Cardano [ADA]: Layer 1 network launches first Hydra head as scalability war intensifies

![Cardano [ADA]: Layer 1 network launches first Hydra head as scalability war intensifies](https://ambcrypto.com/wp-content/uploads/2023/05/AMBCrypto_Prompt_-_An_epic_battle_scene_between_two_armies_repr_b03709a0-7782-40fb-a2c5-2b27c418ae41.jpg.webp)

- Cardano released its first Hydra head on its mainnet.

- ADA holders continue to record losses as negative sentiment overruns the market.

As legacy Layer 1 (L1) blockchain networks strive to become more scalable, leading L1 blockchain Cardano announced the release of the first Hydra head on its mainnet. This marks a major milestone for the network, paving the way for a new era of scalability on the chain.

Hydra is a family of layer 2 protocols designed to make #Cardano more scalable and adaptable for various use cases that require fast and cheap transactions. The first Hydra head recently opened on mainnet.

This video is a great starting point for exploring the current release,… pic.twitter.com/g1moYifGNj

— Input Output (@InputOutputHK) May 4, 2023

Realistic or not, here’s ADA’s market cap in BTC terms

According to Input Output Hong Kong (IOHK), the network’s developers, Hydra represents,

“a family of Layer 2 (L2) protocols designed to make Cardano more scalable and adaptable for various use cases that require fast and cheap transactions.”

With the ability to make transactions cheaper and faster on the Cardano network, the launch of the first Hydra head is expected to significantly scale up Cardano’s transactions per second (TPS) to 1 million from the 250 it sat at before the release of Hydra.

In addition, as decentralized finance (DeFi) projects launch on the L2 network, Cardano’s total value locked (TVL) is expected to climb even further.

As previously reported, Cardano’s TVL increased consistently over the last six months. According to the on-chain data provider Artemis, the seven-day moving average of the chain’s TVL was $154 million, a level last observed in May 2022.

Over the last six months, $ADA TVL has consistently increased.

Currently, the seven-day moving average sits at $154m, a number that has not been seen since May 2022. pic.twitter.com/wkbYoAddQb

— Artemis ? (@Artemis__xyz) May 3, 2023

As of this writing, Cardano’s TVL was $153.96 million, per data from DefiLlama.

State of ADA on-chain

At press time, ADA exchanged hands at $0.3911. Since the middle of April, the coin has posted a double-digit decline of 13%, falling from a high of $0.45 reached on 15 April.

