Can Maker’s ‘world-first’ move merge DeFi with traditional banking

Maker was one of the most-discussed altcoins of the week. The Decentralized Finance protocol proposed the move of integrating the traditional banking system into its ecosystem.

The response being overwhelmingly positive might open doors for many more similar instances.

Maker goes big

The MakerDAO community recently voted on the proposal of adding a 100 million DAI (MakerDAO’s stablecoin) ceiling participation facility of Huntingdon Valley Bank as a vault.

This marked the first-ever collateral integration between a bank and a DeFi protocol. Thus, allowing such banks to borrow against their assets using DeFi.

Now, it would be highly beneficial for small banks such as the Huntingdon Valley Bank, which holds about $500 million worth of assets while the Total value locked on MakerDAO exceeds $7.3 billion.

Furthermore, MakerDAO has been supporting the recovery of other protocols as well, such as the Celsius Network which recently paid off the entire debt it owed to Maker to reclaim its $440 million collateral.

The merge of DeFi with banking could also serve as a boost for MakerDAO, which over the past three months has been noting a gradual increase in the lending revenue.

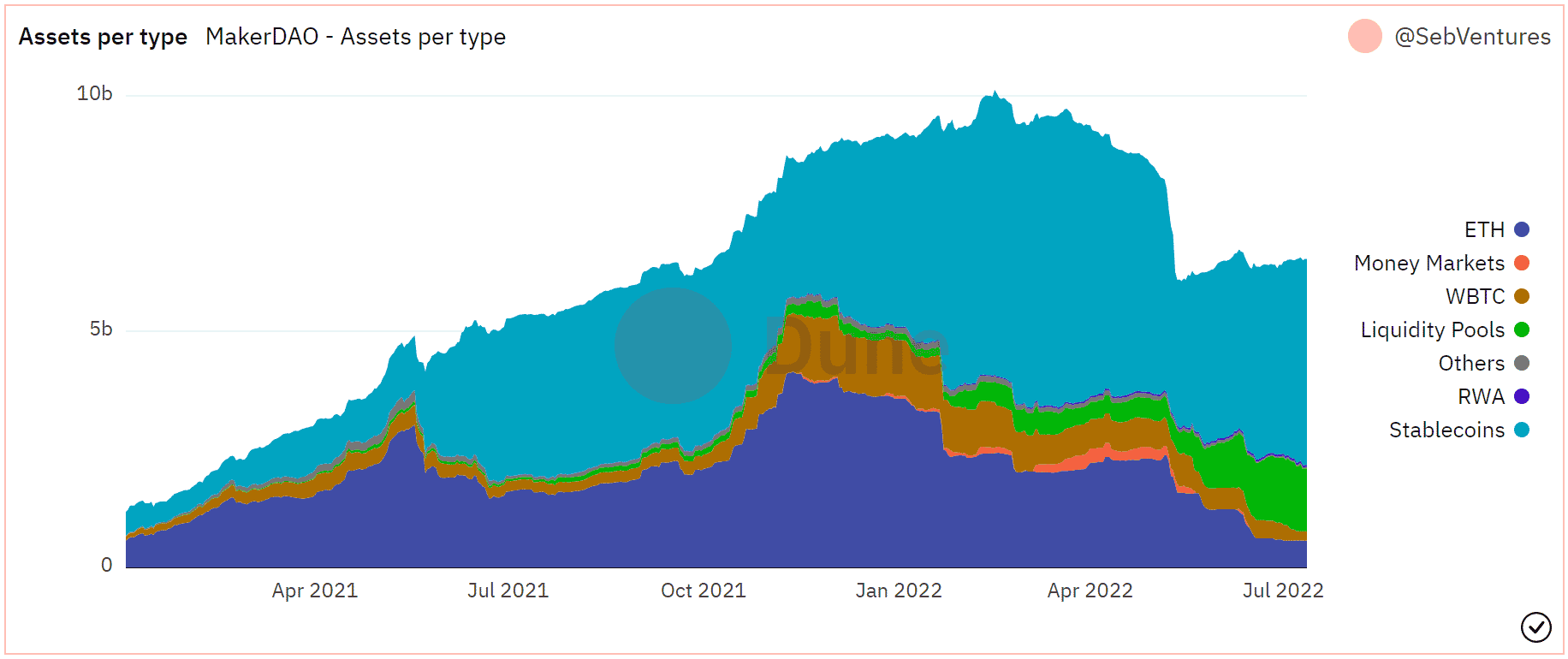

After peaking at almost $10.2 billion back in February this year, the revenue began declining and hit a 7-month low of $5.7 billion in May.

