Cardano: Analyzing the events of the last 15 days to decode ADA’s ongoing price surge

- Cardano (ADA) whales accumulate 560 million tokens worth around $218.4 million in the last two weeks.

- ADA holders hit an all-time high of over 4.4 million, and long positions dominate funding rates.

According to recent data, whales are becoming increasingly intrigued by Cardano [ADA]. As this interest continues to surge, it would pique one’s curiosity to observe how other investors react and how this will ultimately affect ADA’s price trajectory.

– Is your portfolio green? Check out the Cardano Profit Calculator

Cardano whales on a shopping spree

In the last fortnight, the ADA whales have been on a buying spree, acquiring a whopping 560 million ADA tokens valued at approximately $218.4 million.

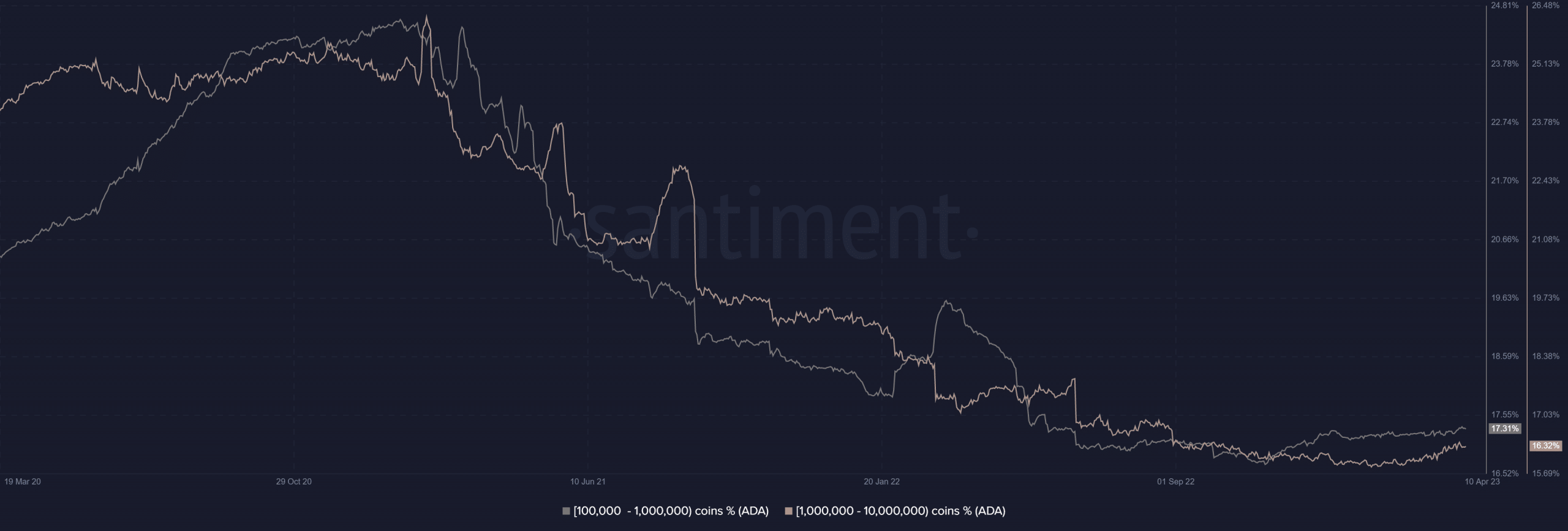

According to Santiment’s data, the accumulation of these whales has not only boosted the overall number of ADA tokens they hold but has also increased the percentage of the tokens in circulation.

As of this writing, the addresses that held between 100,000 to 1 million ADA witnessed a surge and now held 17.23% of the total supply. Furthermore, the number of addresses holding over 1 million ADA also increased and now collectively held 16.51% of the total supply.

