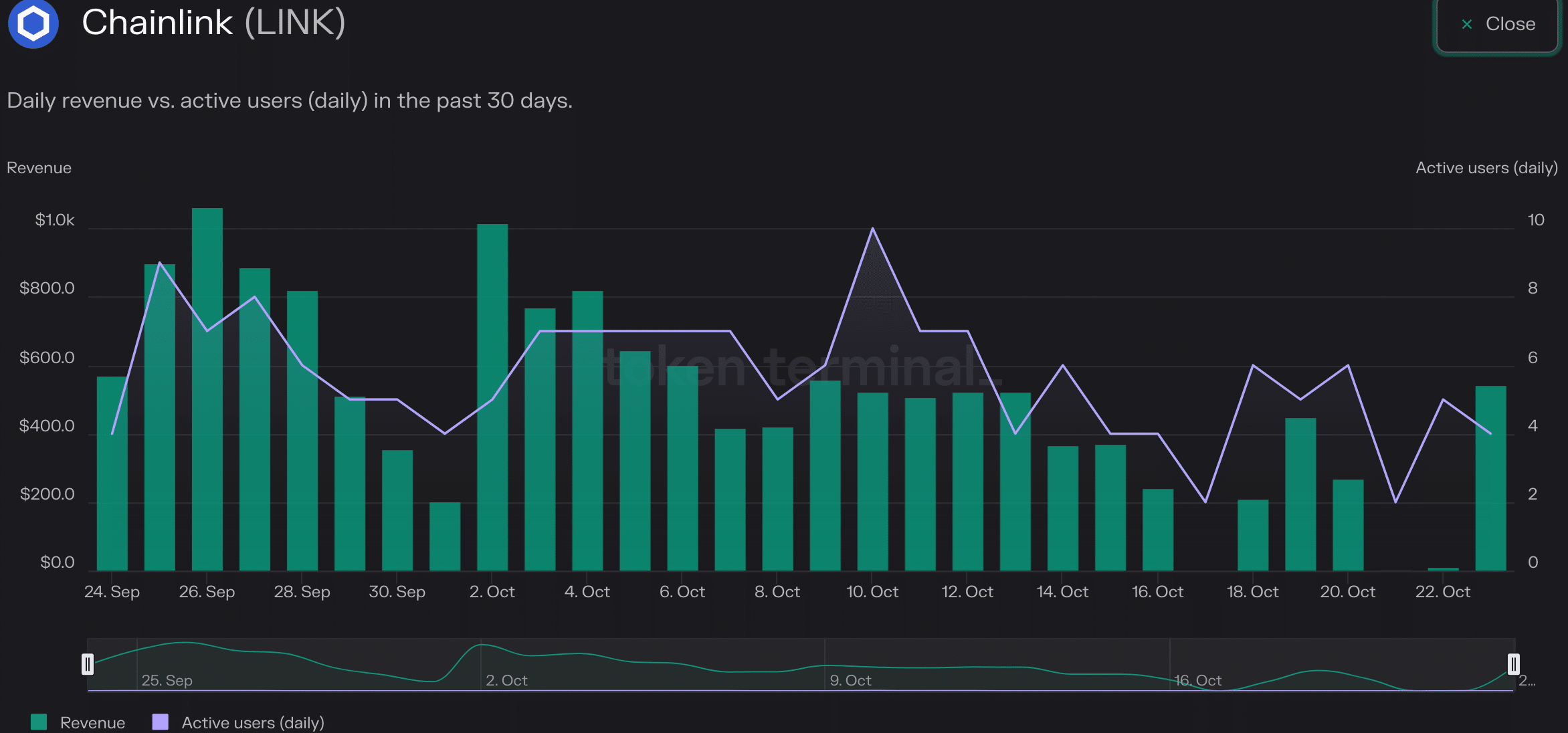

Taking a closer look at the protocol’s performance, the past week experienced a remarkable 100% increase in the Number of Active Users on the network. This surge in user activity seemed promising, but it was juxtaposed with a concerning 51.52% decline in the Daily Revenue generated on the protocol during the same period.

The dynamics of Chainlink’s Development Activity presented another concern. Over the last month, the data revealed a significant 35.5% decrease in code commits.

Additionally, the number of core developers associated with the LINK protocol decreased by 14.4% in the same timeframe. Such trends could potentially have adverse effects on Chainlink’s future prospects.