Cardano – Will shorting yield more gains?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- ADA has been in price consolidation since 8 May.

- Sellers are firmly in control of May.

Cardano [ADA] price consolidation persists despite a recent surge in TVL (total value locked). The overall market condition curtailed ADA from flipping to bullish as sellers took firm control of May.

Read Cardano [ADA] Price Prediction 2023-24

Bitcoin [BTC] was stuck in the $26k zone, exposing the rest of the altcoin market to elevated short-term selling pressure.

Will sellers extend gains?

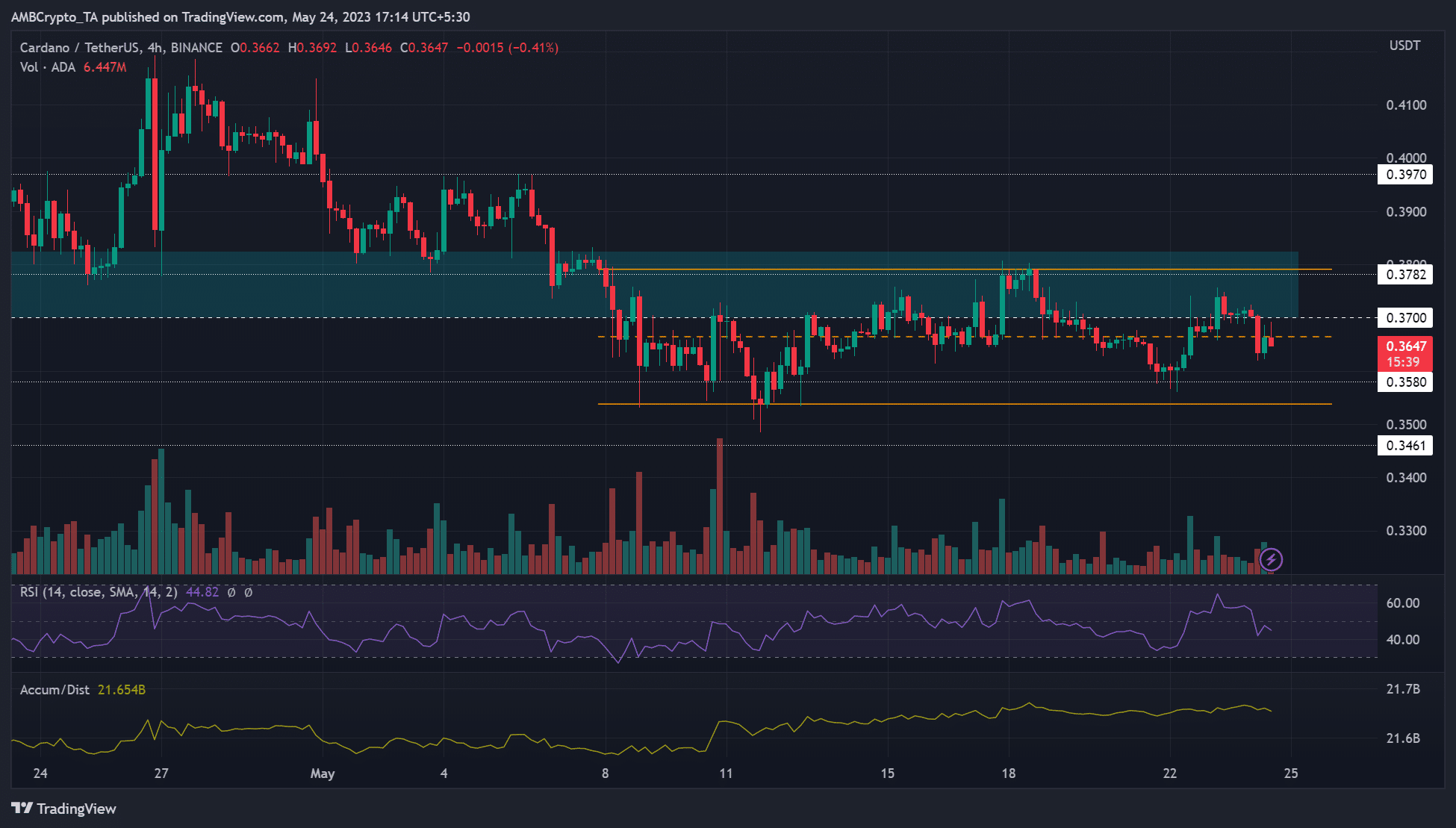

ADA has been fluctuating between $0.3538 – $0.3791 since 8 May. Between Monday and Tuesday (22/23 May), ADA hiked over 5%, rising from $0.3560 to $0.3757.

However, the mild bullish momentum tapered off as U.S. debt ceiling negotiations dragged on. The rally eased and breached the mid-range level of $0.3664. Bulls hadn’t reclaimed the level as of press time, reiterating sellers’ control.