Heavy is the head that wears the crown

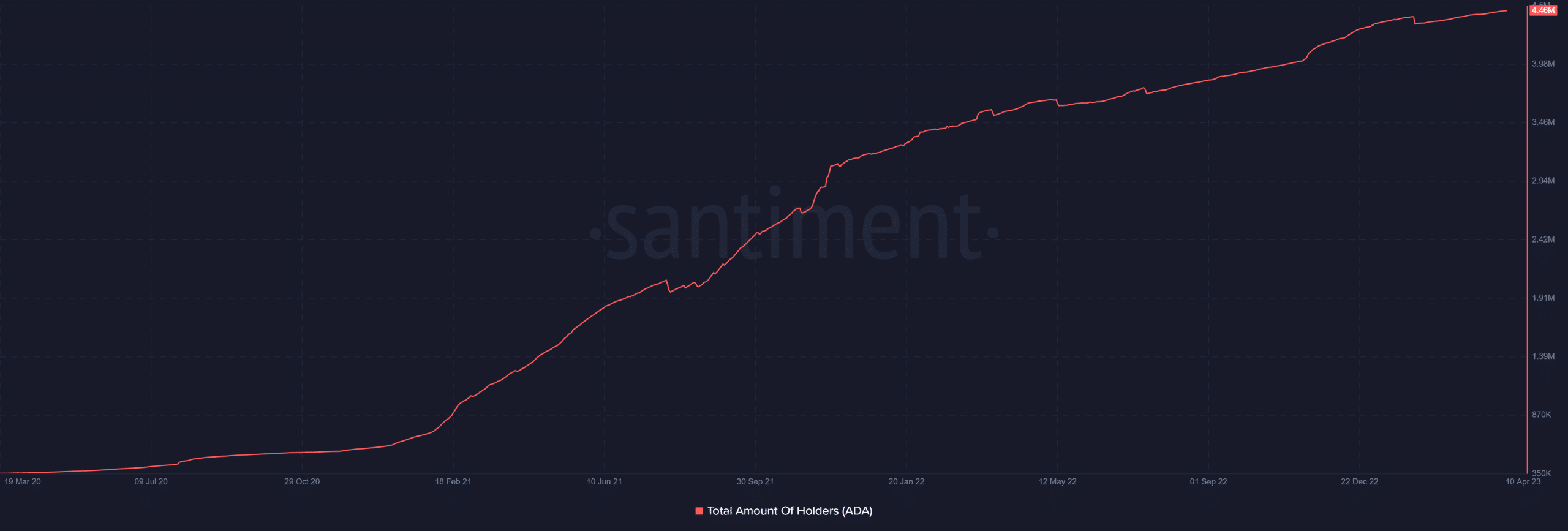

Recent data from Santiment also revealed that the number of ADA holders was also surging. After a sharp decline observed in January, the number of holders had been on a steady rise.

As of this writing, the number of ADA holders had surpassed 4.4 million, which was an all-time high. Despite the current price trend, this growing number indicated the accumulating interest in ADA.

