Can Uniswap prices break past $14 after a 70% rise?

- Uniswap has recorded a 13.34% surge in the last four days

- Key indicators show a continued bullish momentum and a breakout from $12.

Uniswap [UNI], the decentralized exchange, has been in recovery for the last seven days as it’s price surged by over 13%. However, in the last 24 hours, it has recorded a 2.7% drop after experiencing a price surge the previous day.

In fact, at press time, UNI was trading at $11 following its latest correction at $6.7. Since starting a bullish trend, the asset has gained over 70% in three weeks, pushing the prices to $11.9.

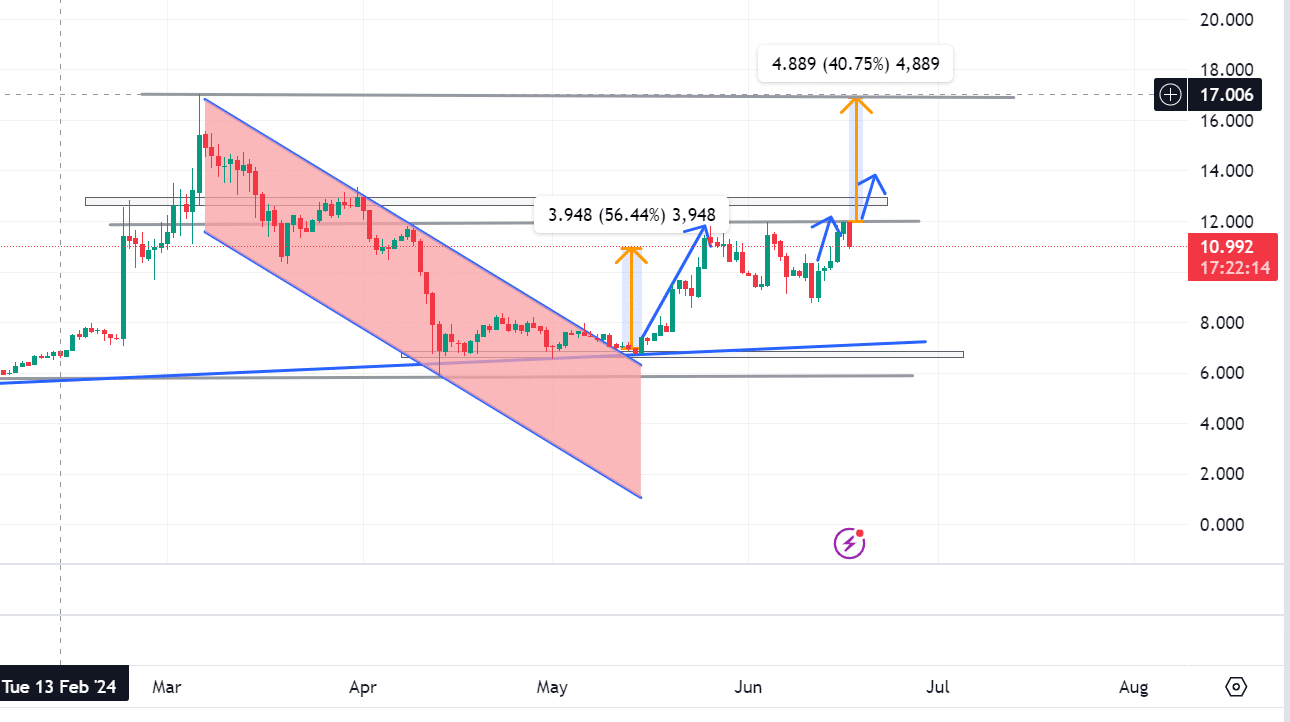

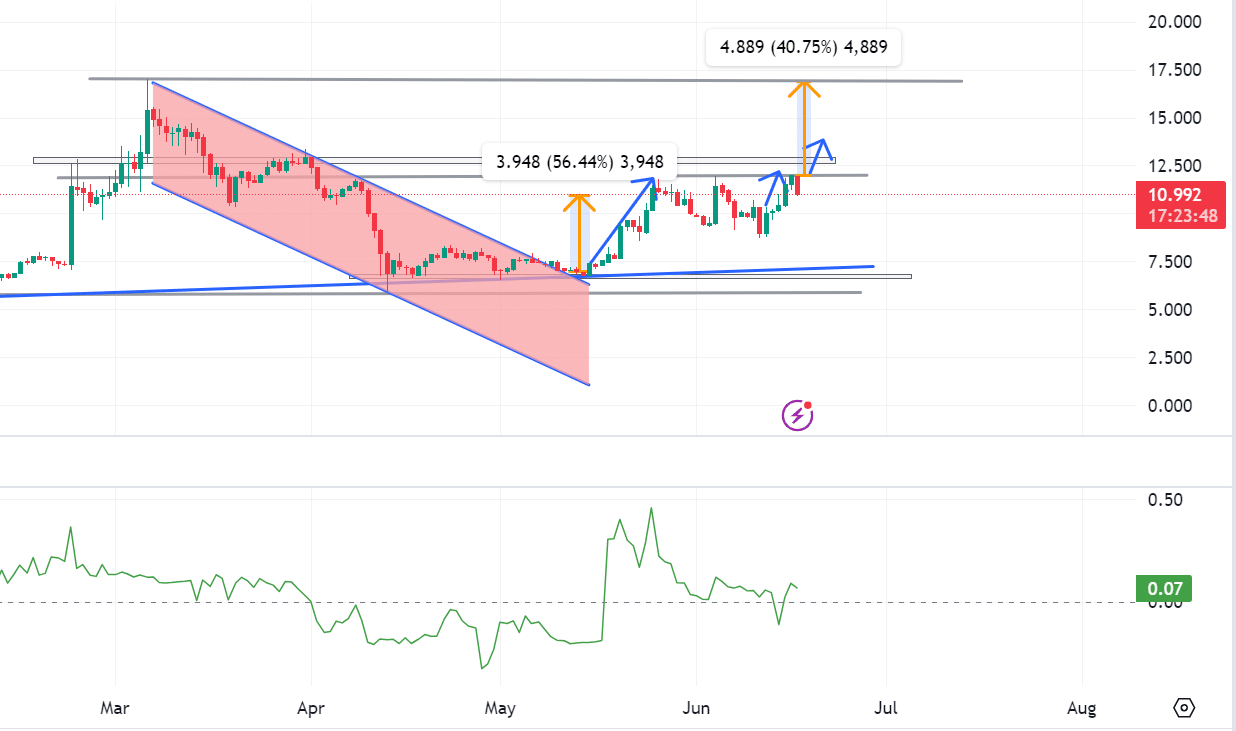

AMBCrypto’s analysis indicates that the current price was 74% below its highest level while enjoying a 2540% increase from ATL. From its lowest price of $6.9 on 3rd May, it has recovered by 56.4% to $10.92.

