Cardano: Can ADA break past this level to give the bulls a much-needed leverage?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

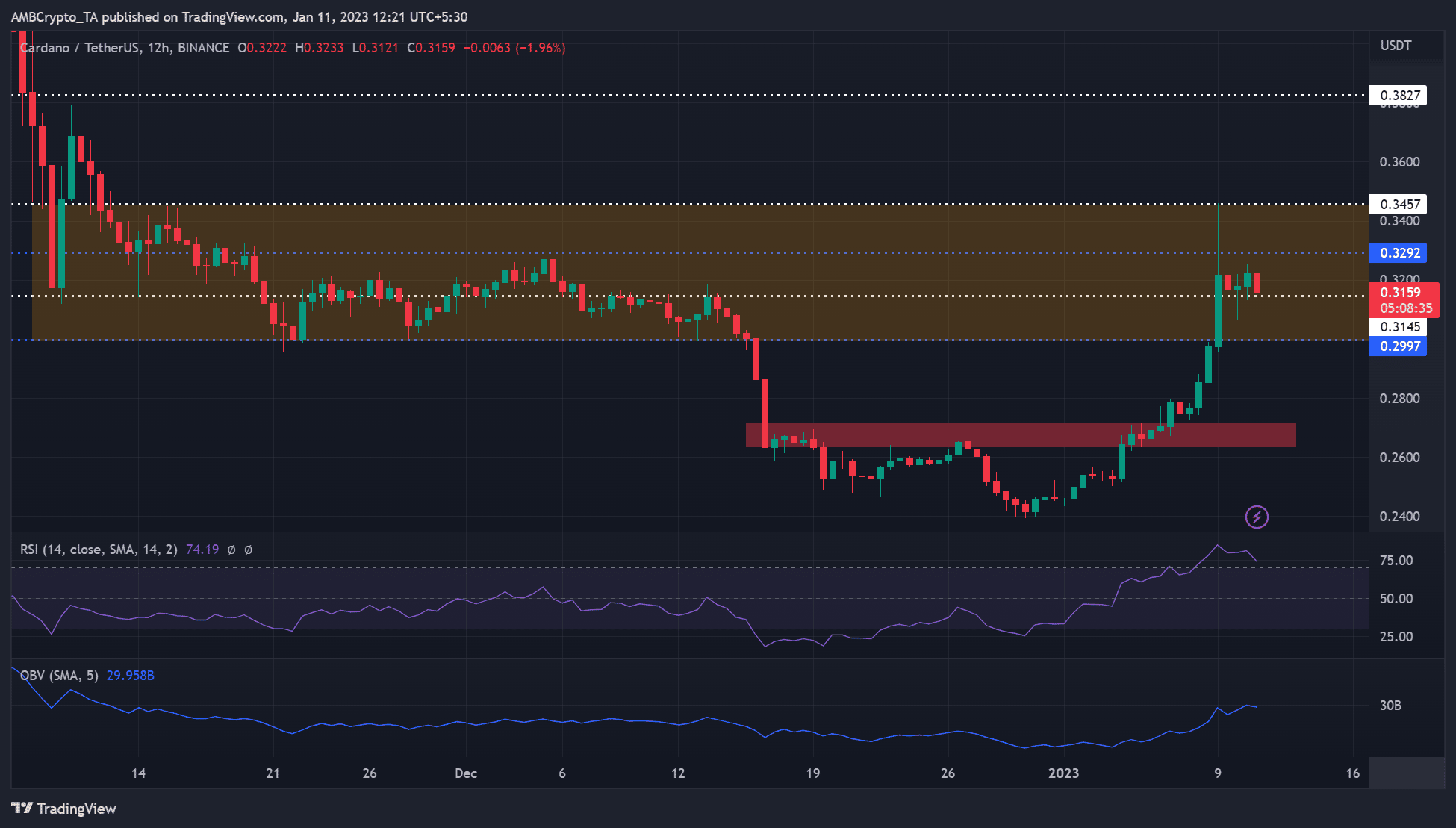

- ADA, at the time of writing, was bullish despite being in the overbought zone

- It could break above $0.3292 and retest $0.3457 resistance

Cardano [ADA] overcame the resistance zone above $0.2660 after Bitcoin’s [BTC] rally on 6 January. BTC’s rally was partly influenced by favorable macroeconomics.