Long positions dominate ADA funding rates

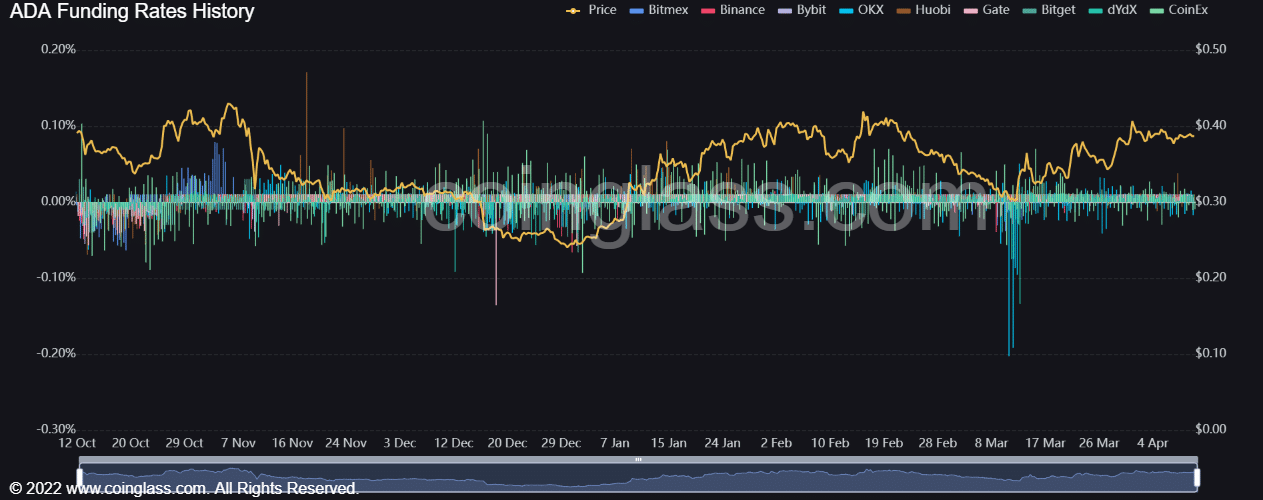

Upon considering ADA derivatives, investors were seen to be quite optimistic about a potential price surge. Currently, the funding rates observed across several prominent exchanges indicated that investors were placing their bets on a price increase.

Notably, the funding rate metric suggested that most investors had taken long positions, making it the dominant position as of this writing.

30-day MVRV and daily timeframe analysis

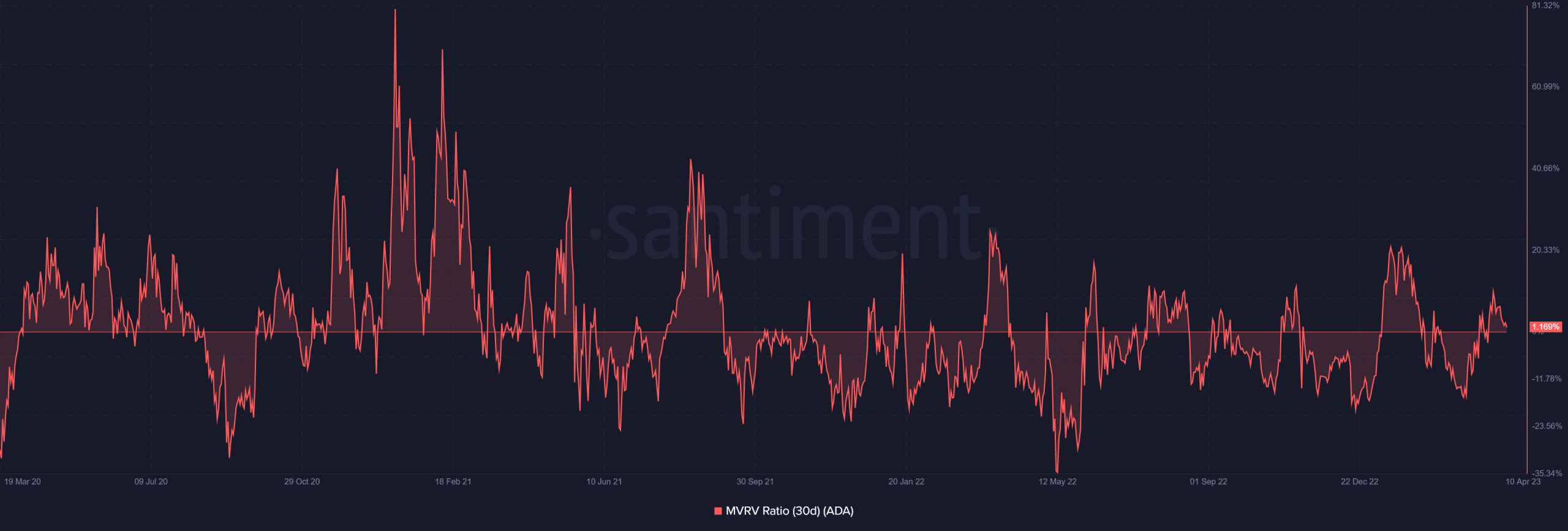

An examination of ADA’s 30-day Market Value to Realized Value ratio (MVRV) suggested that the token was slightly overvalued. As of this writing, the MVRV stood at 1.2%, which might indicate that further accumulation could be expected in the upcoming weeks.

