Cardano [ADA] traders going long might not repent their decision, thanks to…

![Cardano [ADA] traders going long might not repent their decision, thanks to...](https://ambcrypto.com/wp-content/uploads/2022/11/michael-fortsch-6CiqXsgGaM-unsplash-9-e1668597250818.jpg)

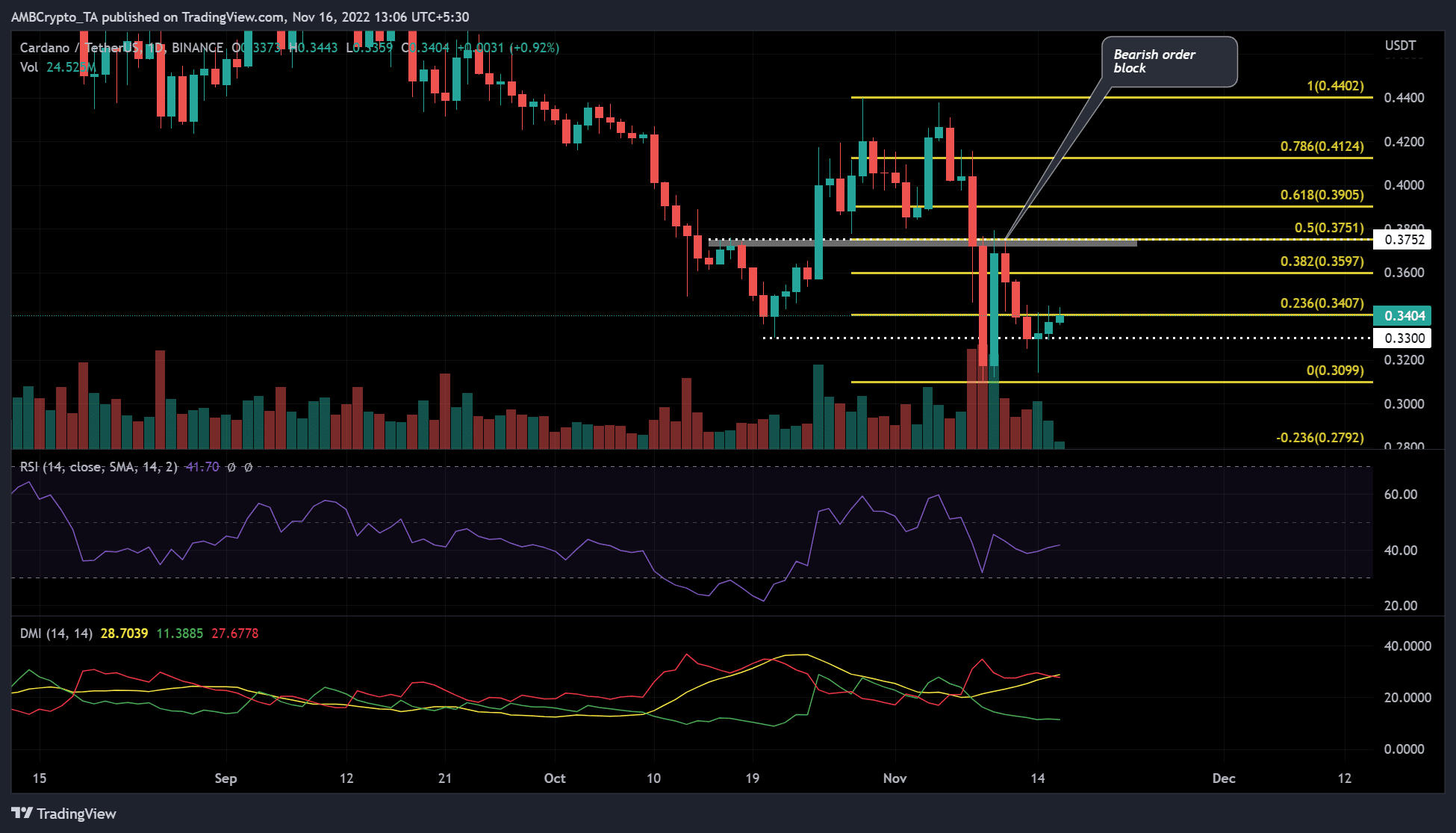

- ADA retests support level of $0.3300 and a resistance level of $0.3407

- Improved weighted sentiment, but ADA holders are still not locking in gains

Cardano [ADA] has formed a price rally on the daily chart and shows a bullish market structure on the lower time timeframe. This is an impressive performance in an overall market that is bearish at the moment. ADA was trading at $0.3404 at press time, up about 1% in the last 24 hours.