The current price indicates a continued bullish trend with the potential to break the $12 resistance level. With a 56% rise above the resistance level, the prices can surge past $14 with $13.7 as its potential next price shift.

Also, the current positive CMF of 0.07 indicates higher buying pressure than selling. A higher buying pressure implies extended accumulation rates than sell-offs.

The indicators reinforce the bullish trend’s continuity.

Uniswap’s market outlook

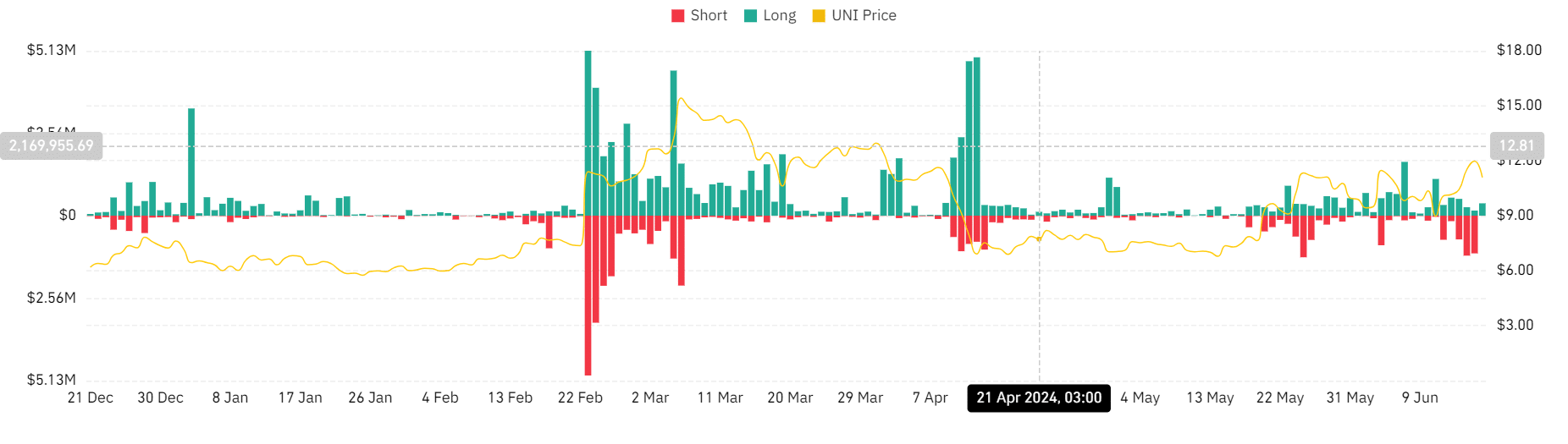

Looking further, according to Coinglass, UNI has reported low liquidation rates. Coinglass data indicates that investors at short positions have the lowest liquidation rates of $2.43k at press time.

