Canadian firm Hut 8 finalizes $11.8 million loan for new Bitcoin mining machines

Bitcoin mining company Hut 8 has finalized a loan to purchase 5,400 units of MicroBT’s mining equipment, which will increase the firm’s capacity to mine Bitcoin by 475 petahashes per second (PH/s), over the next six months.

The firm completed the equipment financing loan worth $11.8 million from Foundry Digital, which is a subsidiary of Digital Currency Group (DCG).

The financing will be a 12-month term which includes 16.5% annual interest rate. Hut 8 plans to use all proceeds from the aforementioned loan and provide a $2.9 million deposit for the order.

The company expects its first batch of mining equipment to run before the end of January.

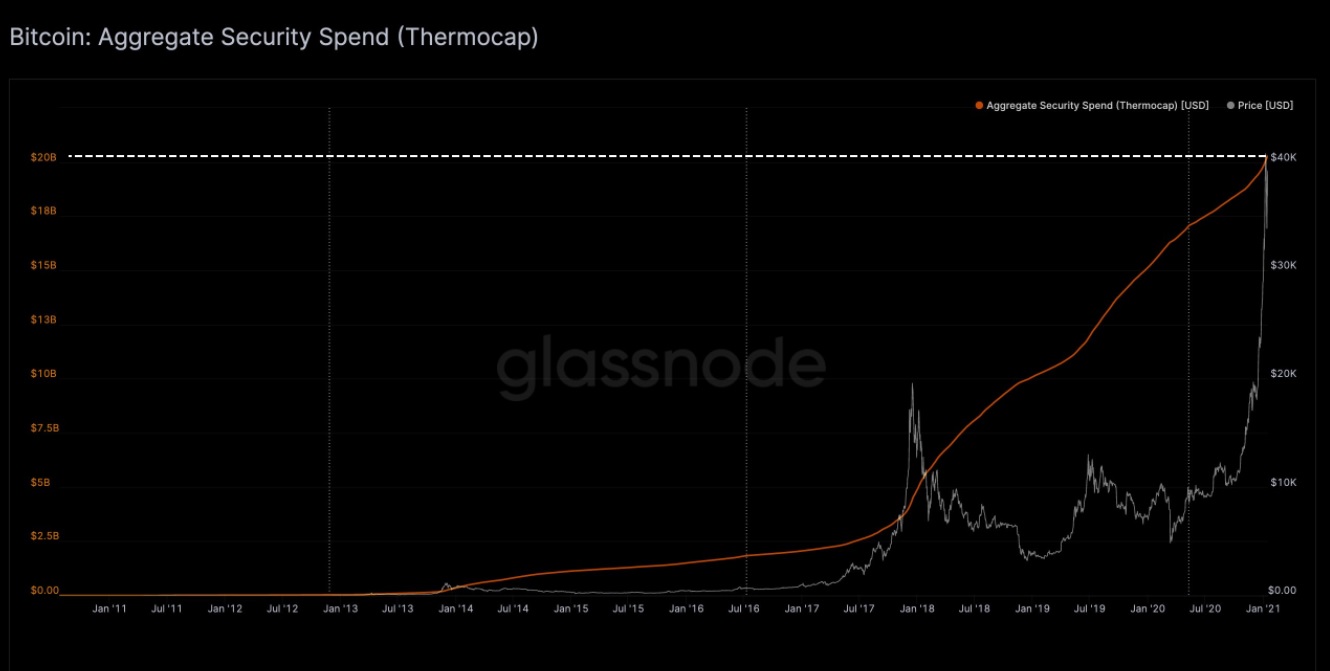

Ever since the digital asset reached unprecedented peaks in price, the Bitcoin mining sector has been making additional purchases to increase computing power. Moreover, in the past 2 years, miners have earned as much as in the first 10 years, according to Glassnode CTO, Rafael Schultze-Kraft.

Additionally, on 15 January Glassnode found that cumulative Bitcoin miner revenue crossed $20 billion:

Source: Twitter/Glassnode

In 2020 itself, several companies began to order machinery. Colorado-based mining company Riot Blockchain (RIOT), purchased an additional 15,000 ASIC mining rigs from Bitmain. After which, in December 2020, Canadian miner Bitfarms deployed 1,000 Whatsminer M31S mining rigs. It expected to acquire 3,000 Whatsminer M31S+ miners in late February this year.

However, it was Galaxy Digital Mining that made headlines after establishing its own Bitcoin mining operation. The company stated that other than offering financial services to miners, it would mine the asset on a proprietary basis.

![Uniswap [UNI] price prediction - Traders, expect THIS after altcoin's 14% hike!](https://ambcrypto.com/wp-content/uploads/2024/12/UNI-1-400x240.webp)