Cardano could rally 65% soon, but not before THIS

- ADA’s $0.7 support level has been respected in recent days.

- A sustained rally beyond $0.8 is expected from ADA bulls.

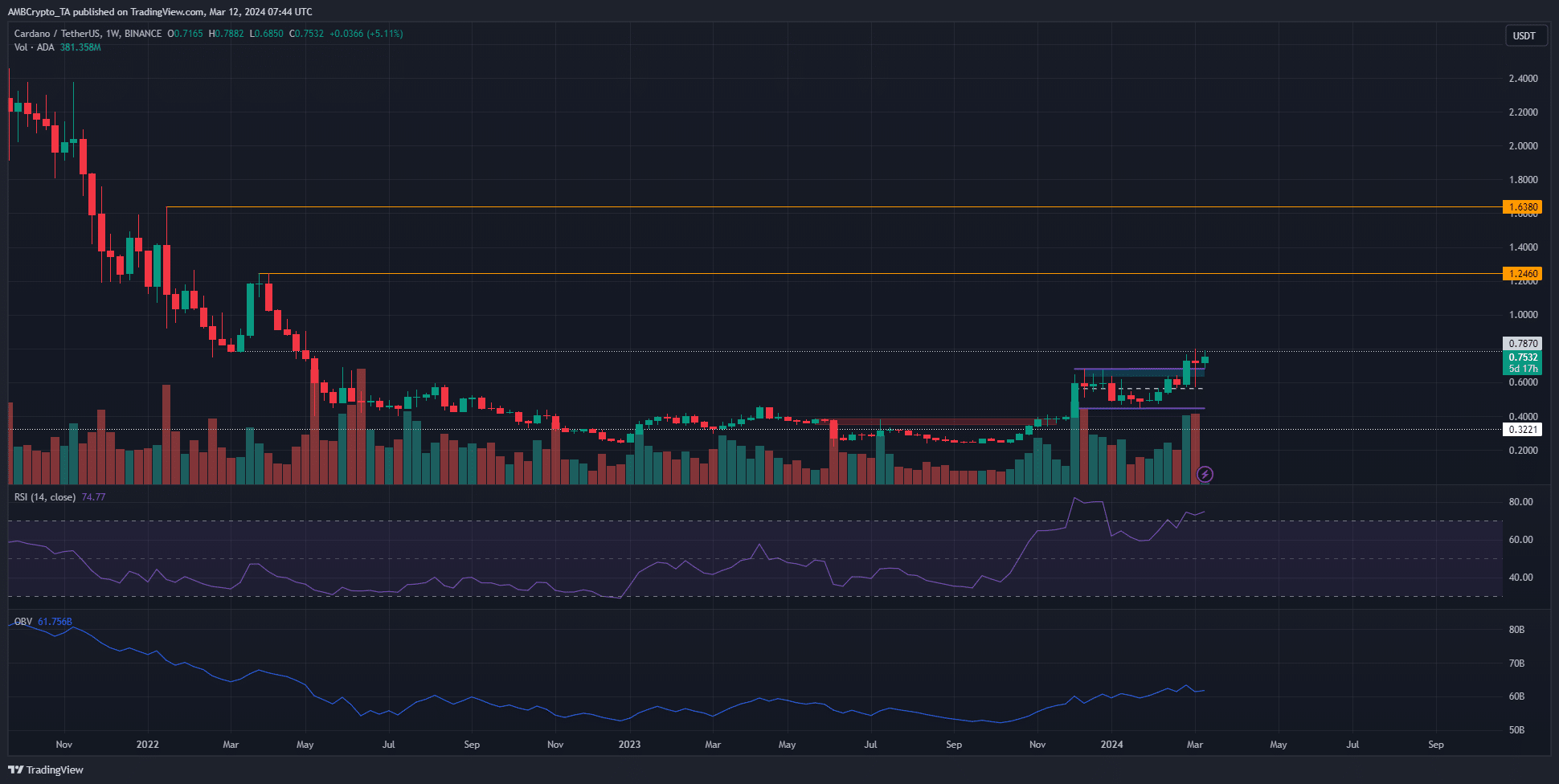

Cardano [ADA] was trading above the $0.7 demand zone and appeared to form a lower timeframe range between $0.7 and $0.787 at press time.

However, technical analysis indicated that more good news was in store for the bulls.

A recent AMBCrypto report highlighted that the trading volume was consistently high in March, measuring more than $1 billion on several days and crossing the $2 billion mark on the 5th and 6th of March.

Yet, the lower timeframe range persisted.

The higher timeframes showed scant resistance to the north

The lower timeframe charts showed consolidation and some loss in bullish momentum. Conversely, the weekly chart highlighted that the rally has more distance to cover.

Above the press time prices, the $0.78-$0.86 zone presented a resistance zone.

ADA has consolidated beneath it over the past two weeks but the RSI continued to show strong bullish momentum. The trend also favored the buyers, and the OBV agreed with this statement.

It has climbed higher since November to reflect increased buying activity in recent months.

Above the $0.8 resistance, the $1 and the $1.18-$1.24 were the next notable resistance levels. If the bulls can drive prices above $0.86, it would be likely that the $1.24 level would be tested next.

Assessing the magnet zones of liquidity

Source: Hyblock

Realistic or not, here’s ADA’s market cap in BTC’s terms

The liquidation levels heatmap showed that there was an estimated $553 million in liquidations at the $0.8 level. This would likely attract prices to it, and the Cardano bulls might be able to drive the rally higher.

To the south, the $0.65 and $0.66 levels each have $250 million in estimated liquidations. A drop in prices below $0.7 could see these levels tested.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.