– Realistic or not, here’s ADA market cap in BTC’s terms

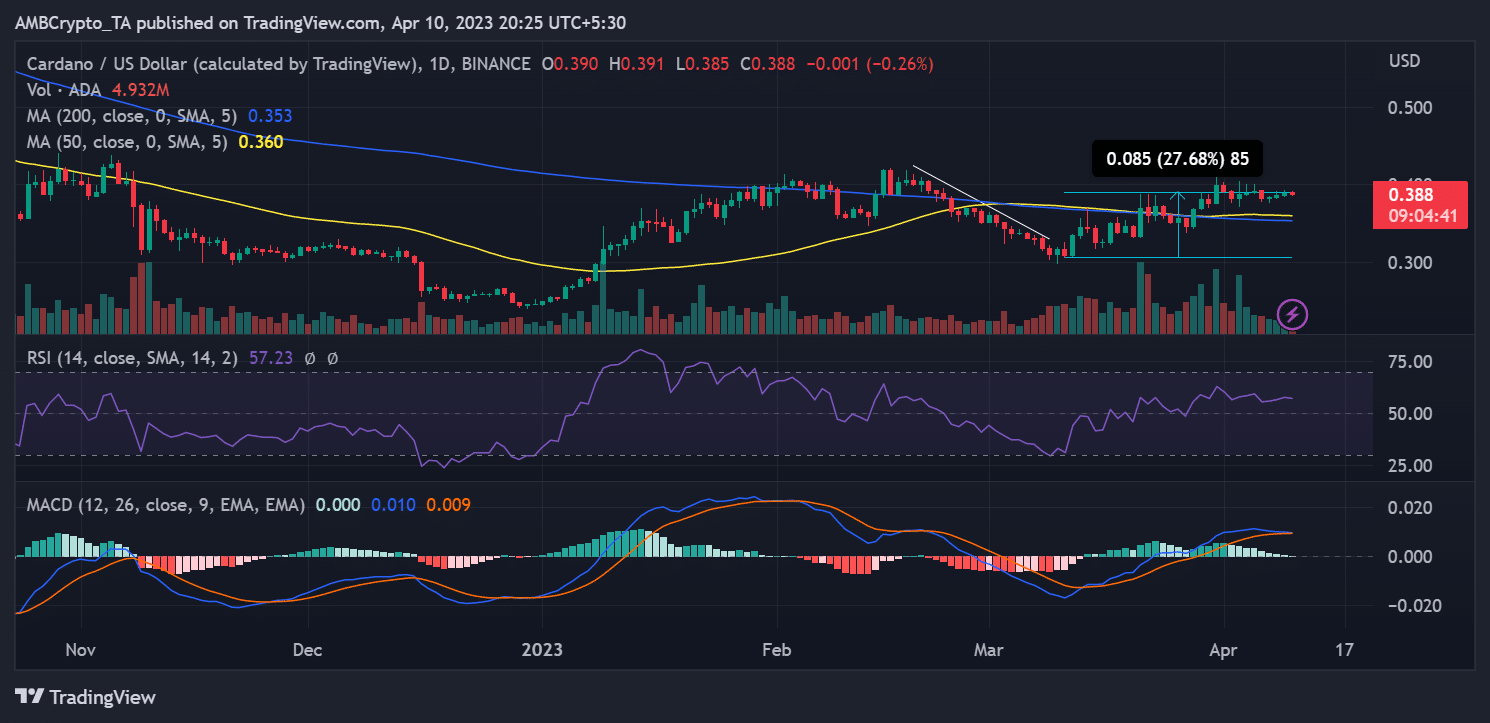

Looking at ADA’s daily timeframe chart, the token had been enjoying a modest uptrend over the past few days. Nonetheless, as of this writing, it had declined in value and was currently trading at around $0.38.

Following the significant dip it faced in February, its upward trajectory since March until now resulted in over a 26% increase in value. Additionally, the chart indicated that it had remained above the neutral line on the Relative Strength Index (RSI) and had maintained a bullish trend.