Can Uniswap [UNI] overtake Ethereum [ETH] on this front?

![Can Uniswap [UNI] overtake Ethereum [ETH] on this front?](https://ambcrypto.com/wp-content/uploads/2023/02/jaye-haych-7tkDoo2L_Eg-unsplash-e1676207205501.jpg)

- Uniswap remained the most profitable DeFi protocol in terms of user fees.

- With V3 deployment on BNB Chain getting approval, UNI’s price rise looked likely.

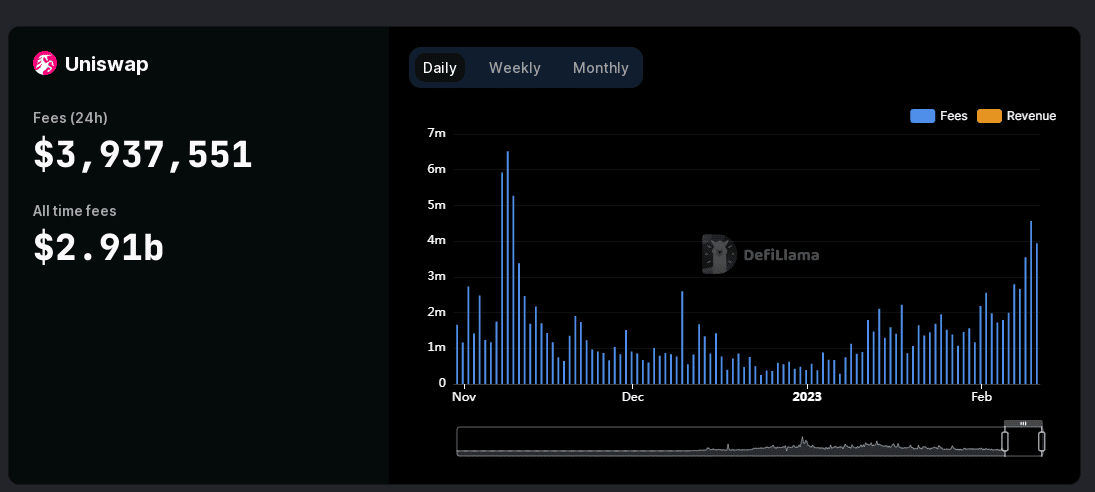

Uniswap [UNI], the world’s largest decentralized exchange (DEX) in the crypto world, continued to attract users to its fold because of high protocol fees.

What’s noticeable is how Uniswap managed to considerably narrow its gap with Ethereum [ETH], the world’s largest project in terms of user fees.

According to data provided by DeFiLlama, the cumulative fees for the last 30 days for Ethereum were more than double than that of Uniswap.

However, this difference was reduced drastically when cumulative fees for the last seven days were observed.

Read Uniswap’s [UNI] Price Prediction 2023-2024

The undisputed king of the DEXes

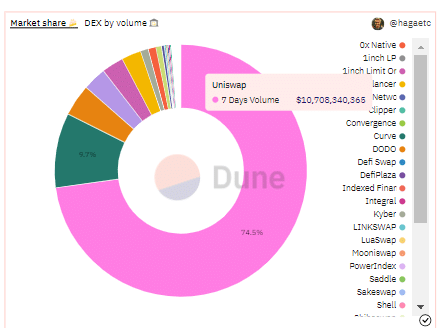

Uniswap has consolidated its position through deployment on popular chains. After launching on Polygon, it captured almost 50% of the DEX market share.

With the latest Uniswap V3 deployment on BNB Chain getting the go-ahead, Uniswap could expect more liquidity on its platform. The latest version is intended to provide maximum returns to traders and liquidity providers and reduce price slippage.

BNB Chain already has the highest number of daily active users on its platform and Uniswap is expected to grab an even larger share of the existing DEX market.

According to data by Dune Analytics, Uniswap is the undisputed leader of the DEXes, capturing almost 75% of the market share at the time of writing.