But since then, despite the worsening market conditions, revenue from lending assets has risen and currently amounts to $6.2 billion.

MakerDAO lending revenue | Source: Dune – AMBCrypto

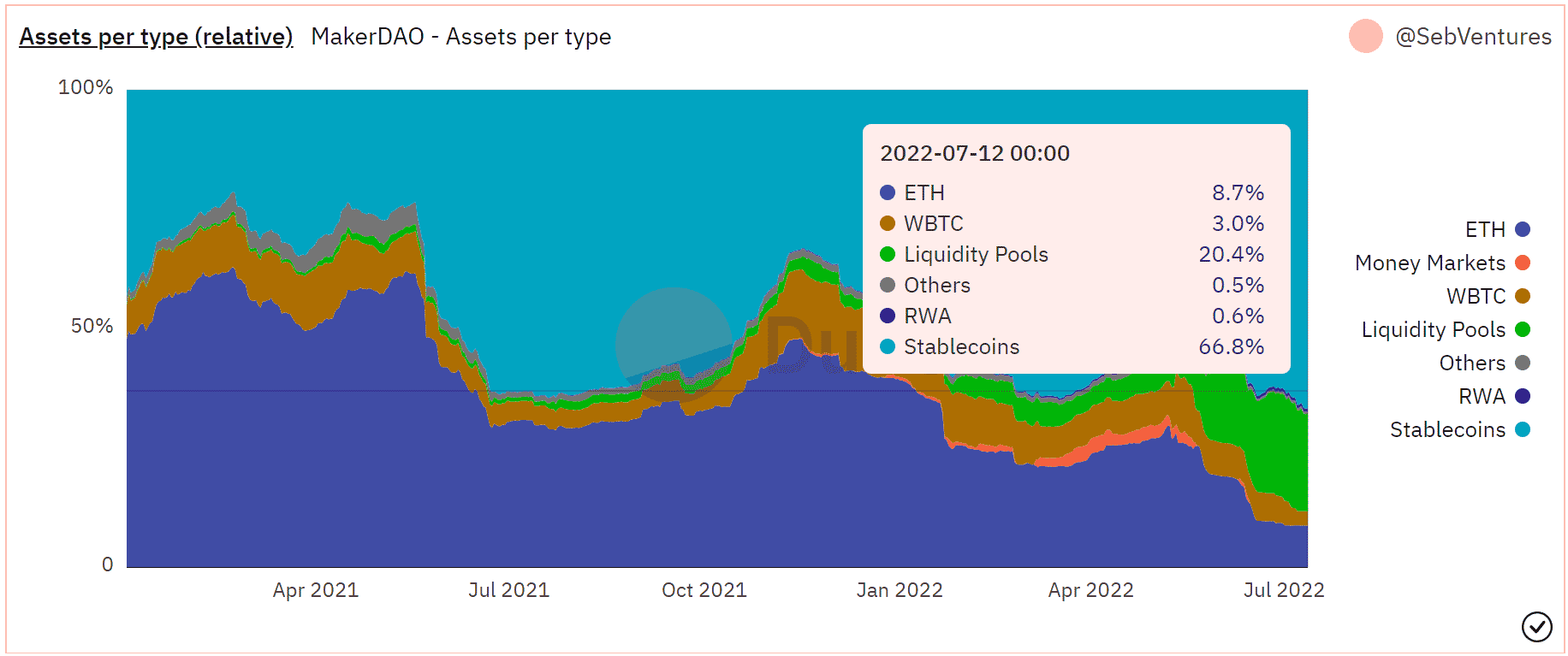

Not so surprisingly, most of the revenue generated has been in the form of stablecoins instead of cryptocurrencies. Up until October 2021, the ratio of borrowed assets was dominated by Ethereum with a 45% share, while stablecoins only accounted for 33.5% share.

Lending revenue by the asset | Source: Dune – AMBCrypto

At the time of writing, the same ratio changed to 8.7% for ETH, and 66.8% for stablecoins, as the latter has been the only asset to not lose their value with the exception of Terra and the momentary depegging of Tether.