At the same time, long positions have higher liquidity levels of $383k.

However, the overall liquidation is low and sets for a further fall. This low liquidation shows stable market conditions, with fewer traders having to sell their positions.

Thus, low selling pressure helps maintain existing prices while supporting a gradual price increase.

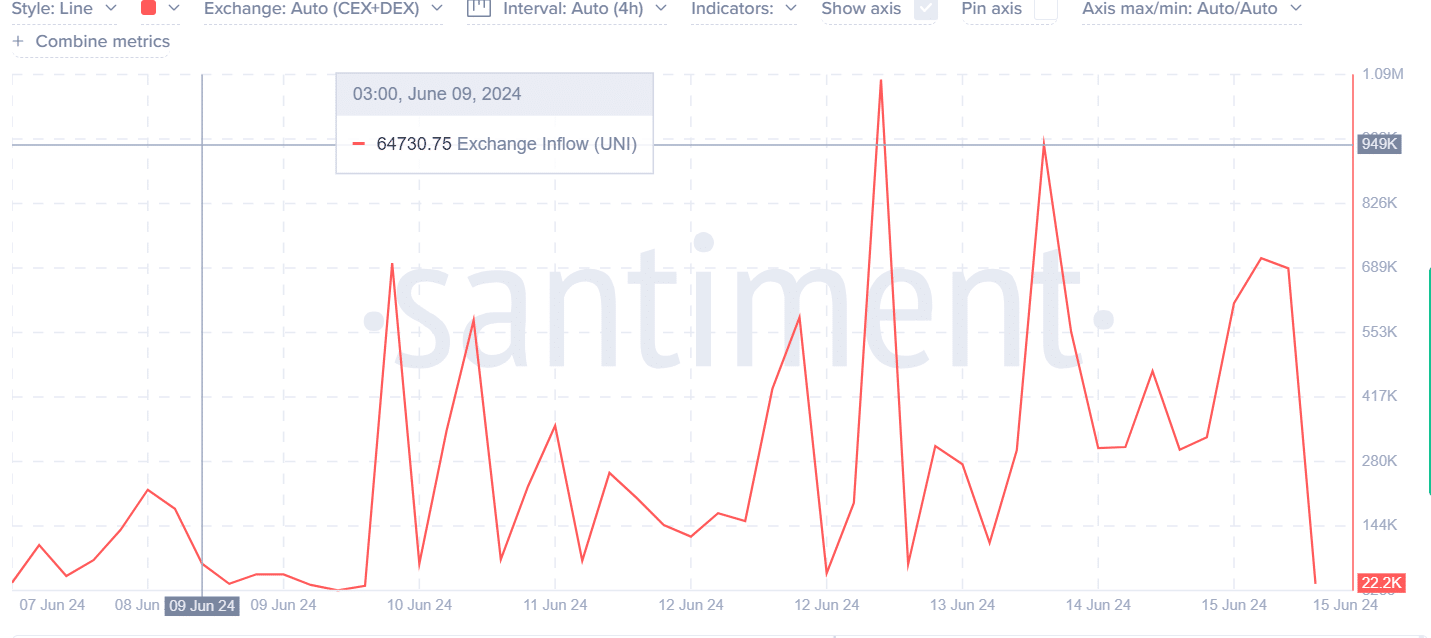

Broadly, Santiment’s data on exchange inflow shows a downtrend. Reduced exchange inflow implies lower selling pressure, which drives prices up.

Lower selling pressure is equated with market stability. This data implies that the UNI market is stable and set for further price increases as the market sentiment indicates no intention to sell.

Is your portfolio green? Check out the UNI Profit Calculator

How far will the bullish momentum hold?

UNI’s current price at $10.9 is testing the resistance level, indicating the potential breakout from the pattern. If it breaks out off the $12 resistance level, it indicates that buyers could aim toward $17 and pass it.

If the market moves past a high of $17, it could aim past $22 if the exact price change holds.