The S&P 500 Index (SPX) surged from 6 January as investors remained optimistic about a further drop in Fed rates. Similarly, the enthusiasm in stock markets resonated well with other asset classes, including BTC.

BTC rallied throughout 6 January and managed to retest $17.50K on 11 January. ADA and the rest of the altcoins also rallied. However, ADA was stuck in another resistance range at press time and oscillated between $0.3145 and $0.3252. Can the bulls overcome this hurdle?

Read Cardano’s [ADA] Price Prediction 2023-24

Can bulls overcome this resistance range hurdle?

The bulls had the upper hand, given the RSI was in the overbought zone and OBV has increased recently. As such, ADA bulls could attempt to break above $0.3292 and retest the overhead resistance at $0.3457 in the next few days.

A bullish BTC, mainly if triggered by favorable CPI data on 12 January, could push ADA to aim at $0.3827, a 20% potential rally.

Alternatively, bears could force ADA prices below $0.3145, which would invalidate the above bias. Nevertheless, such a downward move could find steady support at $0.2997 and rebound, forcing ADA to trade within its previous mid-November and mid-December trading range of $0.2997 – $0.3292.

ADA recorded an increased whale transaction count and development activity

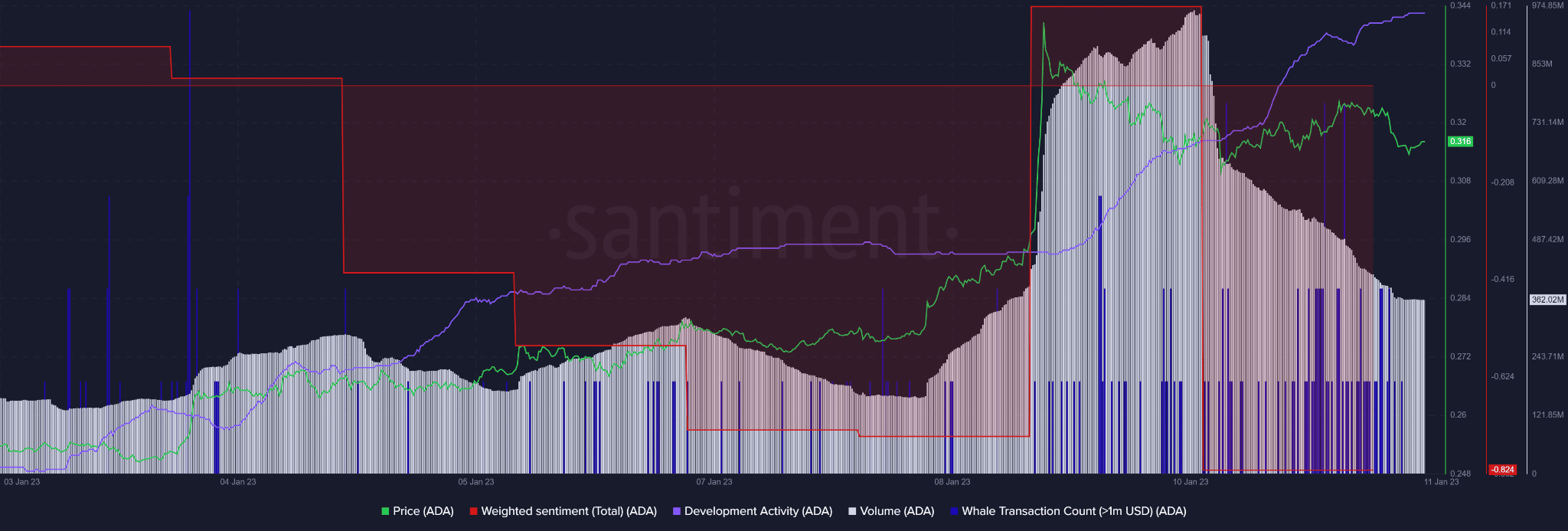

Cardano’s network has seen massive building by developers since 1 January, as evidenced by the uptick in development activity. Although ADA prices peaked around 9 January, development activity continued to soar.