A flip of the 0.236 Fib level (resistance) into the support zone and a subsequent uptrend may provide additional buying opportunities for day traders. If the bulls fail to build enough buying pressure, investors should keep an eye on these levels to stop losses.

Retesting the 0.236 Fib level, will the bulls continue to prevail?

ADA’s recent correction found support at $0.3300 (white, dotted ), corresponding with a bullish order block on 20 October. The support level provided a bounce base for the bulls, and the price rally was still ongoing on the daily chart as of press time.

At the time of writing, the Relative Strength Index (RSI) indicator was climbing from the oversold entry level and moving towards the equilibrium level at 50.

This suggested that selling pressure was easing as the bulls battled with the bears for control. This could allow the bulls to target and reach new resistance levels in the coming days or weeks.

Should the bulls maintain momentum and turn resistance at $0.3404 into support, this would provide an entry point for long trades. Should the bullish momentum continue, immediate targets for long trades would be $0.3957 and the bearish order block would be in the $0.3719 – $0.3752 range.

However, a daily close below the support level of $0.3404 would negate this bullish inclination.

The Directional Movement (DMI) indicator showed that sellers (red line) are outperforming buyers (green line). So the current market continues to favor sellers.

If the bulls fail to build enough buying pressure, ADA prices could slide lower. In such a scenario, you should set your stop loss below the zero fib level ($0.3099).

ADA’s weighted sentiment improves

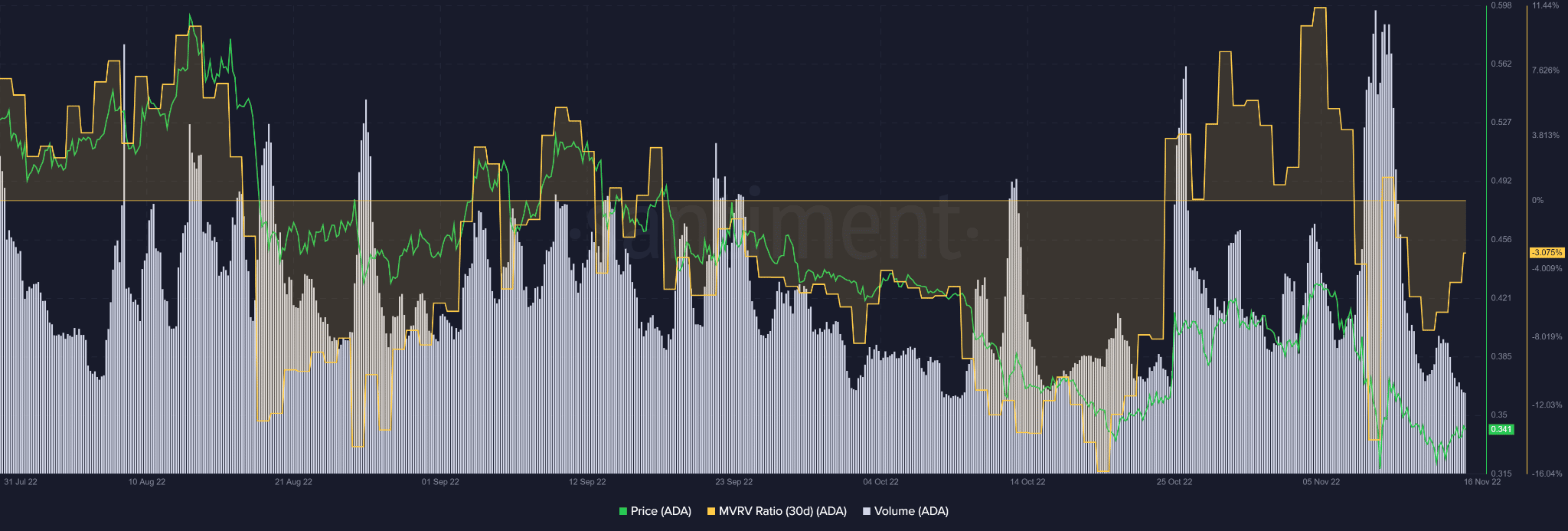

An analysis of Santiment data shows that Cardano (ADA) recorded positive weighted sentiment on 12 November and has steadily risen since then. The improvement was reflected in the price increase of ADA that followed on 14 November.

Short-term ADA holders still suffer losses

Even so, short-term ADA holders suffered losses as the 30-day MVRV was still in negative territory. However, it moved upward, suggesting that losses have narrowed due to improved sentiment and price recovery.

But the improved sentiment and price recovery have not yet resulted in sufficient trading volume. According to Santiment, the price increase has been accompanied by declining volume. This could affect buying pressure, preventing ADA from reaching long trade targets.

That said, traders should monitor the sentiment on ADA and the BTC movement before trading.

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)