Uniswap V3 could pave the way for UNI

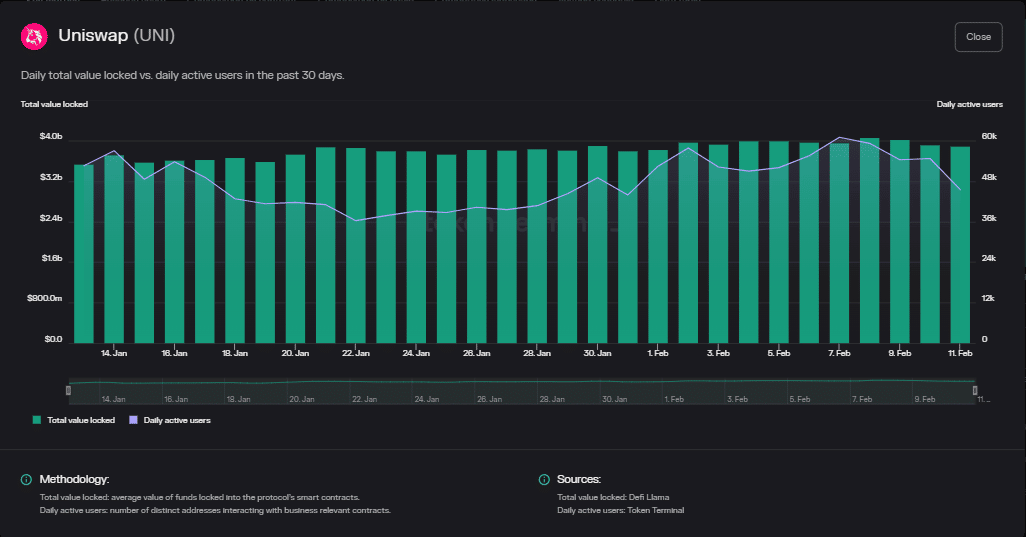

The growth in Uniswap’s daily active users has significantly picked up over the last three weeks or so. It recently hit its six-month high of 61k, although the trajectory over the last two days was negative.

The total value locked (TVL) has moved steadily, not showing a sharp upward or downward movement of late. However, the notable feature was the share of Uniswap V3 out of the total TVL, which stood at more than 70% at the time of writing.

Realistic or not, here’s UNI’s market cap in BTC’s terms

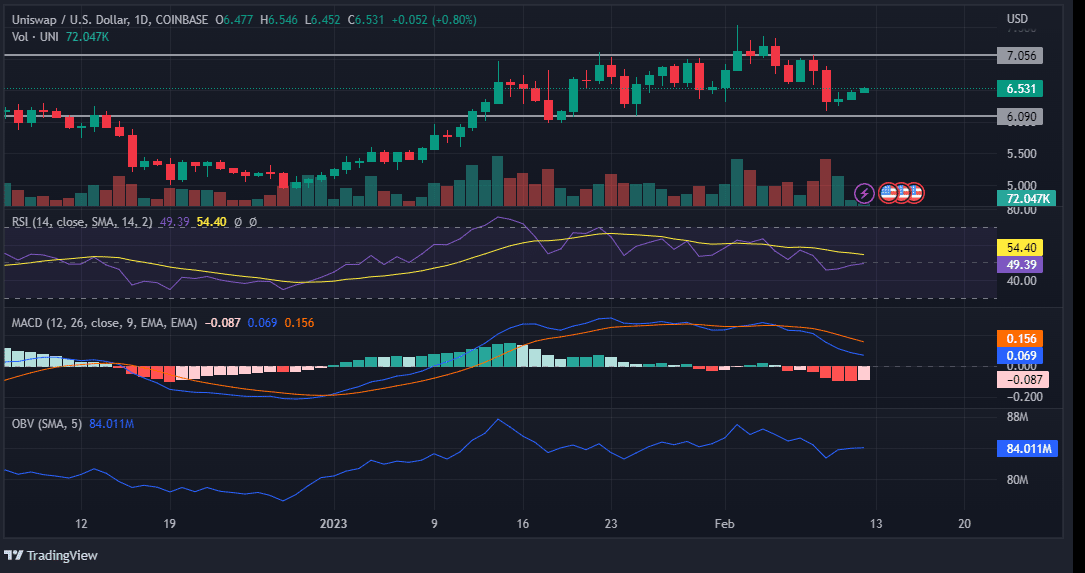

At press time, the governance token UNI was up by 1.8% to exchange hands at $6.52, according to CoinMarketCap. The market cap shed $600 million in value in the last seven days.

The price traversed a range in the last 30 days as indicated. A sharp move above the range highs on 2 February was met with a strong wave of selling. The price is expected to crawl back up to range highs.

The Relative Strength Index (RSI), though below neutral 50, showed signs of an uptrend. The On Balance Volume (OBV) moved northward as well, which meant that price gain in the short term was likely.

The Moving Average Convergence Divergence (MACD) gave early signs of strengthening buying activity.