The RSI (Relative Strength Index) was below the neutral line, at the time of writing, highlighting sellers’ leverage. On the other hand, the accumulation/distribution indicator rose from 10 May but wavered in the past two days, confirming increased selling pressure recently.

Ergo, sellers could sink ADA to lower support levels at $0.3580 or the range low of $0.3538.

Alternatively, near-term bulls could gain traction if ADA closes above the mid-range ($0.3664). Such a move could tip them to retest the range high of $0.3791. The range high also lines up with a bullish order block (cyan) on the 12-hour chart formed on 30 May, making it a solid bearish zone.

Elevated selling pressure in May

Is your portfolio green? Check out the ADA Profit Calculator

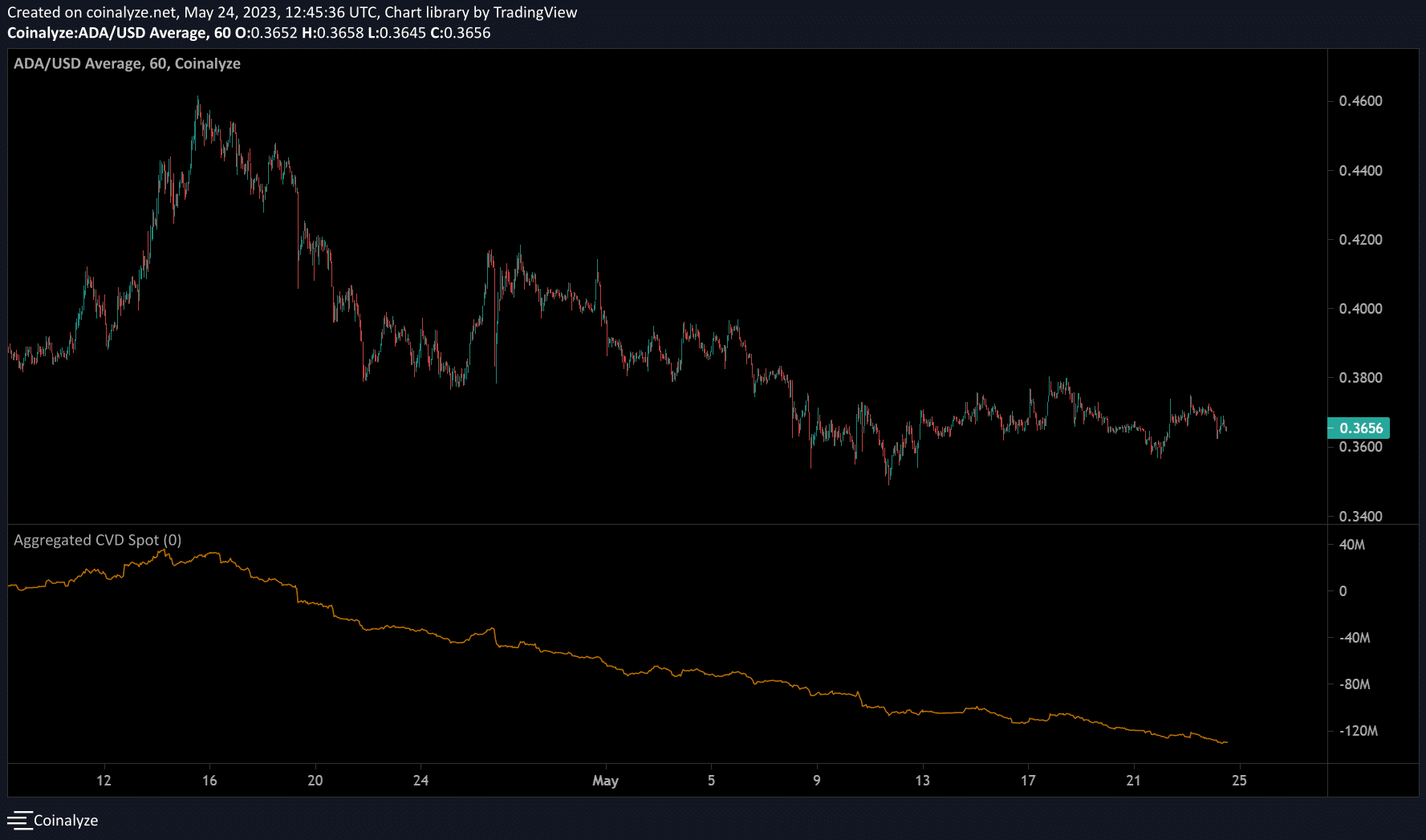

The selling pressure seen in late April has extended to May, albeit stronger. According to Coinalyze, the CVD (Cumulative Volume Delta) declined considerably in May. It confirms that sellers were firmly in control of the market.

With only a few days left to June, bulls could face difficulty reversing recent losses or breaching above the range if BTC’s weakening persists.