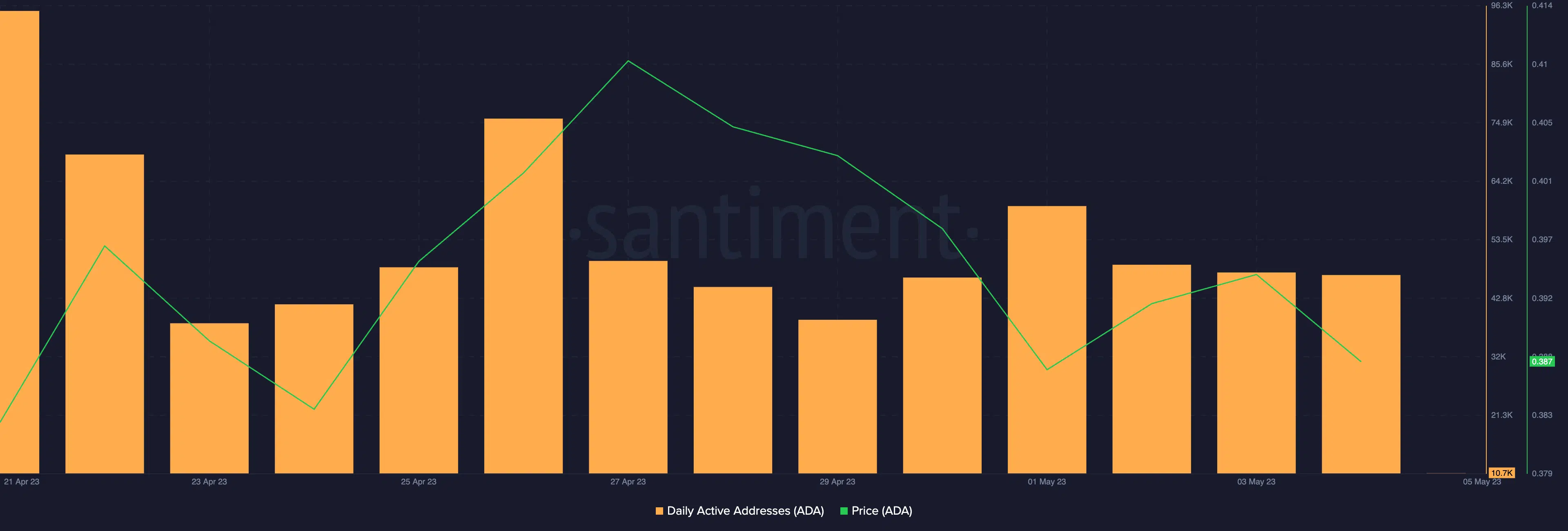

The decline in ADA’s value within this period could be partly attributable to a fall in its network activity. According to data from Santiment, the count of daily active addresses that traded the L1 coin during the period under review fell consistently by over 50%.

With many of its holders still at a loss, negative sentiment continued to trail to ADA. The token’s MVRV ratio remained in negative territory since 27 April.

Is your portfolio green? Check the Cardano Profit Calculator

At the time of writing, the ratio was recorded at -41.60%, meaning that if all ADA holders sold at its current value, they would incur losses on their investments.

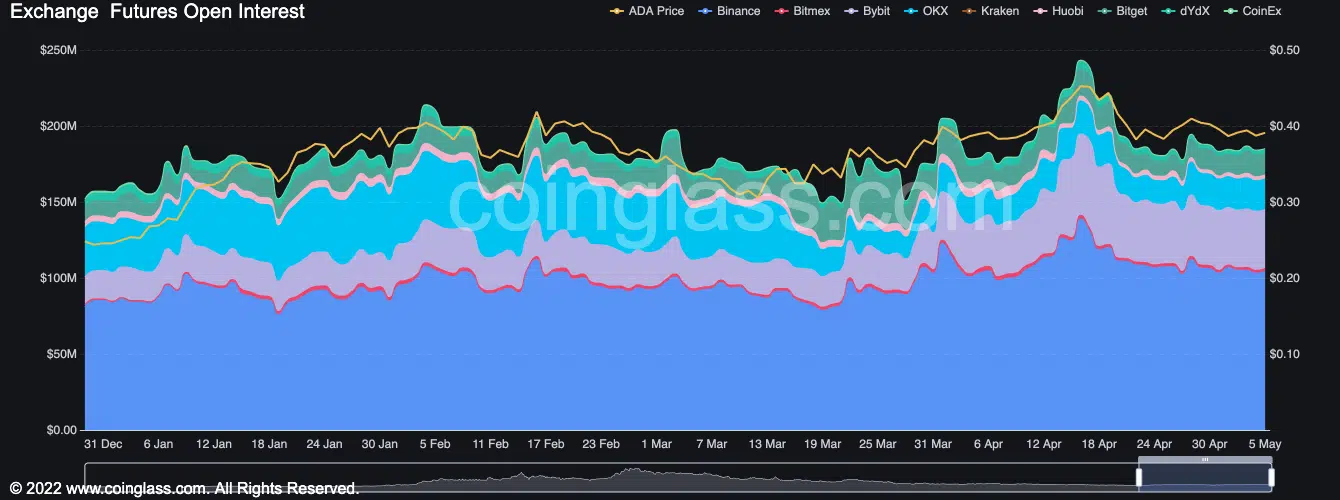

Lastly, ADA’s Open Interests has dipped by 18% since 15 April. Still in a downtrend at press time, this showed that interest in trading ADA remained low, occasioning a reduced trading volume and increased volatility.