Why Filecoin’s revenue plunged 60% in Q3

- Filecoin’s revenue suffered a decline in Q3.

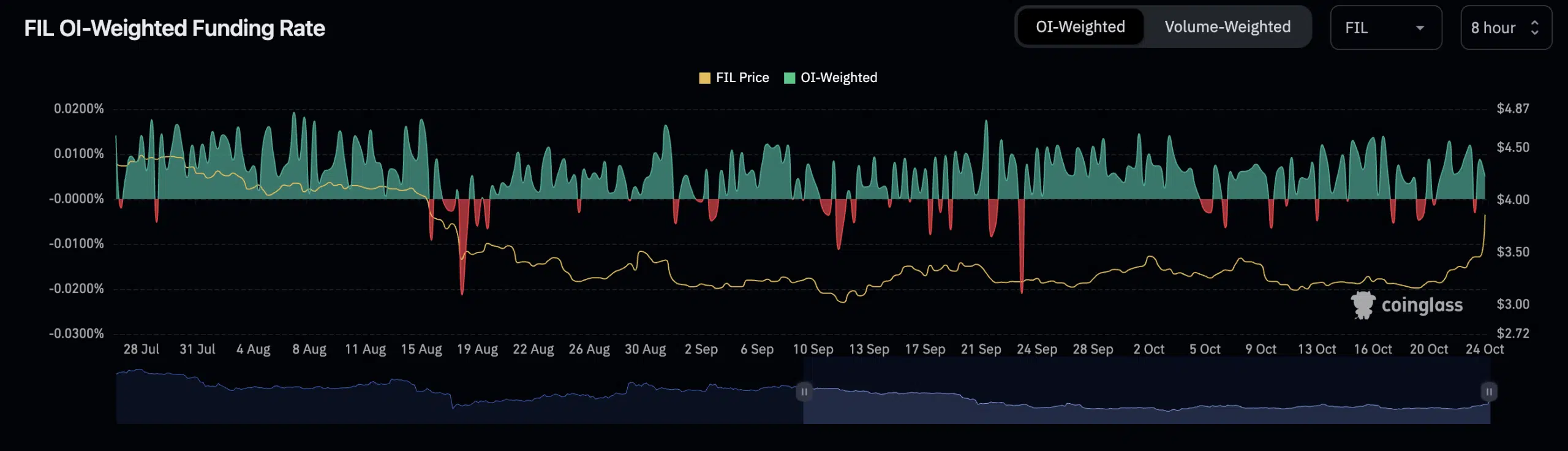

- In the coin’s derivatives markets, participants continued to maintain a bullish outlook.

Leading decentralized storage network Filecoin [FIL] suffered a 60% dip in protocol revenue in the third quarter, Messari found in a new report.

Read Filecoin’s [FIL] Price Prediction 2023-24

According to the on-chain data provider, Filecoin’s revenue decline between July and September was due to an “overall decline in demand-side revenue across the decentralized cloud storage space” during that period.

The Filecoin network is used to store data by both the demand side (storage users) and the supply side (storage providers).

On its demand side, storage users can create storage deals on Filecoin, specify the amount of data they need to store, the duration of the storage, and the price they are willing to pay.

Moreover, Filecoin requires storage users to pay certain fees in the protocol’s native token FIL. These fees incentivize storage providers to store data reliably and prevent the network from being spammed.

On its supply side, storage providers can register their storage capacity on the Filecoin blockchain and then bid on storage deals to offer their storage capacity to storage users.

According to Messari, Filecoin’s Demand-side base fees (the minimum fees paid to store data on the network) plummeted by 72% during the period under review. The analysis further noted,

“In line with base fee declining, all the other FIL fees that accrue to the protocol revenue (penalty, batch, and overestimation fees) declined QoQ.”

