Can OpenSea’s new move overthrow Blur in the coming days

- OpenSea Pro will have 0% marketplace fees for a temporary period.

- OpenSea lost 21% of its market share in total trading volume since February.

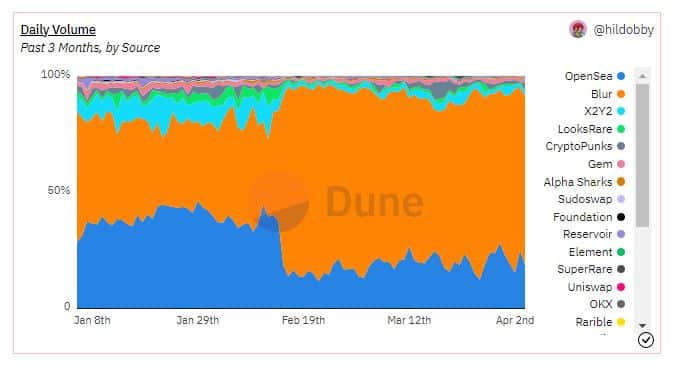

OpenSea was hit hard recently because of the Blur [BLUR] storm that swept the NFT marketplace ecosystem in 2023. As per data from Dune, OpenSea lost a whopping 21% of its market share in total trading volume since February. At the time of writing, its share of the pie was reduced to 18% while Blur was the undisputed leader at over 72%.

Even after making radical changes in its marketplace policy such as scrapping service fees, OpenSea was not able to attract NFT traders back to its fold. However, the popular marketplace has geared up for its next move which could provide just the right impetus it needs at the moment.

How much are 1,10,100 BLURs worth today?

Say hello to OpenSea Pro!

OpenSea announced on 4 April the launch of OpenSea Pro, a marketplace offering advanced trading tools to cater to professional NFT traders. It is a rebranded version of Gem V2, the NFT marketplace aggregator which was acquired by OpenSea last year.

OpenSea Pro will aggregate listings from more than 170 marketplaces, providing greater variety and control to its users. Additionally, as part of an early bird deal, the platform won’t charge any transaction fees for a promotional period.

On the other hand, the parent entity OpenSea announced in a separate tweet that it was reverting to its standard 2.5% marketplace fees starting 4 March.

Today, we’re excited to unveil OpenSea Pro (previously Gem v2) – the fastest and most powerful NFT marketplace aggregator in the industry! Some history in the ?below https://t.co/bjpBKSyNZo

— OpenSea (@opensea) April 4, 2023

Sales volume vs. sales count

The strategic decision to roll out a marketplace for professional traders comes on the heels of rival Blur which adopted a similar policy.

To this date, Blur charges 0% transaction fees from its traders and enforces only a 0.5% minimum royalty. Opensea introduced a royalty fee later in the face of growing competition. This boosted high-value transactions on Blur, giving it dominance in the trading volume.

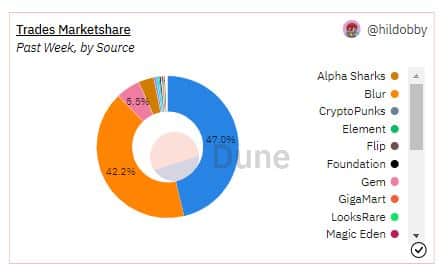

However, despite the falling volume, OpenSea continued to attract a large chunk of individual investors. Dune data revealed that OpenSea accounted for 47% of the total sales last week while Blur captured 42%.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/08/Bitcoin-BTC-400x240.webp)