Similarly, ADA saw a handful of whale transaction counts (>$1M) in the last few days. At press time alone, there were about four transactions of more than $1 million. The supply distribution chart offered extra clarity on the transactions.

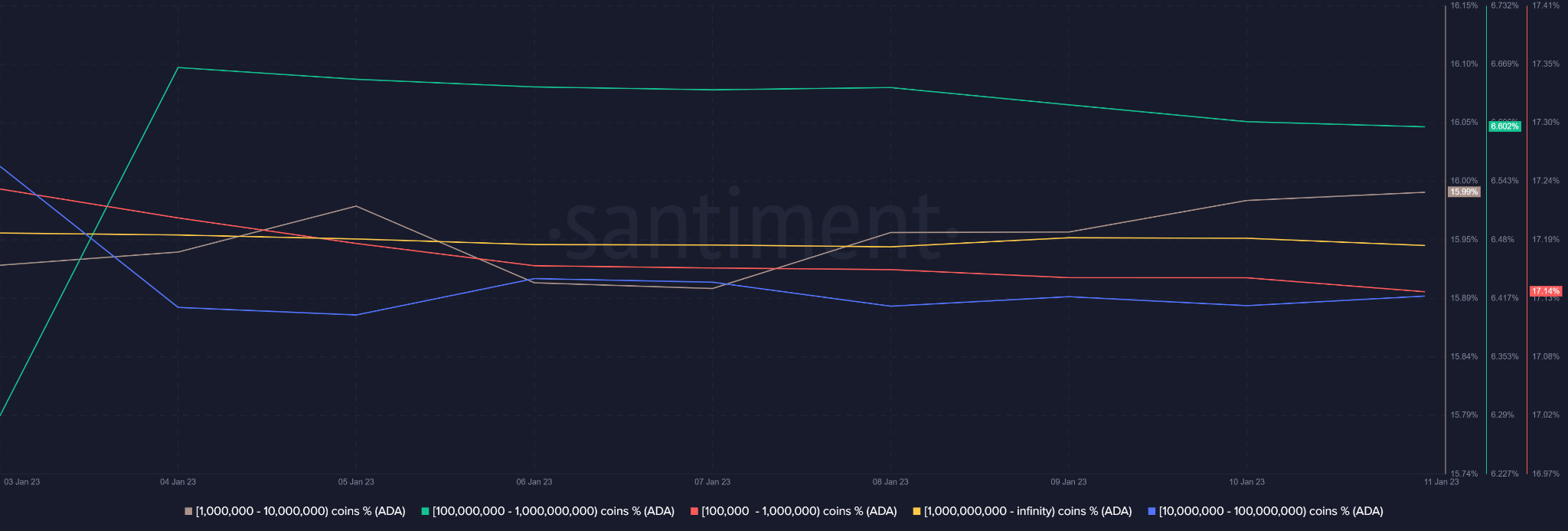

Here is the breakdown of major whale category dominance and actions at press time:

- 1M-10M coins (16%): accumulated

- 100M-1B coins (6%): distributed

- 100K-1M coins (17%): distributed

- 10M-100M coins (41%): accumulated

Selling pressure came from those distributing the coins, while demand came from the whales that were accumulating.

Are your holdings flashing green or red? Check with ADA Profit Calculator

So, which whale category actions would you follow to minimize your risk? The countering forces could confuse investors. Thus, moderation through tracking BTC’s movements would be necessary.