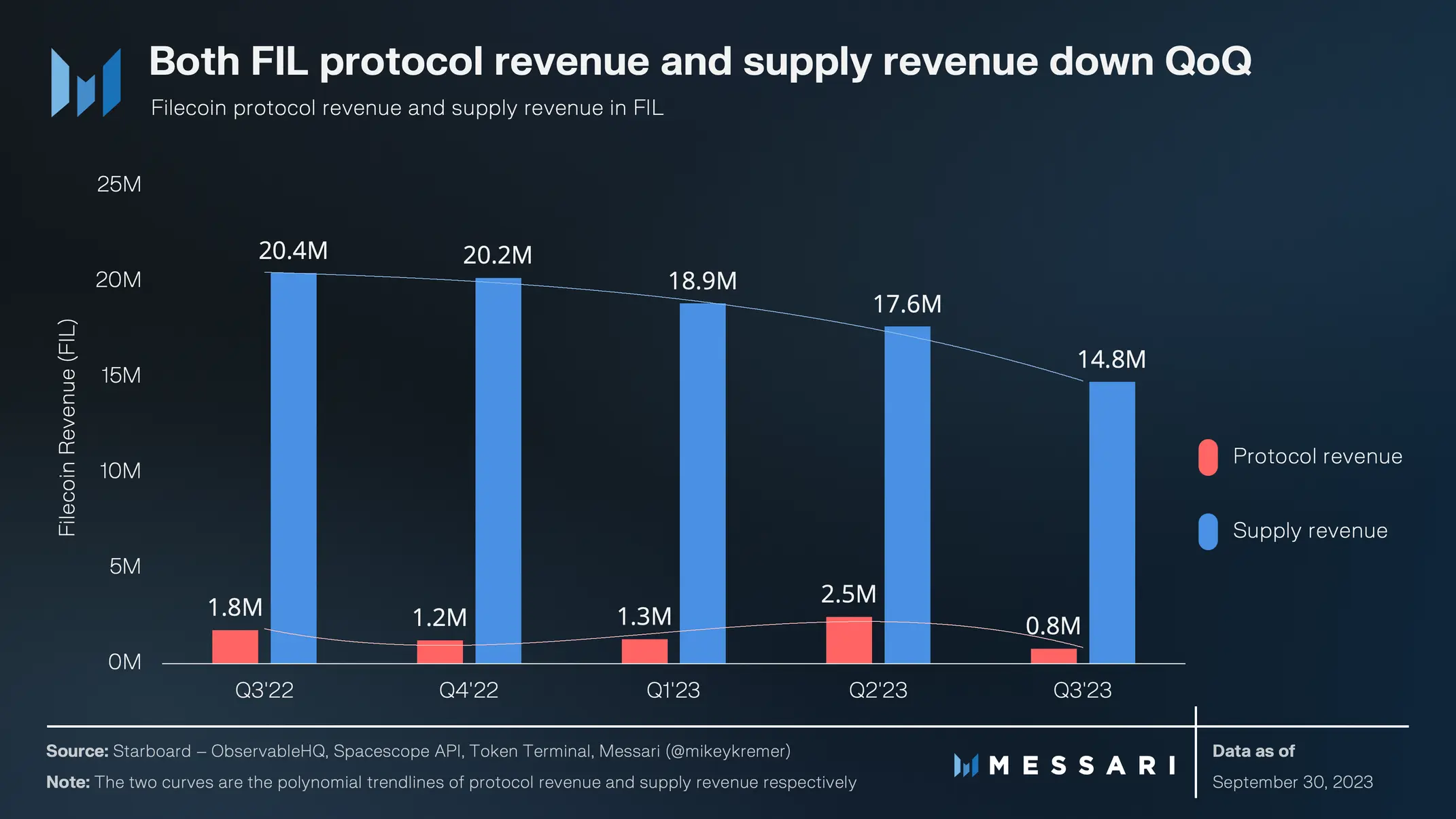

Between July and September, Filecoin’s protocol revenue totaled $14.8 million, declining by 15% from the $17.6 million recorded in Q2. Filecoin’s supply-side revenue measured in FIL also plummeted. Messari found.

“Supply-side revenue in FIL decreased 16% in Q2’23 to 14.8 million FIL (down 34% in USD terms). The decrease was driven by an overall reduction of FIL reward issuance due to the exponential decay model and primarily the baseline minting model.”

During the period under review, Filecoin’s supply-side revenue derived from block rewards, storage deal payments, and tips to speed up transactions totaled $800,000, witnessing a 68% decrease.

State of FIL

At press time, FIL exchanged hands at $3.80. Benefitting from the general market uptrend in the past 24 hours, FIL’s value rallied by 9% in the last 24 hours, according to data from CoinMarketCap.

How much are 1,10,100 FILs worth today?

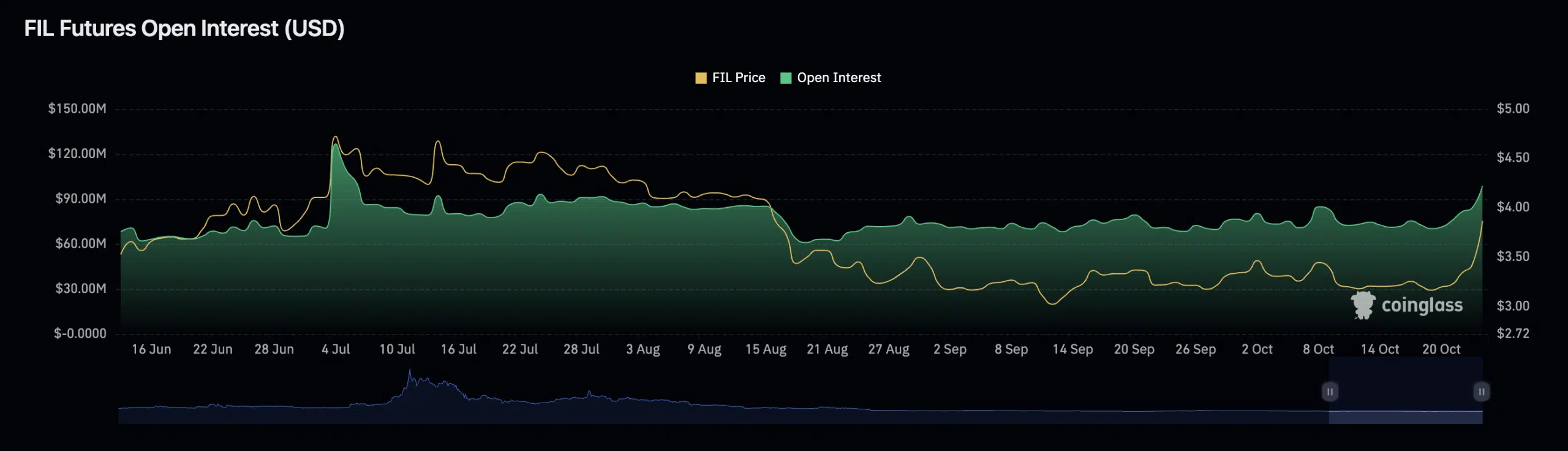

With an 18% jump in value in the last week, FIL’s Open Interest in the derivatives market has increased. At $99 million at press time, this has climbed by 32% in the last three days, data from Coinglass showed.

With the market significantly marked by positive funding rates at press time, participants continued to open trade positions in favor of a price rally.